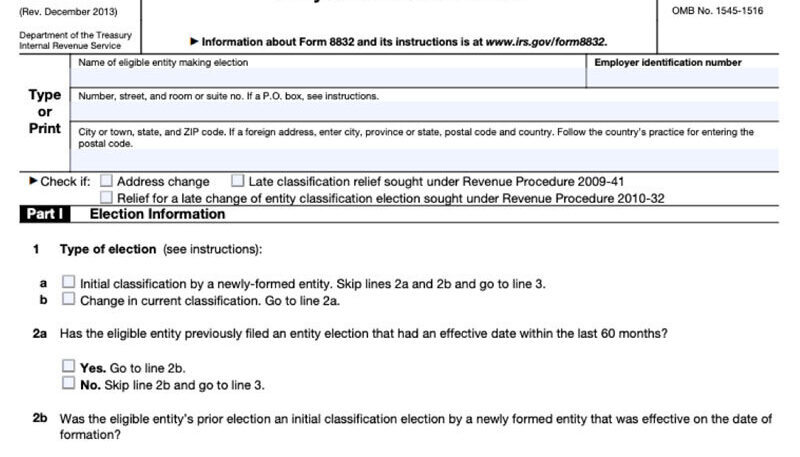

Form 8832: A Complete Guide to Choosing Your Entity Classification (Important Tax Information)

Introduction: Navigating the world of taxes, accounting, and immigration can often be complex, especially when you’re managing a business or thinking about structuring it for tax purposes. One of the essential forms you may encounter in the tax process is Form 8832. This IRS form is crucial for businesses that want to select how they […]