27 Crucial Things to Know About Foreign Income Exclusion

Foreign income exclusion is one of the most powerful tools available to U.S. taxpayers living abroad. But while it can save you thousands in taxes, it’s also misunderstood—and sometimes misused. At Syed Professional Services, we help expatriates, immigrants, and globally mobile individuals make smarter tax decisions every day.

In this guide, you’ll learn:

-

What the foreign income exclusion is

-

Who qualifies for it

-

How to file correctly

-

27 key benefits

-

5 risks or drawbacks

-

Common mistakes

-

Expert tax planning tips

Let’s get started!

✅ What is the Foreign Income Exclusion?

The foreign income exclusion (also called the Foreign Earned Income Exclusion or FEIE) allows U.S. citizens or resident aliens to exclude a portion of their earned income from U.S. taxation if they live and work abroad.

As of 2026, the exclusion limit is $120,000 per qualifying person (adjusted annually for inflation).

✅ 27 Powerful Benefits of Claiming Foreign Income Exclusion

1. 💵 Tax-Free Income

You can legally avoid U.S. income tax on up to $120,000 if you meet the foreign income exclusion qualifications.

2. 💼 Applicable to Salaries and Wages

It includes earned income from employment and self-employment.

3. 🌍 Encourages Global Careers

Professionals working abroad for U.S. or foreign companies can benefit from massive tax savings.

4. 📜 IRS-Recognized

This isn’t a loophole—it’s part of the tax code (Section 911 of the IRS Code).

5. 🧾 Less Need for Foreign Tax Credits

If you’re working in a low- or no-tax country, you can avoid double taxation without relying on credits.

6. 👨👩👧 Filing Jointly Doubles the Exclusion

Married couples can exclude up to $240,000 if both qualify.

7. ✅ Doesn’t Affect Passive Income

You can still earn investment or rental income and only exclude your earned income.

8. 💼 Available to Contractors and Freelancers

It’s not limited to employees—you can use it even if you work for yourself.

9. ✈️ Flexibility in Employment Location

Your employer doesn’t have to be foreign—you just have to work and live abroad.

10. 🗓 Multiple Ways to Qualify

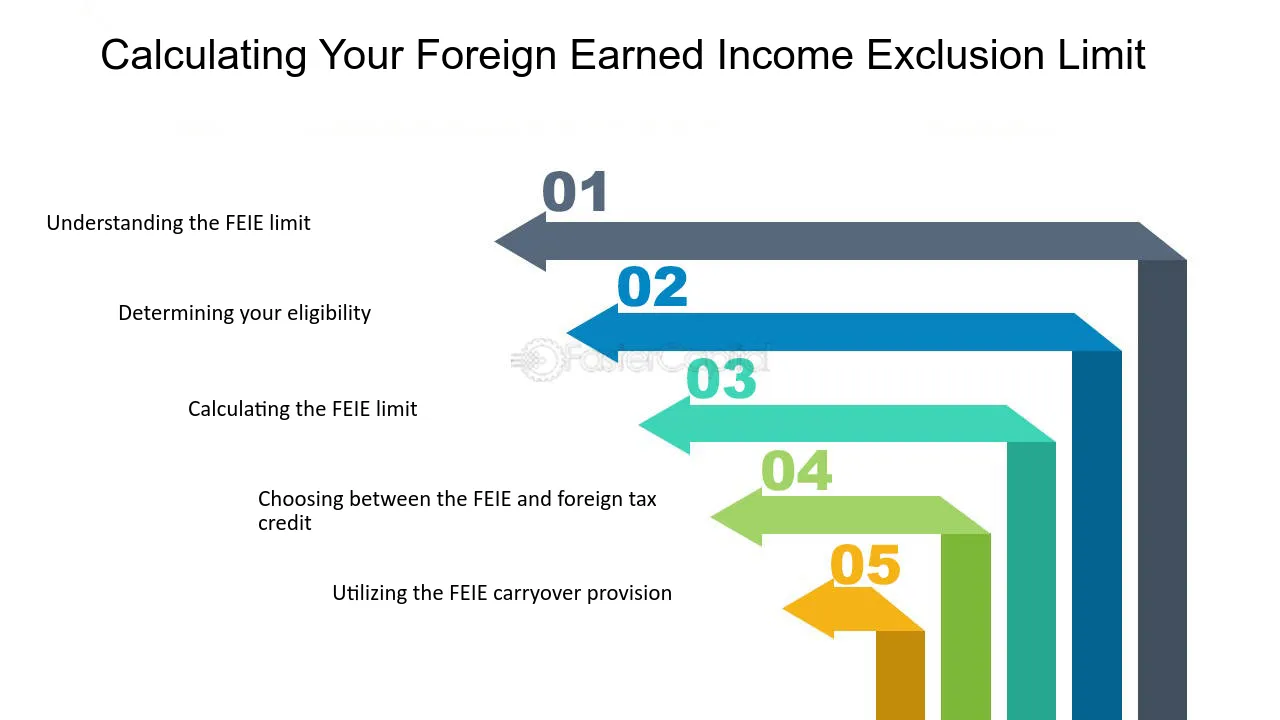

There are two main ways:

-

Physical Presence Test (330 days out of 12 months abroad)

-

Bona Fide Residence Test

11. 🛡 Protects from IRS Penalties

Proper use of the foreign income exclusion prevents accidental underpayment of taxes.

12. 🌎 Supported Worldwide

No matter where you live—from Dubai to Tokyo—this rule applies.

13. 🔄 Renewable Each Year

You can qualify each year as long as you meet the requirements.

14. 🚫 No Double Filing Penalties

Used correctly, the exclusion helps simplify dual-country tax filings.

15. 👌 Helps with Immigration Transitions

Immigrants working abroad before gaining residency can leverage it for tax planning.

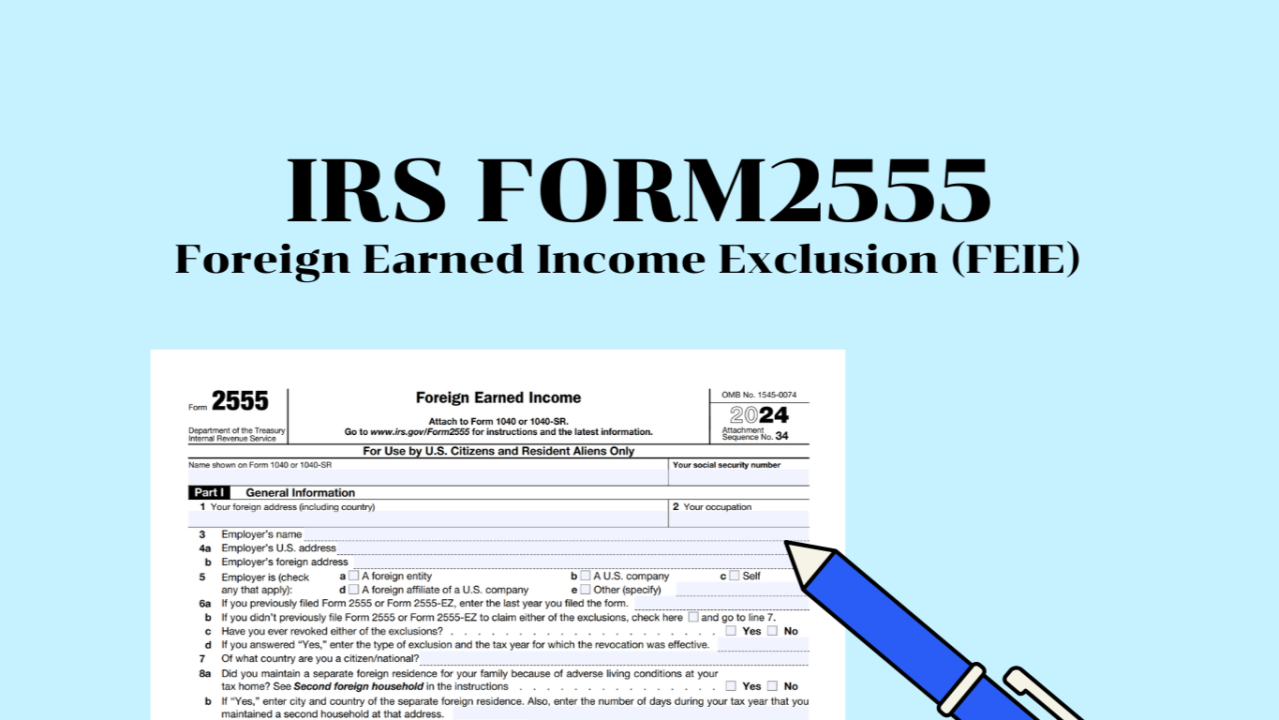

16. 🧮 Easy to Calculate with IRS Form 2555

Just use the IRS form and guidelines to claim the foreign income exclusion.

17. 📈 Can Be Combined with Other Benefits

You may still be eligible for:

-

Foreign housing exclusion

-

Foreign tax credit

(though you can’t double-dip for the same income)

18. 📉 Reduces AGI (Adjusted Gross Income)

This can reduce your exposure to other tax liabilities or Medicare surcharges.

19. 🔐 Helps Save on Self-Employment Tax (in some cases)

Depending on treaties and income type.

20. 👏 Supported by Most Tax Pros

Reputable tax professionals—like us at SyedPro—can help you claim it correctly.

21. 🏖 Enables Retirement Planning Abroad

More after-tax income means more money saved while living overseas.

22. 🛑 Reduces State Tax Headaches (for some states)

If you give up U.S. state residency, this can help eliminate state income tax.

23. 🧠 Helps Simplify FBAR & FATCA Issues

By reducing your taxable income, fewer reporting thresholds are triggered.

24. 🧾 Helps Expats Stay Compliant

Staying on the IRS’s good side is a win for any American abroad.

25. 📋 Supports Clean Tax Records

Using the foreign income exclusion ensures clean, audit-friendly returns.

26. 🎓 Good for Students/Teachers Abroad

Educators and students working overseas often qualify.

27. 💼 Valuable for Remote Workers

As remote work becomes global, many digital nomads benefit greatly.

⚠️ 5 Hidden Drawbacks You Need to Know

While the foreign income exclusion offers amazing benefits, it’s not perfect. Here are some risks and reasons it might not be right for you:

❗️1. Limits Retirement Contributions

Excluded income doesn’t count toward IRA or 401(k) contributions.

❗️2. Not Available for Passive Income

Only earned income qualifies. Dividends, capital gains, or rental income is still taxable.

❗️3. Risk of Disqualification

Missing days abroad, moving back mid-year, or filing incorrectly can void your claim.

❗️4. Reduced Social Security Credits

Excluded income may not count toward your Social Security earnings history.

❗️5. Not Always Beneficial in High-Tax Countries

If you’re already paying 30-40% tax abroad, using the foreign income exclusion may not be better than the foreign tax credit.

🔁 Foreign Income Exclusion vs. Foreign Tax Credit

| Feature | Foreign Income Exclusion | Foreign Tax Credit |

|---|---|---|

| Good for low-tax countries | ✅ | ❌ |

| Good for high-tax countries | ❌ | ✅ |

| Reduces taxable income | ✅ | ❌ (offsets tax, not income) |

| Includes passive income | ❌ | ✅ |

| Form used | IRS Form 2555 | IRS Form 1116 |

We can help you choose the best option based on your location and income sources.

🛠 Common Mistakes to Avoid

-

Failing to meet the Physical Presence Test

-

Using wrong dates on Form 2555

-

Overlapping exclusions with tax credits

-

Forgetting to file FBAR and FATCA forms

-

Not using a professional (like SyedPro 😉)

📌 Conclusion: Is Foreign Income Exclusion Right for You?

The foreign income exclusion is a golden opportunity—but only if it’s used wisely. At Syed Professional Services, we specialize in tax solutions for expats, digital nomads, and immigrants. Whether you’re moving abroad, working remotely, or dealing with complex cross-border tax issues, we can guide you through the process and maximize your legal savings.

📞 Ready to Save Thousands?

Contact Syed Professional Services today for expert help with:

-

Foreign Income Exclusion

-

IRS Form 2555

-

Dual-status tax filings

-

Expat tax strategy

👉 Visit us at: www.syedpro.com

📧 Email: info@syedpro.com