11 Powerful Steps and Costly Mistakes: How to Get an EIN Number the Right Way

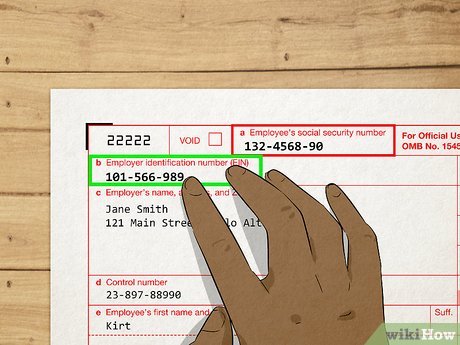

Starting a business, hiring employees, opening a business bank account, or filing certain tax forms in the United States often begins with one essential requirement: an Employer Identification Number (EIN).

Yet, thousands of entrepreneurs, freelancers, and immigrants search every month for how to get an EIN number—and many make costly mistakes along the way.

An EIN is more than just a number. It is your business’s tax identity with the IRS. Errors in obtaining or using it can delay bank accounts, trigger IRS notices, or complicate immigration and compliance matters.

This in-depth guide from Syed Professional Services explains how to get an EIN number correctly, quickly, and legally—whether you are a U.S. citizen, non-resident, LLC owner, corporation, or sole proprietor.

What Is an EIN and Why Do You Need One?

An Employer Identification Number is a unique nine-digit number issued by the IRS to identify a business entity. It functions like a Social Security number for your business.

You need an EIN if you:

-

Form an LLC, corporation, or partnership

-

Hire employees

-

Open a business bank account

-

Apply for business licenses

-

File payroll or excise taxes

-

Operate as a non-resident entrepreneur

-

Change business structure

Understanding how to get an EIN number ensures your business starts on a compliant foundation.

Who Is Eligible to Apply?

Anyone conducting business in the U.S. can obtain an EIN, including:

-

U.S. citizens

-

Permanent residents

-

Non-resident aliens

-

Foreign-owned companies

-

Startups and freelancers

-

Trusts and estates

You do not need a Social Security Number in all cases. Learning how to get an EIN number without an SSN is especially important for immigrants and international founders.

Step-by-Step Guide: How to Get an EIN Number

There are four official ways to apply:

-

Online (fastest)

-

Fax

-

Mail

-

Phone (for international applicants)

Let’s break them down.

Method 1: Online Application (U.S. Residents)

The IRS online portal is the fastest way to apply. You receive your EIN instantly.

To use this method:

-

Your principal business must be in the U.S.

-

You must have an SSN or ITIN

-

You can apply only once per day

Steps:

-

Visit the IRS EIN Assistant

-

Choose your entity type (LLC, corporation, etc.)

-

Enter responsible party information

-

Provide business details

-

Submit and receive EIN immediately

For most small businesses, this is the simplest way to learn how to get an EIN number.

Method 2: Fax Application

If you cannot apply online, complete IRS Form SS-4 and fax it to the IRS.

Processing time:

-

4–7 business days

This method is useful if:

-

You lack an SSN

-

You prefer paper documentation

-

You are working with a professional

Method 3: Mail Application

Mailing Form SS-4 is the slowest option.

-

4–6 weeks

This is usually chosen when:

-

Documents must be submitted together

-

International mailing is required

-

Legal filings accompany the application

Method 4: Phone (International Applicants)

Non-U.S. residents can call the IRS directly.

Requirements:

-

Completed Form SS-4

-

Ability to answer IRS questions

-

English proficiency

This is a critical method for many clients who ask us how to get an EIN number without being in the U.S.

Common Costly Mistakes to Avoid

Many applicants delay their business progress due to errors such as:

-

Using the wrong entity type

-

Entering incorrect legal names

-

Applying multiple times

-

Misidentifying the responsible party

-

Choosing the wrong tax classification

-

Using personal information incorrectly

These mistakes can lead to:

-

Rejected bank accounts

-

IRS mismatches

-

Compliance issues

-

Delays in immigration filings

Understanding how to get an EIN number properly prevents these setbacks.

EIN for Different Business Types

Sole Proprietor

You may not need an EIN, but you should get one if you:

-

Hire employees

-

Want separation from SSN

-

Open a business bank account

LLC

Single-member and multi-member LLCs almost always require an EIN.

Corporation

All corporations must have an EIN.

Non-Profit

Non-profits need EINs before applying for 501(c)(3) status.

Each structure changes how to get an EIN number and how it is used for tax reporting.

EIN Without a Social Security Number

One of the most common questions we receive is how to get an EIN number without an SSN.

You can apply by:

-

Completing Form SS-4

-

Writing “Foreign” in the SSN field

-

Faxing or mailing the form

-

Or calling the IRS directly

This is especially important for:

-

Immigrants

-

International entrepreneurs

-

Foreign-owned LLCs

At Syed Professional Services, we handle these cases daily.

How Long Does It Take?

| Method | Timeframe |

|---|---|

| Online | Immediate |

| Fax | 4–7 business days |

| 4–6 weeks | |

| Phone (Intl.) | Immediate |

Choosing the right method is a key part of mastering how to get an EIN number efficiently.

What to Do After You Receive Your EIN

Once you receive your EIN:

-

Open a business bank account

-

Register for state taxes

-

Apply for licenses

-

Set up payroll

-

File immigration or compliance documents

-

Use it on tax returns

Store your EIN confirmation letter securely.

Why Professional Help Matters

Although the IRS offers free EIN issuance, many people still face:

-

Rejections

-

Mismatched records

-

Delays in banking

-

IRS correspondence

-

Structural errors

A professional ensures:

-

Correct entity classification

-

Accurate IRS records

-

Compliance with tax laws

-

Integration with accounting and immigration needs

Knowing how to get an EIN number is only the first step—using it correctly is what protects your future.

Frequently Asked Questions

Is getting an EIN free?

Yes. The IRS does not charge a fee. Be cautious of third-party websites that do.

Can I apply more than once?

The IRS allows only one online EIN per day per responsible party.

Do I need an EIN if I’m self-employed?

Not always, but it is strongly recommended.

Can I change EIN information later?

Yes, but corrections require formal IRS communication.

Final Thoughts

Whether you are launching a startup, forming an LLC, opening a bank account, or managing immigration compliance, knowing how to get an EIN number is foundational to your success in the United States.

A single mistake at this stage can delay everything that follows.

At Syed Professional Services, we help individuals and businesses: