The Ultimate Guide to EIN Application: A Step-by-Step Process for Your Business

Starting and running a business can be an exciting yet challenging journey. One of the most important steps that many new entrepreneurs overlook is applying for an Employer Identification Number (EIN). The EIN application process can seem complicated, but it’s essential for your business’s financial and legal success. Whether you are a sole proprietor, a corporation, or a partnership, obtaining an EIN is necessary for managing taxes, opening business bank accounts, and ensuring compliance with government regulations.

In this comprehensive guide, we will walk you through everything you need to know about the EIN application, how to apply, and why it’s vital for your business.

What is an EIN?

An Employer Identification Number (EIN), also known as a Federal Tax Identification Number, is a unique nine-digit number assigned by the IRS to businesses for tax purposes. It is similar to a social security number, but instead of identifying individuals, it identifies your business. The EIN is essential for many different business operations, from filing taxes to applying for loans.

Businesses need an EIN if they hire employees, operate as a corporation or partnership, or meet specific IRS filing requirements. Even if you don’t have employees, you may still need an EIN to open a business bank account or file certain types of taxes.

Why is an EIN Important for Your Business?

Understanding the significance of an EIN application is vital for entrepreneurs and business owners. Here are the key reasons why you need to apply for an EIN:

-

Tax Filing and Reporting:

The EIN allows your business to file taxes with the IRS, including income tax, payroll taxes, and excise taxes. Without it, you cannot fulfill tax obligations legally. -

Business Structure:

If you are running a corporation, partnership, or limited liability company (LLC), you will need an EIN for organizational purposes. It helps the IRS identify your business and distinguish it from others. -

Hiring Employees:

If your business hires employees, an EIN is mandatory. It is used to report wages, withholding taxes, and other employee-related taxes to the IRS. -

Opening a Business Bank Account:

Banks require an EIN to open a business account, as it serves as the primary identifier for your business. -

Applying for Business Licenses and Permits:

Certain business licenses and permits require an EIN for approval. These may be specific to your location or industry. -

Establishing Business Credit:

Having an EIN is essential for establishing a business credit profile separate from your personal credit. It opens doors for business loans, lines of credit, and other forms of financing.

Step-by-Step Guide to Applying for an EIN

Now that you understand the importance of the EIN application process, let’s go over the steps involved. The process is straightforward and can be completed online, by mail, or via fax. Below is a detailed guide on how to apply for your EIN:

-

Determine If You Need an EIN

Before applying for an EIN, you must first determine whether your business needs one. Generally, most businesses need an EIN if they:-

Have employees

-

Operate as a corporation or partnership

-

File certain tax returns (excise, employment, etc.)

-

Are involved in specific business activities, such as dealing with alcohol or firearms.

-

-

Visit the IRS Website

The quickest and easiest way to apply for an EIN is through the IRS website. The IRS provides an online EIN application tool that allows you to complete the process in just a few minutes. To apply online, visit the IRS website at www.irs.gov. -

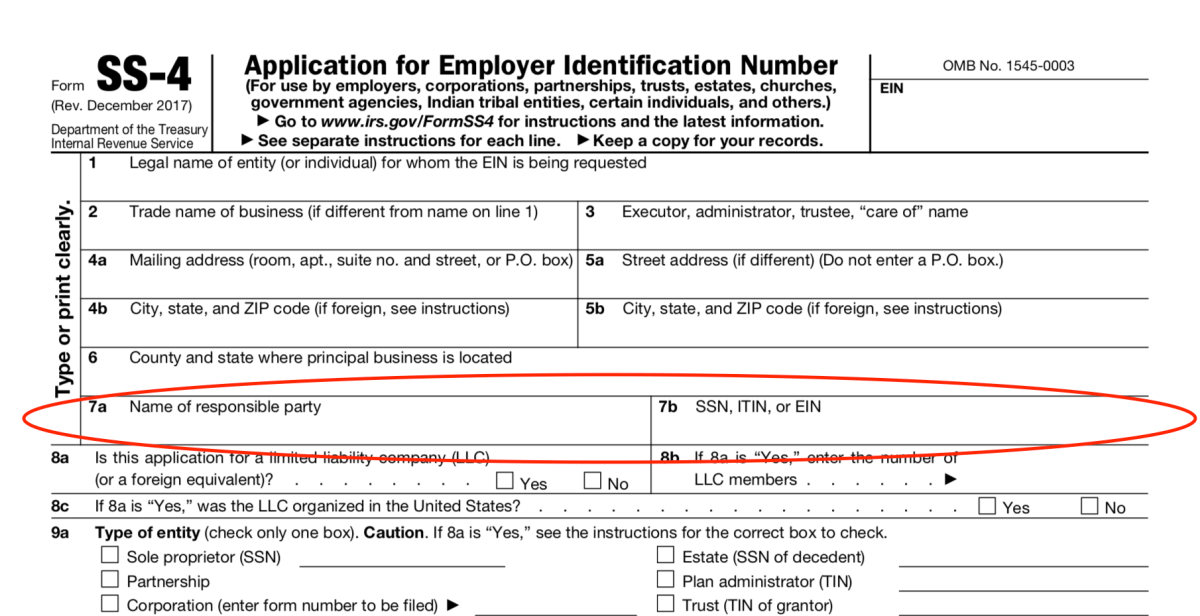

Prepare Your Information

Before starting the EIN application, ensure that you have all the necessary details ready:-

Your legal business name

-

Business structure (LLC, Corporation, Partnership, etc.)

-

The name of the person applying for the EIN

-

Business address

-

Type of business activity

-

Social security number (SSN) or individual taxpayer identification number (ITIN) of the business owner.

-

-

Complete the Application

On the IRS website, follow the step-by-step instructions to complete your EIN application. Make sure to double-check all the details you provide. Any errors could result in delays or rejection of your application. -

Submit Your Application

Once you’ve filled out all the required information, submit the application. If you apply online, you will receive your EIN immediately after submitting your application. -

Receive Your EIN

For online applications, the EIN is issued immediately after completing the form. If you apply by mail or fax, it may take several weeks to receive your EIN.

Common Mistakes to Avoid in the EIN Application Process

While the EIN application is relatively simple, many business owners make mistakes during the process. To ensure a smooth application process, avoid the following:

-

Incorrect Business Information

Always ensure that the information you provide on your EIN application is accurate. Errors in your business name, structure, or other details can delay the process or lead to complications down the road. -

Not Applying at the Right Time

If your business requires an EIN, don’t wait too long to apply. You need an EIN before you start hiring employees, opening a business bank account, or filing your business taxes. -

Incorrect EIN Use

Once you’ve received your EIN, make sure to use it correctly. For example, if your business structure changes, you may need a new EIN. Always check that you’re using the EIN for the right purposes. -

Failure to Apply for an EIN When Required

If your business is required to have an EIN but you neglect to apply for one, you could face penalties from the IRS. Make sure to apply as soon as you are legally required to do so.

EIN Application for Different Business Types

The EIN application process can vary depending on your business type. Let’s take a closer look at the EIN requirements for different business entities:

-

Sole Proprietorships:

While a sole proprietor may not need an EIN if they don’t have employees, it is still recommended to get one to separate personal and business finances. -

Partnerships and LLCs:

Partnerships and LLCs are required to apply for an EIN, as they are separate legal entities from their owners. -

Corporations:

All corporations (C-corporations, S-corporations, etc.) must apply for an EIN, regardless of whether or not they have employees. -

Nonprofits:

Nonprofit organizations must apply for an EIN for tax-exempt status and to comply with federal regulations.

When to Apply for an EIN

Timing your EIN application is essential. Here are some key moments when you should apply for an EIN:

-

Before hiring employees

-

Before opening a business bank account

-

Before filing taxes or applying for licenses

Conclusion: Take Action with Your EIN Application

The EIN application process is a crucial step for any business. Whether you are a new entrepreneur or managing an established company, obtaining an EIN ensures that you remain compliant with federal tax laws and can conduct business without roadblocks. If you’re unsure about the process or need assistance, Syed Professional Services is here to help.

By following this easy-to-understand guide, you’ll have your EIN in no time and be able to focus on what truly matters—growing your business. If you have questions or need expert advice, reach out to Syed Professional Services today!