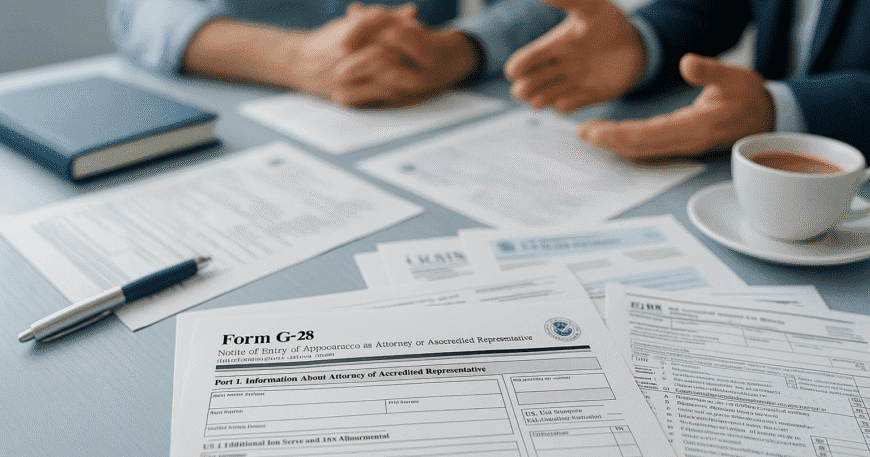

G-28 Form: Simplifying Your Immigration Journey with Expert

G-28 Form: What is it and How is it Used? Introduction:. The G-28 Form, also known as the “Notice of Entry of Appearance as Attorney or Accredited Representative,” is an essential form used in the United States immigration process. This form allows an individual, typically an attorney or accredited representative, to represent someone in immigration […]