What is a 1099?

When it comes to taxes, one of the most common questions people have is, “What is a 1099?” Whether you are a business owner, a contractor, or someone trying to understand how taxes work, the 1099 form is something you’ll likely encounter. This comprehensive guide will break down what is a 1099 form is, the different types of 1099 forms, when they are used, and how they affect your taxes.

What is a 1099?

A 1099 form is a tax document used by businesses to report various types of income to the Internal Revenue Service (IRS). It is typically used to report income earned by individuals who are not employees of a business, such as independent contractors, freelancers, or self-employed workers. This form is essential because it ensures that the IRS is aware of the income being earned by individuals outside of traditional employment relationships.

If you have received a 1099 form, it means you were paid for your services or work but were not classified as an employee of the business. The 1099 form serves as a way for the payer to report that income to the IRS, and it also informs you of how much income you need to report on your own tax return.

Types of 1099 Forms

There are several different types of 1099 forms, each designed to report different kinds of income. Below are the most common types:

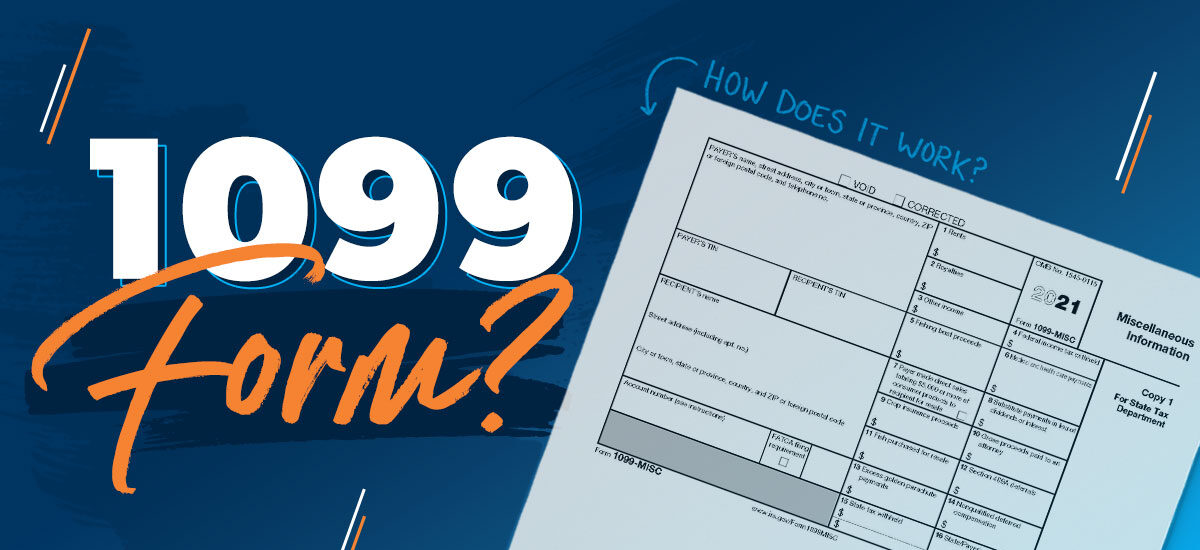

1. 1099-MISC

This form is one of the most frequently used 1099 forms. It is typically used to report miscellaneous income, including payments to independent contractors, freelancers, or service providers. For example, if you were paid $600 or more for services, a business may issue you a 1099-MISC form.

2. 1099-NEC

The 1099-NEC is similar to the 1099-MISC but is specifically used to report nonemployee compensation. This form was reintroduced in 2020 to better distinguish between types of income and simplify the reporting process for independent contractors. If you are an independent contractor or freelancer, you’ll most likely receive this form.

3. 1099-INT

This form reports interest income. If you earned interest on a savings account, a bond, or from any other financial instrument, you would receive a 1099-INT. The form reports how much interest you’ve earned during the year, and it is taxable income.

4. 1099-DIV

The 1099-DIV is used to report dividends earned on stocks or mutual funds. If you hold investments that pay out dividends, this form will summarize the dividend income you received.

5. 1099-G

This form is used to report government payments, such as unemployment benefits, state tax refunds, or other government-issued grants.

6. 1099-R

The 1099-R form reports distributions from retirement accounts such as pensions, IRAs, and 401(k) plans. If you took a distribution from your retirement plan, you will receive this form to report the income.

When to Expect a 1099?

As an independent contractor or business owner, you may receive a 1099 form if you were paid $600 or more during the tax year. Businesses are required by the IRS to issue 1099 forms to individuals who were paid $600 or more in non-employee compensation. For example, if you are a freelancer or contractor and you worked with a company or individual, and they paid you more than $600, you will likely receive a 1099-MISC or 1099-NEC.

For income types like interest or dividends, you might receive a 1099-INT or 1099-DIV if you earned $10 or more during the year.

How Does a 1099 Affect Your Taxes?

Receiving a 1099 means that you have to report the income on your tax return. However, there are some important differences in how you report this income compared to wages earned as an employee.

Reporting Income

If you are an independent contractor or freelancer, you will report your income on Schedule C (Profit or Loss from Business) of your tax return. This form allows you to list your income and expenses, which will help determine your taxable profit. Keep in mind that even if you receive a 1099, you are still responsible for paying self-employment taxes, which include Social Security and Medicare taxes.

Deducting Expenses

One of the advantages of working as an independent contractor or freelancer is that you can deduct certain business expenses from your income. These may include the cost of office supplies, business-related travel, and equipment. These deductions can help lower your taxable income, which ultimately reduces your tax liability.

Self-Employment Tax

Self-employed individuals must also pay self-employment tax, which covers Social Security and Medicare taxes. This is calculated on the net income from your business (after expenses). The current self-employment tax rate is 15.3%, which includes 12.4% for Social Security and 2.9% for Medicare.

What Happens If You Don’t Receive a 1099?

If you were paid more than $600 by a business and did not receive a 1099 form, you are still required to report that income on your tax return. The business may have missed the deadline to send the form or failed to issue one altogether, but the IRS requires you to report all income, whether you receive a 1099 or not.

You should contact the business that paid you and request that they issue a 1099. If they fail to do so, you can still file your taxes without it, but it is always best to report all your income accurately.

Common Mistakes to Avoid When Filing a 1099

When dealing with 1099 forms, it’s essential to ensure that you are reporting your income accurately and avoiding common mistakes. Here are some tips:

-

Ensure Accurate Information

Double-check the information on the 1099 form to ensure your name, address, and tax identification number are correct. If there are any mistakes, contact the payer to have the form corrected. -

Report All Income

Even if you didn’t receive a 1099 for a particular income source, make sure to report it. The IRS receives copies of all 1099 forms issued, and failing to report income can lead to penalties and interest. -

Don’t Forget Deductions

If you’re self-employed, be sure to take advantage of business-related deductions to lower your taxable income. This can help reduce your overall tax bill. -

Pay Your Self-Employment Taxes

Remember to account for self-employment taxes when filing your return. These taxes are separate from your regular income tax and should be calculated on your net income.

Conclusion: What is a 1099 and Why is It Important?

Understanding what a 1099 is and how it impacts your taxes is crucial for anyone who works as an independent contractor, freelancer, or has non-employee income. The 1099 form is a key document in the tax reporting process, and it ensures that the IRS is aware of the income you earned during the year.

By learning about the different types of 1099 forms and how they affect your taxes, you can better prepare for tax season and ensure that you are meeting all of your tax obligations. Whether you are new to freelancing or have been self-employed for years, it’s essential to stay informed about what a 1099 is and how it plays a role in your overall tax situation.

If you’re unsure about your 1099 form or need help with your tax filing, Syed Professional Services is here to assist you. We specialize in tax, accounting, and immigration services, and we can help you navigate the complexities of tax reporting, including understanding your 1099 forms. Contact us today to learn more!