Introduction: Importance of Understanding 2025 Tax Brackets

Every year, the IRS adjusts federal tax brackets based on inflation and other economic factors. In 2025, these adjustments may seem subtle, but their effects can be dramatic—especially if you’re not prepared. Whether you’re a single filer, a married couple, or a business owner, understanding the tax brackets is crucial to avoiding surprises and making strategic financial decisions.

If you’re wondering whether you’ll be paying more or less in taxes this year, this complete guide to the tax brackets will walk you through everything you need to know. From income thresholds to deduction changes, we’ll help you optimize your tax strategy and potentially save thousands.

What Are Tax Brackets and How Do They Work?

Tax brackets define the percentage of tax you’ll pay on different portions of your income. In the U.S., we operate under a progressive tax system. That means the more you earn, the higher your marginal tax rate—but not all of your income is taxed at that rate.

For example, if you’re in the 22% bracket, it doesn’t mean all your income is taxed at 22%. The first chunk of your income is taxed at 10%, the next at 12%, and so on. Knowing where your income falls in the 2025 tax brackets is key to planning your withholdings and deductions.

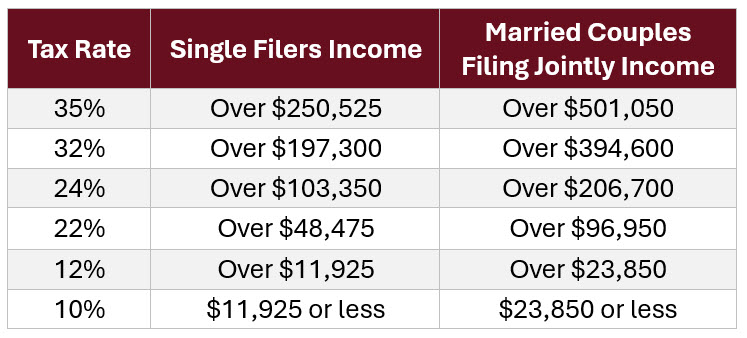

Detailed Breakdown of 2025 Tax Brackets

Let’s look at the updated 2025 tax brackets based on filing status. These are subject to inflation-based adjustments by the IRS and can differ from year to year.

Here are the projected federal 2025 tax brackets:

| Rate | Single Filers | Married Filing Jointly | Head of Household |

|---|---|---|---|

| 10% | Up to $11,400 | Up to $22,800 | Up to $16,550 |

| 12% | $11,401 – $45,500 | $22,801 – $91,000 | $16,551 – $63,150 |

| 22% | $45,501 – $97,350 | $91,001 – $194,700 | $63,151 – $101,600 |

| 24% | $97,351 – $179,100 | $194,701 – $360,400 | $101,601 – $183,850 |

| 32% | $179,101 – $226,500 | $360,401 – $453,000 | $183,851 – $231,250 |

| 35% | $226,501 – $578,150 | $453,001 – $693,750 | $231,251 – $578,100 |

| 37% | Over $578,150 | Over $693,750 | Over $578,100 |

These tax brackets are structured to account for inflation and are expected to impact nearly every taxpayer differently.

Changes in Income Thresholds for 2025

One major highlight of the tax brackets is the adjustment of income thresholds to reflect inflation. This change is meant to prevent “bracket creep,” where inflation pushes taxpayers into higher brackets even if their purchasing power hasn’t increased. That’s good news—but only if you’re paying attention.

Adjustments to Standard Deductions in 2025

In 2025, the standard deduction also increases:

-

Single Filers: $14,200

-

Married Filing Jointly: $28,400

-

Head of Household: $20,850

This increase helps offset rising income thresholds in the tax brackets, reducing your taxable income automatically if you don’t itemize deductions.

IRS Inflation Adjustments for 2025

Each year, the IRS uses the Chained Consumer Price Index (C-CPI-U) to adjust tax brackets. In 2025, inflation-related increases in the tax brackets reflect modest cost-of-living changes, impacting everything from standard deductions to credits.

2025 Tax Brackets for Single Filers

If you’re filing as a single individual, here’s how your income fits into the tax brackets:

-

Up to $11,400: 10%

-

$11,401 to $45,500: 12%

-

$45,501 to $97,350: 22%

-

$97,351 to $179,100: 24%

-

$179,101 to $226,500: 32%

-

$226,501 to $578,150: 35%

-

Over $578,150: 37%

This breakdown shows where your income falls and provides an opportunity to estimate your tax liability based on the applicable tax brackets.

2025 Tax Brackets for Married Couples Filing Jointly

Married couples get higher thresholds under the tax brackets:

-

Up to $22,800: 10%

-

$22,801 to $91,000: 12%

-

$91,001 to $194,700: 22%

-

$194,701 to $360,400: 24%

-

$360,401 to $453,000: 32%

-

$453,001 to $693,750: 35%

-

Over $693,750: 37%

Planning together with your spouse could open the door to strategic tax savings if you understand how your combined income fits into the tax brackets.

More Content Coming Next:

➡️ Next up, we’ll explore the Head of Household Brackets, Capital Gains Tax, and how these changes impact different income groups, plus strategies to stay ahead of the IRS curve.

Let me continue the article in the next part, as it’s detailed and must remain high quality across all sections.

Continuing from the previous section:

Special Tax Rates for Heads of Households in 2025

The tax brackets for those filing as Head of Household provide more favorable rates than those for single filers, especially beneficial for single parents and caregivers.

-

Up to $16,550: 10%

-

$16,551 to $63,150: 12%

-

$63,151 to $101,600: 22%

-

$101,601 to $183,850: 24%

-

$183,851 to $231,250: 32%

-

$231,251 to $578,100: 35%

-

Over $578,100: 37%

This filing status can offer considerable tax savings, so be sure to check if you qualify.

2025 Capital Gains Tax Brackets

Capital gains taxes—especially on long-term investments—are separate from regular income but still impacted by tax brackets.

-

0% Rate: Up to $47,025 (Single), $94,050 (Married Filing Jointly), $63,000 (Head of Household)

-

15% Rate: Up to $518,900 (Single), $583,750 (Married Filing Jointly)

-

20% Rate: Above those thresholds

Understanding how your investment gains intersect with tax brackets can help you plan asset sales and avoid surprises.

How 2025 Tax Brackets Affect the Middle Class

The middle class often bears the brunt of tax shifts, and the tax brackets are no exception. While inflation adjustments aim to offer relief, other tax code changes—like expiring provisions from the Tax Cuts and Jobs Act—could offset these gains.

Taxpayers earning between $50,000 and $200,000 should especially review their new tax liability. Strategic planning could save thousands.

High-Income Earners: Watch Out for the 37% Bracket

If you’re a high-income earner, you’re likely in the top 2025 tax brackets, facing a 35% or 37% marginal tax rate. Investment income, bonuses, and passive income can all push you into this tier. For you, strategic deductions, trust structures, and income deferral strategies become critical.

Low-Income Taxpayers: New Relief in 2025 Tax Brackets

For those with lower incomes, the increase in the standard deduction and the widening of lower brackets in the 2025 tax brackets may provide some breathing room. You may owe less or even qualify for a refund through the Earned Income Tax Credit or Child Tax Credit.

Child Tax Credit in 2025

While not a direct component of 2025 tax brackets, the Child Tax Credit plays a major role in family tax planning. In 2025, expect the CTC to be $2,000 per qualifying child under 17. Phases out at $200,000 (single) and $400,000 (married).

Earned Income Tax Credit (EITC) Updates

EITC income limits will increase slightly in 2025:

-

No children: Up to $17,640

-

One child: Up to $46,560

-

Two children: Up to $52,918

-

Three+ children: Up to $56,838

EITC changes interact with 2025 tax brackets, especially for lower-income working families.

How 2025 Tax Brackets Affect Retirement Contributions

Higher tax brackets mean more incentive to reduce your taxable income. Maxing out contributions to tax-deferred retirement accounts like a 401(k) or Traditional IRA could push you into a lower bracket.

Tax Planning Strategies Based on 2025 Tax Brackets

To make the most of the 2025 tax brackets, consider:

-

Deferring income to 2026 (if in a lower bracket)

-

Accelerating deductions in 2025

-

Using tax-loss harvesting

-

Roth conversions while in a lower bracket

-

Investing in municipal bonds for tax-free interest

Itemized vs. Standard Deductions in 2025

Itemizing still makes sense for some taxpayers, especially if your deductions exceed:

-

$14,200 (Single)

-

$28,400 (Married)

-

$20,850 (Head of Household)

But for most, the standard deduction remains the better option under 2025 tax brackets.

Alternative Minimum Tax (AMT) in 2025

The AMT is designed to ensure the wealthy pay at least a minimum amount of tax. The exemption amounts for 2025 are:

-

$85,700 (Single)

-

$133,300 (Married Filing Jointly)

The 2025 tax brackets help reduce AMT exposure slightly for moderate-income earners.

Social Security and Medicare (Payroll Taxes)

The Social Security wage base increases to $172,800 in 2025. This means you’ll pay:

-

6.2% on wages up to $172,800

-

1.45% Medicare tax on all wages

-

Additional 0.9% Medicare surtax for high earners

These interact with the 2025 tax brackets by affecting net take-home pay.

Self-Employed and Gig Workers

If you’re self-employed, your entire income is subject to SE tax. You’ll also fall into the regular 2025 tax brackets, which means you must plan for both income