Introduction

An Employer Identification Number (EIN), also known as a Federal Tax Identification Number, is a unique identifier assigned by the IRS to businesses operating in the United States. Whether you’re starting a new business, hiring employees, or forming a legal entity, obtaining an EIN Number is a crucial step. In this comprehensive guide, we’ll dive deep into what an EIN number is, how to apply for one, why it’s important, and other key information you need to know.

What is an EIN Number?

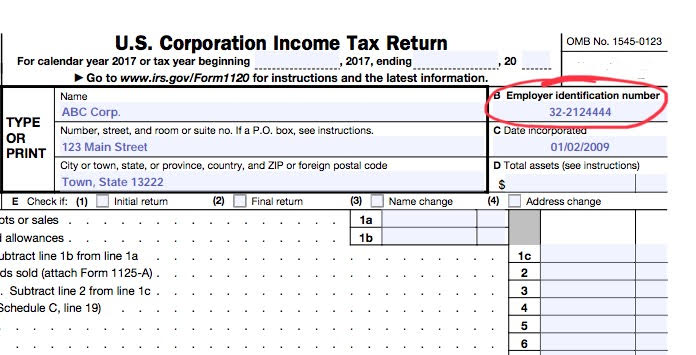

An EIN number is a nine-digit code that the IRS uses to track business activities for taxation purposes. This number is essential for identifying your business when filing taxes, hiring employees, or even opening a business bank account. Think of it as a Social Security Number (SSN) for your business.

EIN Structure: The format of an EIN Number is XX-XXXXXXX (two digits, a hyphen, then seven more digits).

Why Do You Need an EIN Number?

While not every business is required to have an EIN Number, it’s often necessary for a variety of reasons. Here’s why your business might need one:

-

Hiring Employees: If your business plans to hire employees, you’ll need an EIN Number to handle payroll taxes and other employee-related matters.

-

Forming a Business Entity: Businesses like corporations, LLCs, and partnerships need an EIN Number for legal purposes.

-

Tax Reporting: If your business operates as a partnership or corporation, you’ll need an EIN Number to file taxes correctly.

-

Opening a Business Bank Account: Most banks will require an EIN to open a business bank account, separate from your personal finances.

-

Complying with State Regulations: Depending on your state, you might need an EIN to meet local tax requirements.

-

Credibility and Trust: Having an EIN can give your business a more professional appearance, which can be important when establishing relationships with clients, vendors, and lenders.

Do You Need an EIN?

Not every business is required to have an EIN. Here’s a breakdown of who must obtain an EIN:

-

Businesses with Employees: If you have or plan to hire employees, an EIN is required.

-

Businesses Operating as a Corporation or Partnership: LLCs, S-Corporations, and C-Corporations are required to obtain an EIN.

-

Business Entities That Pay Taxes: If your business will be subject to federal taxes or excise taxes, you’ll need an EIN.

-

Businesses That File Certain Tax Forms: If your business will file any of the following forms, you’ll need an EIN:

-

Form 941 (Employer’s Quarterly Federal Tax Return)

-

Form 944 (Employer’s Annual Federal Tax Return)

-

Form 1120 (U.S. Corporation Income Tax Return)

-

If your business operates as a sole proprietorship and doesn’t have employees, you may not need an EIN. However, some sole proprietors still choose to get one to maintain separation between their personal and business finances.

How to Apply for an EIN Number

The process of applying for an EIN is simple and free. Here’s a step-by-step guide to help you obtain your EIN:

-

Check Your Eligibility: Before applying, ensure that your business is based in the U.S. or U.S. territories and that you have a valid Taxpayer Identification Number (TIN).

-

Prepare Your Business Information: You will need details like your business structure (LLC, corporation, partnership, etc.), legal business name, and the name of the principal officer or owner.

-

Visit the IRS Website: Go to the IRS website and complete the EIN online application. The application is available Monday to Friday, from 7 a.m. to 10 p.m. Eastern Time.

-

Complete the Application: The online form will ask for basic information about your business, such as:

-

Legal name of the business

-

Type of entity (LLC, Corporation, etc.)

-

The reason for applying

-

The business address

-

-

Submit Your Application: Once you’ve completed the application, you will immediately receive your EIN on-screen, and you can save it for your records.

How Long Does It Take to Get an EIN?

In most cases, you can receive your EIN instantly if you apply online via the IRS website. If you apply by fax, mail, or phone (for international applicants), it may take up to 4-6 weeks for processing.

EIN Number for LLCs, Corporations, and Sole Proprietors

-

EIN for LLC: Limited Liability Companies (LLCs) are required to obtain an EIN to file taxes, regardless of whether they have employees. It’s especially important if the LLC is treated as a corporation or partnership for tax purposes.

-

EIN for Corporations: Corporations, whether S-Corporations or C-Corporations, need an EIN for tax filings and to fulfill employee payroll obligations.

-

EIN for Sole Proprietors: Sole proprietors without employees aren’t legally required to obtain an EIN. However, many still do so for convenience and credibility.

Can You Have More Than One EIN?

Typically, businesses only need one EIN. However, if you have multiple businesses or legal entities (e.g., separate LLCs or corporations), you may need a separate EIN for each. The IRS does not issue EINs for individuals or personal use.

EIN Number vs. Taxpayer Identification Number (TIN)

It’s easy to confuse an EIN with other types of Taxpayer Identification Numbers (TIN). While an EIN is specifically for businesses, there are other forms of TINs used for different purposes:

-

Social Security Number (SSN): This is used by individuals for tax purposes.

-

Individual Taxpayer Identification Number (ITIN): This is used by non-resident aliens and others who are not eligible for an SSN but need to file taxes.

-

EIN: Used for businesses, trusts, estates, and other entities.

What Happens If You Lose Your EIN?

If you lose your EIN, you can easily retrieve it by:

-

Checking your previous tax returns or official IRS documents.

-

If you cannot find your EIN, you can contact the IRS directly at their Business and Specialty Tax Line: 800-829-4933.

Common Mistakes When Applying for an EIN

-

Entering Incorrect Information: Ensure that all your business details are accurate and up-to-date. Inaccurate data can delay the process or lead to complications.

-

Applying for Multiple EINs: As mentioned, businesses generally only need one EIN. Applying for multiple EINs can cause confusion with the IRS.

-

Not Understanding Entity Structure: Make sure you understand your business structure (LLC, Corporation, etc.) as it can affect your tax obligations.

EIN Number and Business Taxes

Once you have your EIN, you’ll use it for various tax-related activities, including:

-

Filing Business Taxes: Your EIN is required when you file tax forms for your business, including Form 1120, Form 1065, or Form 941.

-

Withholding Taxes: If you have employees, your EIN is needed to withhold and remit payroll taxes.

-

State Taxes: Depending on your state, you may also need to use your EIN for local and state-level taxes.

Conclusion

An EIN number is one of the most important identifiers for your business, allowing you to file taxes, open bank accounts, and hire employees. Whether you’re a sole proprietor, partnership, LLC, or corporation, understanding when and how to apply for an EIN is crucial to running your business smoothly and staying compliant with the IRS.

If you’re starting a new business or reorganizing your existing one, make sure to get your EIN as soon as possible to avoid any future complications. Thankfully, obtaining an EIN is a quick and straightforward process.