Comprehensive Guide to IRS Form 56

Understanding tax responsibilities during estate management, guardianship, trusts, or fiduciary relationships is crucial. One of the most important IRS documents in these situations is IRS Form-56. Whether you are an executor, trustee, guardian, or someone handling another person’s tax matters, IRS Form-56 plays a major role in establishing your fiduciary authority with the IRS.

In this complete guide, we will break down everything you need to know about IRS Form-56, how to file it, common mistakes to avoid, and why it matters for tax compliance.

What Is IRS Form 56 and Why It Matters

At its core, IRS Form 56 is an official notice to the IRS indicating that a fiduciary relationship exists. This form helps the IRS recognize who is legally responsible for managing someone else’s tax obligations. Whether you’re dealing with an estate, trust, bankruptcy, or guardianship, IRS Form-56 ensures the IRS knows who to communicate with.

Purpose of IRS Form 56

The main purpose of IRS Form-56 is simple:

It notifies the IRS that you, as a fiduciary, have taken over responsibility for another person’s taxes. This could be a deceased family member, someone incapacitated, or an entity like a trust.

When Filing IRS Form 56 Is Required

You must file IRS Form-56 in situations such as:

-

When a person passes away and you serve as executor

-

When you become a court-appointed guardian

-

When you manage a trust

-

When representing someone for tax purposes due to incapacity

Failing to file IRS Form 56 may delay IRS communication or cause tax obligations to be missed.

Who Must File IRS Form 56

Not everyone needs to file IRS Form-56. Only fiduciaries—people or entities legally responsible for someone else’s financial or tax matters—must submit it.

Executors and Estate Administrators

If you’re managing the estate of someone who has died, IRS Form-56 is essential. It tells the IRS that you’re the person responsible for settling tax returns, refund claims, or unpaid tax liabilities.

Trustees and Fiduciaries

Trustees handling revocable or irrevocable trusts also file IRS Form-56. This ensures the IRS directs all tax notices to the correct person during trust operations.

Guardians and Conservators

Individuals appointed to manage the finances of a minor or incapacitated adult must file IRS Form-56 to communicate with the IRS about tax matters.

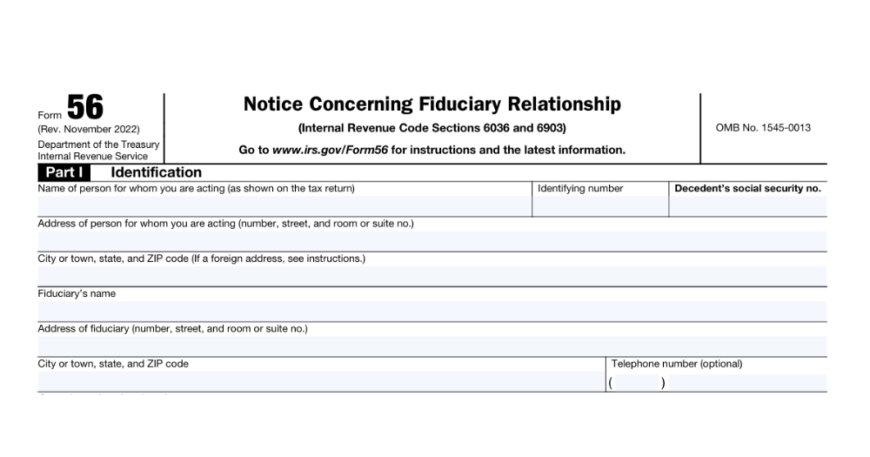

Step-by-Step Instructions for Completing IRS Form 56

Let’s walk through the main sections of IRS Form-56 to help you complete it correctly.

Section A: Identifying the Taxpayer

In this part, list the taxpayer’s information—not your own. This includes:

-

Name

-

Address

-

Social Security Number

-

Fiduciary’s relationship type

Make sure all details match IRS records.

Section B: Fiduciary Details

Here, you enter your information as the fiduciary. This section is crucial because it establishes your authority under the law.

Section C: Authority and Termination

This part lets you specify:

-

Why you’re acting as fiduciary

-

Court documents or legal assignments

-

When your authority ends

Many people forget to file a termination notice using IRS Form-56, leading to IRS mailing issues later.

Mailing Instructions for IRS Form 56

You must mail IRS Form 56 to the IRS office where the taxpayer normally files returns. You may also attach it to a tax return if filing one on the taxpayer’s behalf.

Common Mistakes to Avoid When Filing IRS Form 56

Even though IRS Form-56 appears simple, many fiduciaries make costly mistakes.

Forgetting to End Fiduciary Relationship

Once your responsibilities end, you must file another IRS Form-56 to notify the IRS. Not doing so can create unnecessary IRS notices.

Incorrect Taxpayer Identification Numbers

A single digit error can delay IRS processing. Always double-check SSNs and EINs.

How IRS Form 56 Helps Executors and Trustees

For executors, IRS Form 56 helps manage final tax returns, refund checks, and estate tax notices.

For trustees, filing IRS Form-56 ensures all trust-related tax issues flow through the correct fiduciary.

Using IRS Form 56 helps prevent:

-

Missed IRS deadlines

-

Misrouted tax notices

-

Delayed refunds

-

Compliance issues

IRS Form 56 vs. IRS Power of Attorney (Form 2848)

Many people confuse IRS Form-56 with Form 2848, but they are very different.

Key Differences

-

IRS Form 56 establishes fiduciary authority.

-

Form 2848 grants power of attorney for representation only.

-

IRS Form 56 applies to legal responsibility, not just authorization.

When to Use Each Form

Use IRS Form 56 if you are legally responsible.

Use Form 2848 if you’re simply representing someone but not managing their finances.

Frequently Asked Questions About IRS Form 56

1. What is IRS Form-56 used for?

To notify the IRS that you’re legally responsible for someone else’s tax matters.

2. Who must file IRS Form-56?

Executors, trustees, guardians, conservators, or anyone acting as a fiduciary.

3. Can IRS Form-56 be filed electronically?

Currently, it must be mailed or attached to a return.

4. What happens if I don’t file IRS Form-56?

The IRS may send notices to the wrong person, causing delays in tax matters.

5. Do I need to refile IRS Form-56 when my role ends?

Yes. You must file a termination notice.

6. Can a CPA file IRS Form-56 for me?

Yes, with proper documentation and authority.

Conclusion

IRS Form-56 is one of the most important documents for anyone handling fiduciary responsibilities. Filing it correctly ensures smooth communication with the IRS, prevents missed notices, and protects both the fiduciary and the taxpayer. Whether you’re an executor, trustee, or guardian, understanding IRS Form-56 can save time, prevent tax delays, and help you manage your legal duties effectively.