Introduction: Understanding Code 4 on Form 1099-R

For individuals who have taken distributions from retirement accounts such as IRAs, 401(k)s, or pensions, Form 1099-R is a key document for reporting income. On this form, the IRS uses various “distribution codes” to specify the nature of the distribution. One of the most important codes you may come across is Code 4.

In this blog post, we’ll dive deep into Code 4 on 1099-R, explaining its significance, what it means for your tax return, and how to handle it. Whether you’re an individual filing taxes, or a tax professional helping clients, understanding Code 4 1099-R is critical to accurate tax reporting and compliance.

What Is Form 1099-R?

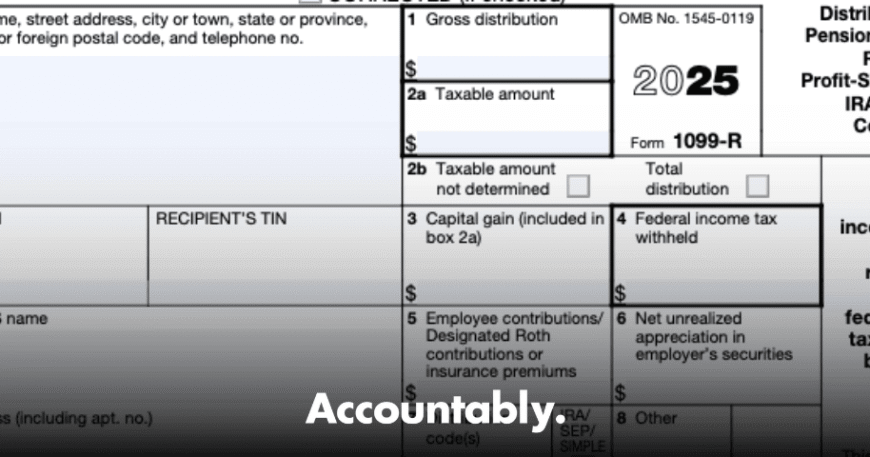

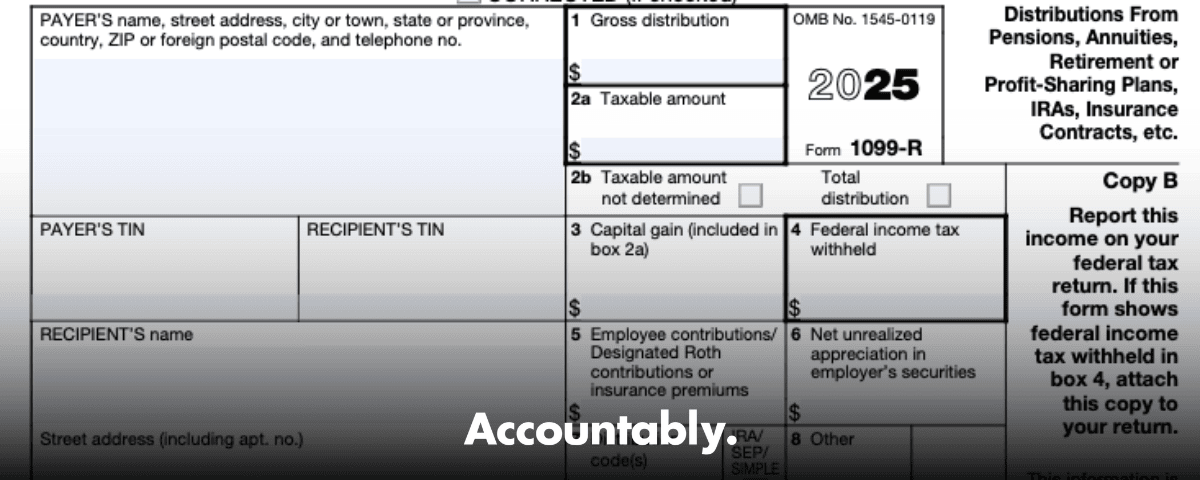

Form 1099-R is used to report distributions from retirement accounts, including pensions, 401(k)s, IRAs, and annuities. This form is provided by the financial institution or plan administrator and shows the total amount of money you’ve withdrawn during the year, along with the taxable portion and any penalties that might apply.

On Form 1099-R, you’ll see several important pieces of information:

-

Box 1: Gross distribution

-

Box 2a: Taxable amount

-

Box 7: Distribution codes

The distribution codes in Box 7 tell the IRS and taxpayers the nature of the distribution. Each code represents a different type of distribution scenario, and understanding these codes is vital for proper tax reporting. Code 4 is one such distribution code, and it comes with specific implications for your taxes.

What Does Code 4 Mean on 1099-R?

Code 4 1099-R indicates a “Early Distribution from a Qualified Retirement Plan (IRS Exception Applies).” Specifically, this code is used when you take an early withdrawal from your retirement account but qualify for an exemption from the 10% early withdrawal penalty.

The IRS generally imposes a 10% early withdrawal penalty on distributions taken before age 59 ½ from retirement accounts like a 401(k) or traditional IRA. However, there are several exceptions to this rule, and Code 4 signals that the distribution qualifies for one of those exceptions, meaning you are not subject to the penalty.

Common Exceptions for Code 4 1099-R

The reason you may be seeing Code 4 1099-R on your 1099-R is because your early distribution meets one of the IRS exceptions. Some of the most common exceptions include:

-

Disability: If you become disabled before the age of 59 ½, you can take early withdrawals from your retirement accounts without incurring the 10% penalty. Code 4 1099-R will be used to report this distribution.

-

Medical Expenses: If you incur significant medical expenses that exceed 7.5% of your adjusted gross income (AGI), you may take an early distribution without paying the penalty. The distribution must be used to cover medical costs.

-

Health Insurance Premiums: If you are unemployed and need to pay health insurance premiums, you may take an early distribution from your 401(k) or IRA to cover these costs without the 10% penalty.

-

Separation from Service: If you separate from your employer after turning 55, you may take penalty-free withdrawals from your 401(k) plan. This applies to 401(k) plans specifically; IRAs do not qualify for this exception.

-

Qualified Higher Education Expenses: Early distributions used for higher education costs may be exempt from the penalty, though the distribution is still taxable.

-

First-Time Home Purchase: You can withdraw up to $10,000 from an IRA to purchase your first home without paying the 10% penalty. This exception only applies to IRAs, not to 401(k) plans.

How Does Code 4 Affect Your Tax Return?

Even though Code 4 1099-R on your 1099-R means you’re exempt from the 10% early withdrawal penalty, the distribution is still subject to regular income tax. The IRS requires you to report the gross distribution as income on your tax return. This means:

-

The amount in Box 1 of your 1099-R (the gross distribution) will be added to your taxable income for the year.

-

You will not face the additional 10% penalty, but the distribution still counts as ordinary income, and you must pay income taxes on it according to your tax bracket.

What to Do if You Have Code 4 Your 1099-R?

If you receive a 1099-R with Code 4, follow these steps to ensure your taxes are properly filed:

-

Check Your Taxable Income: Ensure that the distribution is included in your gross income for the year. Remember, Code 4 1099-R does not exempt you from taxes; it only exempts you from the early withdrawal penalty.

-

Review Your Exceptions: Double-check the reason for your Code 4 1099-R distribution. Make sure it matches one of the IRS exceptions listed above, such as disability or medical expenses.

-

Form 5329: If you believe you qualify for an exception and you do not see Code 4 1099-R on your 1099-R, you may need to file Form 5329 to claim the exception and avoid the penalty.

-

Consult a Tax Professional: If you’re unsure how to report your Code 4 1099-R distribution on your tax return, it’s a good idea to consult a tax professional. They can guide you through the process and ensure you avoid mistakes that could lead to penalties or audit issues.

Tax Implications of Early Withdrawals and Code 4

Taking an early distribution from a retirement account can have long-term consequences on your financial future. In addition to the taxable income and penalty (unless you qualify for Code 4 or another exception), you may miss out on the compounding growth of your retirement savings.

While Code 4 1099-R eliminates the 10% early withdrawal penalty, the taxable portion of the distribution will still be included in your total income for the year. This could push you into a higher tax bracket, leading to more taxes owed than you originally anticipated.

Therefore, before taking an early withdrawal, it’s important to consider:

-

The immediate tax implications

-

The long-term impact on your retirement savings

-

Other potential sources of funds (such as a personal loan or a hardship withdrawal from other accounts)

Common Mistakes to Avoid with Code 4 1099-R

-

Misunderstanding the Exceptions: Ensure you meet one of the IRS exceptions for Code 4 1099-R . Just because you have an early withdrawal does not automatically mean you qualify for the exception.

-

Not Reporting the Distribution Correctly: Even with Code 4 1099-R , the distribution is still taxable. Make sure you report it on your tax return, even though you’re exempt from the 10% penalty.

-

Not Filing Form 5329: If you believe you qualify for an exception and your 1099-R shows a code other than Code 4 1099-R , you might need to file Form 5329 to claim your exception from the penalty.

Conclusion: Handling Code 4 on 1099-R

Understanding Code 4 1099-R is crucial for accurate tax reporting. While this code means you are exempt from the 10% early withdrawal penalty, it does not exempt you from paying taxes on the distribution. Always ensure that you’re following the correct procedure for reporting the distribution and that you qualify for one of the IRS exceptions.

At Syed Professional Services, we are here to guide you through all aspects of tax preparation and filing, including complex retirement account distributions. If you’re unsure how to handle Code 4 on 1099-R, or need assistance with any other tax matters, contact us today for expert advice and support.