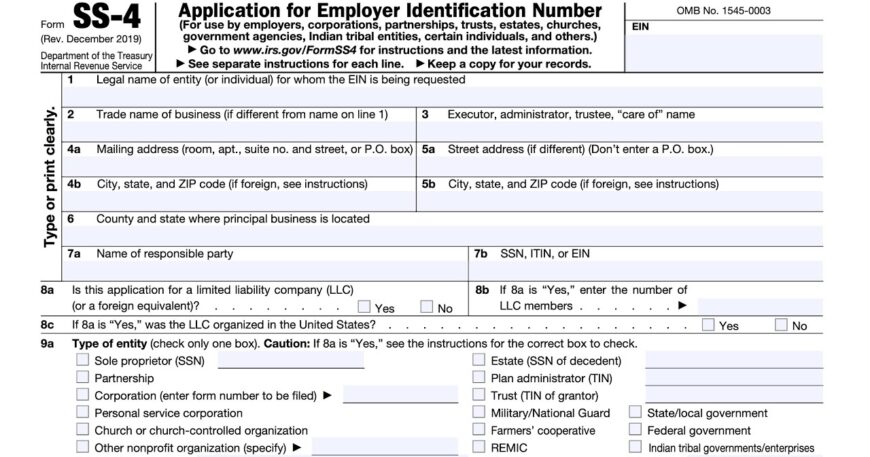

7 Powerful Reasons to Take the SS4 Form Seriously

7 Powerful Reasons the SS4 Form Can Make or Break Your Business Starting a business comes with a long list of forms, filings, and acronyms. But few are as misunderstood — yet vital — as the SS4 form. Whether you’re launching a new business, hiring employees, or applying for a business bank account, the SS4 […]