Introduction

Tax season can be a daunting time for many. And understanding how tax brackets work is essential for effective tax planning. If you’re wondering, “What are the tax bracket?” or “How do tax brackets affect my finances?”. You’ve come to the right place. In this blog post, we’ll dive deep into the concept of tax brackets, explain how they work, and give you an overview of the current tax brackets for 2024 and 2025.

What Are Tax Bracket?

Tax brackets are income ranges defined by the IRS (Internal Revenue Service) that determine the rate at which an individual’s income is taxed. In simple terms, the higher your income, the higher the tax rate you’ll pay on the portion of your income that falls within a higher tax bracket. The U.S. operates a progressive tax system, meaning that as your income increases, different portions of your income are taxed at different rates.

In this system, you only pay the higher rate on income that exceeds a specific threshold. The tax brackets are divided into several categories, each representing a different rate.

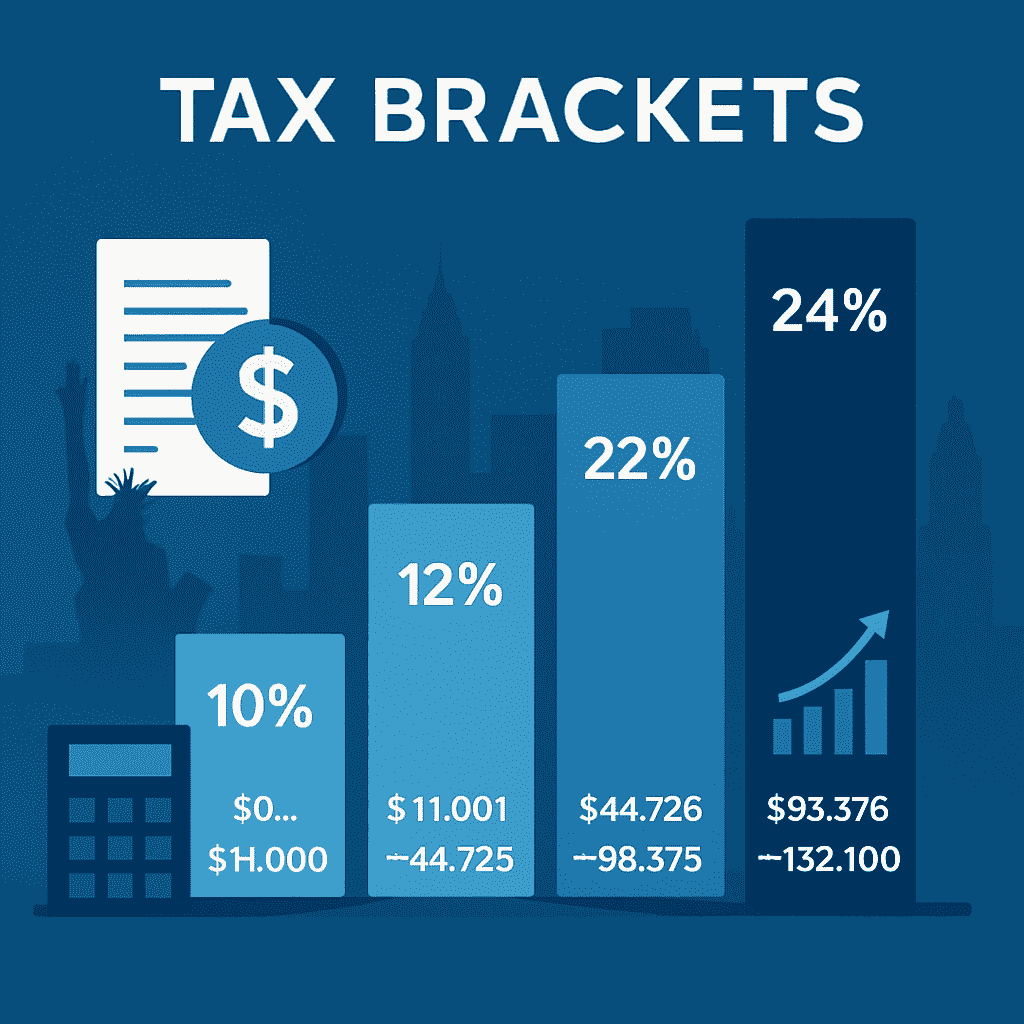

What Are the Tax Brackets for 2024?

For the tax year 2024, the IRS has updated the tax brackets to reflect inflation adjustments. Here’s a breakdown of the tax brackets for 2024:

- 10% Tax Bracket: For individuals earning up to $11,000 (single) or $22,000 (married, filing jointly).

- 12% Tax Bracket: For income over $11,000 to $44,725 (single) or $22,000 to $89,450 (married, filing jointly).

- 22% Tax Bracket: For income over $44,725 to $95,375 (single) or $89,450 to $190,750 (married, filing jointly).

- 24% Tax Bracket: For income over $95,375 to $182,100 (single) or $190,750 to $364,200 (married, filing jointly).

- 32% Tax Bracket: For income over $182,100 to $231,250 (single) or $364,200 to $462,500 (married, filing jointly).

- 35% Tax Bracket: For income over $231,250 to $578,100 (single) or $462,500 to $693,750 (married, filing jointly).

- 37% Tax Bracket: For income over $578,100 (single) or $693,750 (married, filing jointly).

These rates apply to ordinary income, such as wages, salaries, and interest income.

What Are the Tax Bracket for 2025?

Looking ahead, tax brackets for 2025 will see some minor changes due to inflation adjustments. While the IRS has not yet finalized the official tax brackets for 2025, it’s expected that the tax thresholds will slightly increase, which could lead to a reduction in overall tax liability for many taxpayers.

It’s important to stay updated on the tax brackets for 2025 once they are officially released, as they may impact your tax planning strategies. We’ll update this post once the IRS publishes the official rates.

How Do Tax Brackets Work?

Understanding how tax brackets work can help you better manage your taxes. If you’re in a higher tax bracket, it doesn’t mean that all your income is taxed at that higher rate. Here’s a quick example:

- If you’re a single filer and earn $50,000, part of your income will be taxed at the 22% rate, and the remaining portion will be taxed at a lower rate (12%).

To clarify, the progressive nature of tax brackets ensures that you only pay higher tax rates on the income that falls within the higher brackets. For example:

- First $11,000 taxed at 10%

- Next $33,725 taxed at 12%

- The remaining income over $44,725 is taxed at 22%

This system helps reduce the tax burden for those in the lower to middle-income brackets, while still ensuring that higher earners contribute a fair share.

What Are the Different Tax Brackets?

The U.S. tax code includes multiple tax brackets based on income levels. As we mentioned, the tax rates are progressive, meaning they increase as your income goes up. The different tax brackets are organized into seven categories, ranging from 10% to 37%. These brackets apply to various types of income, including wages, self-employment income, and even some types of investment income.

It’s worth noting that there are also tax brackets for corporations, which can be a bit different. However, for most individuals, the seven income tax brackets will apply.

What Is the Highest Tax Bracket?

The highest tax bracket for 2024 is 37%. This rate applies to individuals earning over $578,100 (single) or $693,750 (married, filing jointly). This is the maximum tax rate under the current U.S. tax system, and it applies to the portion of your income that exceeds these high thresholds.

For those in the highest tax bracket, it’s crucial to consider strategies for reducing taxable income, such as contributing to retirement accounts, utilizing tax credits, or exploring other deductions.

How to Minimize Your Tax Liability Within the Tax Bracket?

Tax planning is an essential part of managing your finances, and there are a few strategies to consider:

- Maximize Retirement Contributions: Contributing to retirement accounts like 401(k)s or IRAs can reduce your taxable income, potentially moving you into a lower tax bracket.

- Take Advantage of Tax Deductions and Credits: Be sure to explore all available deductions and credits, such as the standard deduction, child tax credit, or education-related deductions.

- Consider Tax-Advantaged Accounts: Health savings accounts (HSAs) and flexible spending accounts (FSAs) can lower your taxable income, giving you more room to reduce your liability.

Conclusion

Understanding tax brackets is essential for efficient financial planning. By knowing what tax brackets apply to you for 2024 and 2025, you can better manage your finances and make informed decisions. The U.S. tax system is progressive, so as your income increases, you may pay a higher tax rate, but only on the income that falls within the higher tax brackets.

To stay ahead, regularly check for updates to the tax brackets for 2025 and explore strategies to reduce your taxable income. If you’re unsure how tax brackets affect you specifically, consulting with a tax professional can help you develop a plan tailored to your financial situation.

At Syed Professional Services, we specialize in helping individuals and businesses optimize their tax strategies. Feel free to reach out for more personalized advice on tax planning, filing, and financial optimization.

Key Takeaways:

- Tax Brackets Explained: Tax brackets are critical to understanding how your income is taxed. The U.S. tax system uses a progressive structure, meaning the more you earn, the higher the rate you’ll pay on the income that exceeds each threshold.

- 2024 Tax Brackets: The 2024 tax brackets range from 10% for the lowest earners to 37% for the highest earners. It’s important to stay updated on these figures as they can impact your filing decisions.

- What’s Ahead in 2025: The IRS will likely adjust tax brackets for inflation in 2025, but the specifics are not yet finalized. Keep an eye on official announcements for any changes.

- Tax Planning Tips: There are ways to reduce your tax liability, like contributing to retirement funds, leveraging tax deductions and credits, and taking advantage of tax-advantaged accounts like HSAs and FSAs. Always seek professional advice tailored to your unique financial situation.

Next Steps for Effective Tax Planning

Now that you understand the tax brackets, it’s time to take action to optimize your tax situation for both the current year and the year ahead. Here’s a checklist of steps to help:

- Review Your Income and Tax Bracket: Analyze your income for the year and determine which tax bracket you fall into. This will give you an idea of where you stand and where you might be able to save.

- Maximize Tax-Advantaged Accounts: If you’re not already doing so, consider contributing to a 401(k), IRA, or HSA. These accounts can significantly reduce your taxable income.

- Track Deductions and Credits: Ensure that you’re taking advantage of all available deductions and credits. This includes the standard deduction, education credits, and other potential savings based on your situation.

- Consider Your Filing Status: Your filing status—single, married filing jointly, married filing separately, head of household—can impact which tax bracket you’re in. Ensure you’re filing in a way that benefits you most.

- Consult with a Tax Professional: Tax laws can be complex, and working with a tax professional ensures you’re making the most of all tax-saving opportunities.

- Stay Updated on Future Changes: Tax laws evolve, and new regulations or adjustments could impact your tax bracket. Make sure to stay informed on any updates for 2025.

Conclusion: How Syed Professional Services Can Help

At Syed Professional Services, we understand how important it is to keep your taxes in check. Whether you’re a small business owner, a freelancer, or an individual looking for advice, we are here to guide you through the complexities of tax planning and filing. Our team can help you navigate the tax brackets, develop strategies to minimize your tax burden, and ensure you’re on the right track for both the current and future tax years.

Contact us today for personalized advice on how you can optimize your taxes for 2024 and beyond. We’re here to help you make the most of your hard-earned money.

Call to Action:

Need help with tax planning?

Reach out to Syed Professional Services for expert tax advice and solutions tailored to your needs. Book a consultation today and start optimizing your taxes for 2024 and beyond!

Additional Resources:

How to Maximize Tax Savings: Advanced Strategies

While we’ve covered the basics of tax brackets, let’s go a step further and explore some advanced strategies for minimizing your tax liability in the 2024 and 2025 tax years:

-

Tax-Deferred Growth:

- Contributing to tax-deferred retirement accounts like a Traditional 401(k) or Traditional IRA allows you to reduce your taxable income in the current year. These contributions grow tax-deferred, which means you won’t pay taxes on them until you withdraw the funds in retirement, likely when you’re in a lower tax bracket.

-

Capital Gains Taxes:

- If you have investments, understanding capital gains taxes is crucial. Long-term capital gains (on investments held for over a year) are generally taxed at a lower rate than ordinary income. Taxpayers in lower tax brackets may even pay 0% on long-term capital gains, while those in higher tax brackets will pay 15% or 20%, depending on their income.

-

Tax-Loss Harvesting:

- For investors, tax-loss harvesting is a strategy that involves selling investments that are underperforming to offset gains in other areas of your portfolio. This reduces your taxable income and can lower your overall tax bill.

-

Charitable Contributions:

- Donations to qualified charitable organizations can be deducted from your taxable income, potentially lowering the amount of income subject to tax. In addition, if you are age 70½ or older, you can make qualified charitable distributions (QCDs) directly from your IRA to a charity, which won’t count as taxable income.

-

State Tax Considerations:

- Keep in mind that state income taxes may also apply. Each state has its tax brackets, and in some cases, the rates can be significant. Be sure to understand your state’s tax laws and how they interact with federal tax brackets to optimize your tax strategy.

How to Determine Your Tax Bracket

To ascertain your tax bracket, follow these steps:

- Calculate Your Taxable Income: Begin with your gross income and subtract any deductions (standard or itemized) to determine your taxable income.

- Identify Your Filing Status: Determine whether you are filing as single, married filing jointly, married filing separately, or head of household.

- Locate Your Tax Bracket 2025: Using the tables above, find the range that includes your taxable income under your filing status.

For example, if you are a single filer with a taxable income of $50,000 in 2025, you fall into the 22% tax bracket.

Understanding Marginal vs. Effective Tax Rates

It’s crucial to distinguish between marginal and effective tax rates:

- Marginal Tax Rate: The rate applied to your last dollar of taxable income. In the example above, the marginal rate is 22%.

- Effective Tax Rate: The average rate you pay on your total taxable income, calculated by dividing your total tax liability by your taxable income.

Common Questions About Tax Bracket 2025

What is my Tax Bracket 2025?

Your Tax Bracket 2025 depends on your taxable income and filing status. Refer to the tables above to determine where your income falls.

Do tax brackets include standard deductions?

No, tax brackets apply to taxable income, which is calculated after subtracting deductions from your gross income.

Can the Tax Bracket 2025 change annually?

Yes, the IRS adjusts tax brackets annually to account for inflation and other factors.

Strategies to Manage Your Tax Budget

Understanding your Tax Bracket for 2025 can help you implement strategies to manage your tax liability.

- Income Timing: If you’re close to the next tax bracket, consider deferring income to the following year to stay within a lower bracket.

- Retirement Contributions: Contributing to retirement accounts like a 401(k) or IRA can reduce your taxable income.

- Tax Credits and Deductions: Explore available tax credits and deductions to lower your taxable income.

Wrap-Up: Stay Ahead of Tax Season with Syed Professional Services

At Syed Professional Services. We believe that tax planning isn’t just about filing your taxes—it’s about strategically managing your income and deductions year-round. With the help of tax bracket knowledge and smart tax-saving strategies. You can make informed decisions that reduce your tax burden and keep more of your hard-earned money.

Get in touch with us to explore how our expert tax advice can help you maximize your savings and ensure compliance with tax regulations in both 2024 and 2025. Our team of professionals will guide you every step of the way, helping you make the most of the tax benefits available.

Here’s a brief on what Syed Professional Services can do for you:

- Tax Preparation and Filing: They offer professional tax services to help individuals and businesses file their taxes efficiently, ensuring accuracy and minimizing the risk of audits.

- Tax Planning and Strategy: They provide expert tax planning advice, helping you navigate the complexities of tax laws. This includes optimizing your tax strategy by leveraging deductions, credits, and tax-efficient investments.

- Financial Consultation: Syed Professional Services can help you with overall financial planning, budgeting, and wealth management to ensure your financial health is on track.

- Business Services: For small businesses or self-employed individuals, Syed Professional Services can assist with business tax filings, financial analysis, and accounting services, making sure your business complies with tax laws while maximizing deductions.

- Estate and Trust Planning: They also offer advice on estate planning, helping you plan for the future and ensure that your assets are distributed according to your wishes while minimizing taxes.

- Audit Support: If the IRS or state tax authorities ever audit you, Syed Professional Services can provide representation and guidance, helping you through the audit process to minimize potential issues.

Essentially, Syed Professional Services acts as a partner in managing your taxes, finances, and business. Offering tailored solutions that aim to save you money, reduce stress, and ensure compliance with current tax laws.

If this is for a real business or project you’re working on, I’d recommend positioning Syed Professional Services as a trusted advisor to help clients make informed financial decisions and achieve tax efficiency. Does that help clarify things? Let me know if you’d like to discuss any other services or specific questions!