Introduction

When it comes to filing your taxes accurately and quickly, one detail you absolutely can’t afford to overlook is your AGI from last year — Adjusted Gross Income. Many taxpayers don’t realize that this single number can affect everything from your refund timing to your eligibility for credits and deductions.

At Syed Professional Services, we’ve helped thousands of clients file stress-free returns by understanding how to properly use and report their AGI from last year. Whether you’re e-filing your return, applying for financial aid, or reconciling a delayed IRS refund, your AGI is your golden key.

In this detailed guide, we’re breaking down 7 powerful reasons your AGI-from last year truly matters — plus how to find it, use it, and make sure it’s reported correctly.

What Is AGI from Last Year and Why It’s Essential

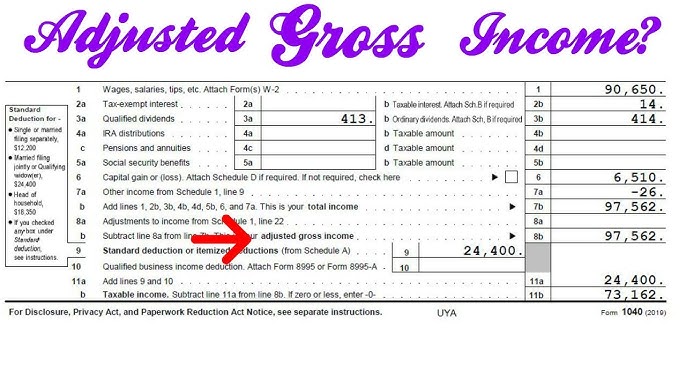

Your AGI-from last year refers to your Adjusted Gross Income as calculated on your previous tax return — typically found on Form 1040, Line 11. It includes your total income minus certain allowable deductions like student loan interest, IRA contributions, and educator expenses.

This number is used by the IRS as a key verification tool when you file your taxes electronically. If your AGI-from last year is incorrect or missing, your e-filed return could be rejected.

But that’s not all — your AGI also affects eligibility for tax credits, stimulus payments, FAFSA applications, and even IRS payment plans.

In short, AGI from last year is a foundational number that influences multiple financial decisions and outcomes.

Filing Electronically? AGI from Last Year is Mandatory

Here’s a harsh truth: if your AGI-from last year is incorrect, your e-file will be rejected. The IRS uses your previous AGI as a PIN substitute to verify your identity. Even if you do everything else right, one wrong digit can delay your filing.

This is especially common if:

-

You switched tax preparers

-

You didn’t file the previous year

-

You used a different filing status

At Syed Professional Services, we cross-reference your prior returns and IRS transcripts to make sure your AGI is accurate before e-filing — avoiding unnecessary rejections and delays.

Your AGI from Last Year Affects Refund Timing

One of the lesser-known truths is that your AGI-from last year affects how quickly you get your refund. When it matches IRS records, your return is processed smoothly. When it doesn’t, your refund can be delayed for weeks.

We’ve had clients come to us with horror stories of months-long refund delays — all traced back to a mismatched AGI. By ensuring your AGI-from last year is correctly reported, you greatly increase your chances of a fast, hassle-free refund.

Let Syed Professional Services handle your return to ensure everything lines up perfectly the first time.

Need to Apply for FAFSA? You’ll Need AGI from Last Year

If you or your child is applying for college financial aid, the Free Application for Federal Student Aid (FAFSA) will require your AGI-from last year. This number determines your Expected Family Contribution (EFC), which impacts how much aid you receive.

Using the wrong AGI could result in:

-

Reduced aid eligibility

-

Delays in processing

-

Requests for additional verification

Don’t guess your AGI — retrieve your IRS transcript, or work with professionals like Syed Professional Services to get the accurate number without delay.

Your AGI from Last Year Impacts Tax Credit Eligibility

Several key tax credits are income-based, and your AGI-from last year plays a major role in determining whether you qualify. These include:

-

Earned Income Tax Credit (EITC)

-

Child Tax Credit (CTC)

-

Education Credits (AOTC & LLC)

-

Premium Tax Credit (for Marketplace health insurance)

Even small errors in your AGI can push you above or below thresholds, impacting the size of your refund. Our expert tax team ensures your AGI is perfectly aligned with your return to maximize every credit you’re legally entitled to.

How to Find Your AGI from Last Year

Wondering where to find your AGI-from last year? It’s typically located on:

-

Form 1040, Line 11

-

IRS Transcript (Tax Return Transcript)

-

Prior year tax software or accountant copy

If you’ve lost your return, don’t worry. Syed Professional Services can retrieve your AGI securely from the IRS or your previous filing system. We take the stress out of the process so you can file without delay.

What If You Didn’t File Last Year?

If you didn’t file a tax return last year, your AGI-from last year is officially zero. You’ll need to enter “0” when prompted during e-filing. However, this can trigger additional IRS identity verification steps.

Our advice? Let us help you file any missing returns first — then your current year’s filing will go smoother. We specialize in helping clients who are behind on taxes or confused about how to proceed.

Common Mistakes When Entering AGI from Last Year

Mistakes with AGI-from last year are more common than you’d think — and the consequences are real. Here are a few frequent errors:

-

Using the wrong line on the tax form

-

Using a W-2 income total instead of AGI

-

Entering AGI from two years ago

-

Using someone else’s AGI (spouse or dependent)

-

Not adjusting for amended returns

Every year, the IRS rejects millions of returns due to these simple AGI-related errors. Avoid them entirely with the help of Syed Professional Services, where our tax pros double-check every digit before submission.

FAQs About AGI from Last Year

Where is my AGI-from last year on my tax return?

It’s on Form 1040, Line 11 of your prior year’s return.

What happens if I enter the wrong AGI from last year?

The IRS will reject your e-filed return. You’ll need to correct it and resubmit.

Can I get my AGI from last year without my tax return?

Yes, by requesting a Tax Return Transcript from the IRS, or through your prior tax preparer.

Do I use AGI from last year if I didn’t file taxes?

If you didn’t file, you must enter “0” as your prior-year AGI when e-filing.

Why is AGI from last year important for FAFSA?

It’s used to determine your financial aid eligibility and how much federal aid you can receive.

Does AGI from last year affect my refund amount?

Not directly — but incorrect AGI can delay your refund or disqualify you from certain tax credits.

Conclusion

Your AGI from last year is more than just a line on a form — it’s a critical number that impacts your taxes, refunds, financial aid, and filing experience. Whether you’re filing on your own or working with a tax professional, having the correct AGI from last year ensures your return gets accepted, your credits are calculated accurately, and your refund is processed quickly.

At Syed Professional Services, we make tax filing seamless by ensuring every detail, including AGI, is correct from the start. Don’t risk delays, rejections, or missed refunds due to AGI errors — let our expert team guide you.

Visit www.syedpro.com today and get started with professional support that puts your finances first.