Introduction: Federal ID Number vs TIN – What’s the Difference?

When navigating the world of taxes, accounting, and immigration, two terms often come up: Federal ID number and TIN (Taxpayer Identification Number). While both are used to identify individuals and entities for tax-related purposes, many people are unsure of the exact differences between these terms. Understanding these distinctions is essential for compliance, accurate tax reporting, and avoiding unnecessary delays in processing your tax filings.

In this article, we will break down the key differences between a Federal ID number vs TIN, explaining what each term means, when to use them, and how they apply in various contexts such as business, individual tax filing, and immigration. By the end, you’ll have a clear understanding of which identification number you need and why it’s important for your specific situation.

What is a Federal ID Number?

A Federal ID number (also known as an Employer Identification Number, or EIN) is a unique nine-digit number assigned by the IRS to businesses, organizations, and other entities operating in the United States. This number functions much like a Social Security Number (SSN) for individuals, but it is intended for businesses, non-profits, and other entities that must report taxes.

When Do You Need a Federal ID Number?

-

For Business Purposes: If you own a business, whether a corporation, partnership, LLC, or nonprofit, you will need a Federal ID number to report your business income, file taxes, and hire employees.

-

For Employment: If you are running a business and have employees, you are required to have a Federal ID Number Vs TIN to report employee wages and withholdings to the IRS.

-

For Financial Institutions: Banks will ask for your Federal ID Number Vs TIN when you open a business account or apply for credit.

What is a TIN (Taxpayer Identification Number)?

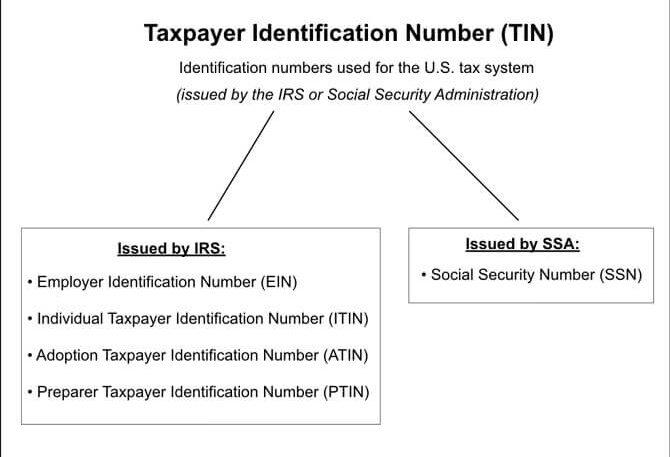

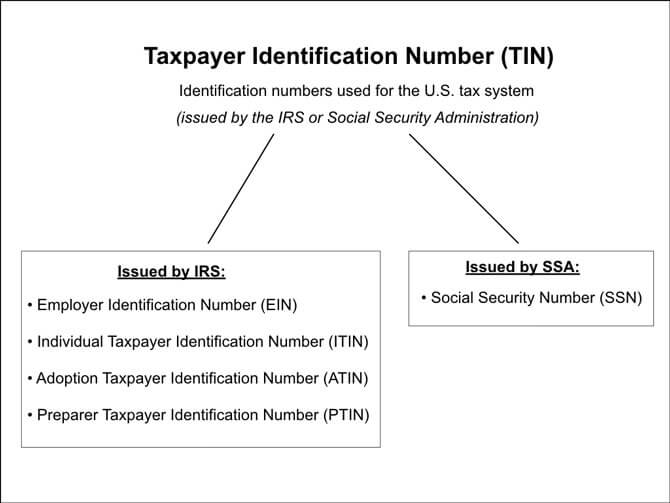

A TIN (Taxpayer Identification Number) is a generic term used by the IRS to refer to any number used to identify a taxpayer. There are several types of TINs, and the specific type you use depends on your status as a taxpayer (individual or business).

Types of TINs:

-

Social Security Number (SSN): Used by U.S. citizens, permanent residents, and some non-resident aliens. This is the most common form of TIN.

-

Employer Identification Number (EIN): Also referred to as a Federal ID Number Vs TIN, this is used by businesses, corporations, and other entities for tax reporting purposes.

-

Individual Taxpayer Identification Number (ITIN): Issued to individuals who need a TIN for tax purposes but do not qualify for an SSN. This is commonly used by non-resident aliens, their spouses, or dependents.

-

Adoption Taxpayer Identification Number (ATIN): Used for children in the process of being adopted who cannot yet obtain a Social Security Number.

Thus, the term TIN encompasses several different types of numbers, including the Federal ID number (EIN), which is a specific form of TIN used by businesses.

Federal ID Number vs TIN: Key Differences

At this point, you may be asking yourself, “Is there really a difference between a Federal ID number vs TIN?” While the two terms are often used interchangeably, they are not exactly the same. The key difference lies in the scope of their usage:

-

Federal ID Number (EIN) is a specific type of TIN used by businesses and other entities for tax reporting. It is mainly used for business, non-profit, and other organizational purposes.

-

TIN, on the other hand, is a broader term that includes several types of identification numbers used for various tax purposes, such as SSNs, ITINs, and EINs.

In other words, every Federal ID number is a TIN, but not every TIN is a Federal ID number. For example, an individual taxpayer’s Social Security Number (SSN) is a TIN, but it is not a Federal ID number.

When to Use a Federal ID Number vs TIN

The correct usage of a Federal ID number vs TIN depends on your situation:

-

For Businesses: If you’re filing taxes or submitting forms on behalf of your business, you will almost always need a Federal ID number (EIN). This is true whether you are an LLC, a corporation, a partnership, or a non-profit organization.

-

For Individuals: If you are an individual filing personal taxes, your Social Security Number (SSN) serves as your TIN. However, if you’re a non-resident alien or someone who is not eligible for an SSN, you will need an ITIN.

-

For Immigration: If you are an immigrant or non-resident alien living in the U.S. and need to file taxes, you will likely require an ITIN as your TIN, unless you qualify for an SSN.

Why Do You Need a Federal ID Number or TIN?

Whether you’re a business owner, self-employed, or an individual taxpayer, having the correct Federal ID number vs TIN is vital for several reasons:

-

Tax Filing: The primary purpose of both Federal ID numbers and TINs is for filing taxes. They allow the IRS to track taxpayer obligations and ensure proper reporting of income.

-

Employment: Businesses use Federal ID numbers to report employee wages and withholdings to the IRS. For individuals, the SSN (a form of TIN) is used for tax reporting and retirement benefits.

-

Opening Bank Accounts: Whether you’re opening a business account or setting up personal financial accounts, Federal ID numbers and TINs are required to identify the taxpayer to financial institutions.

-

Immigration and Visas: Non-resident aliens may need an ITIN for tax reporting, and certain types of visas may require specific identification numbers for employment or other purposes.

Common Confusion Between Federal ID Number vs TIN

There is often confusion regarding the use of Federal ID number vs TIN because many people assume that the Federal ID number (EIN) and TIN are the same thing. However, as outlined earlier, while the Federal ID number is a specific type of TIN, the term TIN encompasses a variety of identification numbers, such as SSNs, ITINs, and EINs.

For businesses, the need for a Federal ID number is clear when registering for taxes, hiring employees, and establishing business operations. However, individuals may mistakenly think they need a Federal ID number when they simply need an SSN or ITIN.

How to Apply for a Federal ID Number or TIN

-

For Businesses: To obtain a Federal ID number (EIN), you can apply online through the IRS website, by mail, or by fax. The application process is relatively straightforward, and the EIN is typically issued within a few days.

-

For Individuals: If you are a U.S. citizen or permanent resident, you can use your SSN as your TIN. If you are not eligible for an SSN, you can apply for an ITIN using IRS Form W-7. Individuals who are in the process of adoption may apply for an ATIN.

Conclusion: Federal ID Number vs TIN – Why the Distinction Matters

Understanding the difference between a Federal ID number vs TIN is crucial for ensuring proper tax compliance, accurate filings, and smooth business operations. While both terms are related to tax identification, they are used in different contexts and have specific requirements based on your situation—whether you’re filing as an individual, business, or non-resident alien.

By familiarizing yourself with these distinctions, you can avoid confusion and make sure that you’re using the correct identification number for your needs. Whether you’re a business owner, a self-employed individual, or a foreign national in the U.S., understanding how to use Federal ID numbers vs TINs will streamline your tax and accounting processes.

If you’re unsure about which number applies to your case, don’t hesitate to reach out to Syed Professional Services. We specialize in tax, accounting, and immigration services and can guide you in obtaining the correct identification number for your specific needs.