Introduction

When it comes to IRS compliance for foreign individuals and entities, Form 1042 is one of the most misunderstood yet critically important tax forms. Filed annually by withholding agents, this form reports income subject to withholding under Chapter 3 of the Internal Revenue Code. Whether you’re a multinational corporation, university, bank, or even an individual managing cross-border transactions, mastering Form 1042 is non-negotiable.

At Syed Professional Services, we help clients navigate U.S. tax complexities, especially those dealing with international payments. In this detailed guide, we uncover the hidden pitfalls of Form 1042, the importance of accuracy, and the strategies to stay audit-proof.

What Is Form 1042 and Who Needs to File It?

Form 1042 is used to report U.S.-source income paid to nonresident aliens and foreign entities that is subject to withholding. It works hand-in-hand with Form 1042-S, which details individual payments.

Entities that must file Form 1042 include:

-

U.S. financial institutions

-

Foreign banks with U.S. income

-

Universities and academic institutions

-

Insurance and mutual fund companies

-

Partnerships and LLCs with foreign partners

-

Individuals paying interest, dividends, or royalties to nonresidents

If you’re making payments like:

-

Interest

-

Dividends

-

Royalties

-

Rents

-

Scholarships and fellowships

-

Independent contractor fees

…you may be required to file Form 1042 and remit proper withholding to the IRS.

Why Form 1042 Compliance Matters More Than Ever

Incorrect Form 1042 filings can lead to serious consequences including:

-

IRS audits

-

Withholding agent penalties (as high as 100% of tax due)

-

Loss of eligibility for treaty benefits

-

Reputational damage

Because the IRS enforces strict rules around cross-border income and withholding, even small errors in Form 1042 can lead to significant penalties.

With global financial scrutiny increasing, now more than ever, your business must get Form 1042 filings right the first time.

7 Costly Form 1042 Mistakes That Can Destroy Your IRS Compliance

1. Misclassifying the Income Type

Each income type (interest, dividend, royalty, etc.) has different withholding rules. Misclassifying income on Form 1042 affects:

-

Withholding rate

-

Reporting on Form 1042-S

-

Treaty eligibility

Example: Treating a dividend as a royalty could lead to underwithholding and penalties.

2. Not Applying the Right Treaty Rate

Foreign payees may be eligible for reduced withholding rates under IRS tax treaties. However, failure to verify this with Form W-8BEN or W-8ECI can result in excessive or insufficient withholding.

If you apply a treaty rate without valid documentation, you’re liable for the difference. Always confirm treaty eligibility before completing Form 1042.

3. Incomplete or Incorrect Form 1042-S Matching

Form 1042-S is used to detail the payments reported in Form 1042. If the totals on your Form 1042 don’t match the 1042-S filings, the IRS flags your return.

Common errors include:

-

Missing recipient data

-

Wrong country codes

-

Incorrect income codes

These discrepancies are easily avoidable with proper review and reconciliation.

4. Failure to Withhold or Deposit Taxes Timely

Withholding agents must deposit taxes withheld according to the IRS deposit schedule. Missing deadlines can result in:

-

Interest

-

Late deposit penalties

-

Invalidation of your Form-1042

Ensure your team tracks due dates and uses the Electronic Federal Tax Payment System (EFTPS) to submit payments.

5. Not Understanding Your Role as a Withholding Agent

Many businesses don’t realize they qualify as withholding agents, meaning they’re legally responsible for reporting and paying withholding tax. Ignorance isn’t an excuse.

If you are the first U.S. payor in a chain involving foreign recipients, the IRS holds you liable. Form 1042 ensures that chain is traceable and compliant.

6. Filing Late or Not Filing at All

Form 1042 is due March 15 each year. Extensions can be requested using Form 7004, but late filings without an extension can incur serious fines.

Penalties may include:

-

$270 per incorrect Form-1042-S

-

25% of tax due for late payment

-

Criminal penalties for willful non-compliance

7. Failing to Keep Proper Documentation

To defend your Form-1042 filings in the event of an audit, you must maintain:

-

Valid W-8BEN or W-8BEN-E forms

-

Payment records

-

Deposit confirmations

-

Correspondence with payees

IRS guidelines require you to retain these documents for at least 3 years. Digital copies are acceptable but must be easily retrievable.

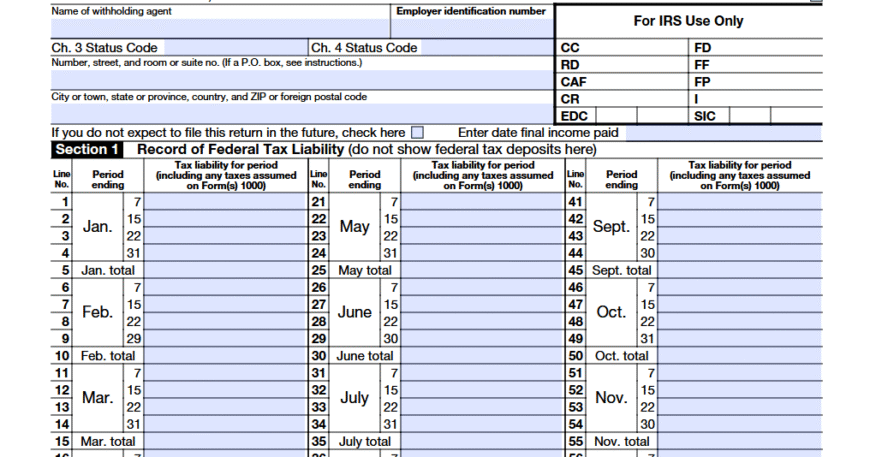

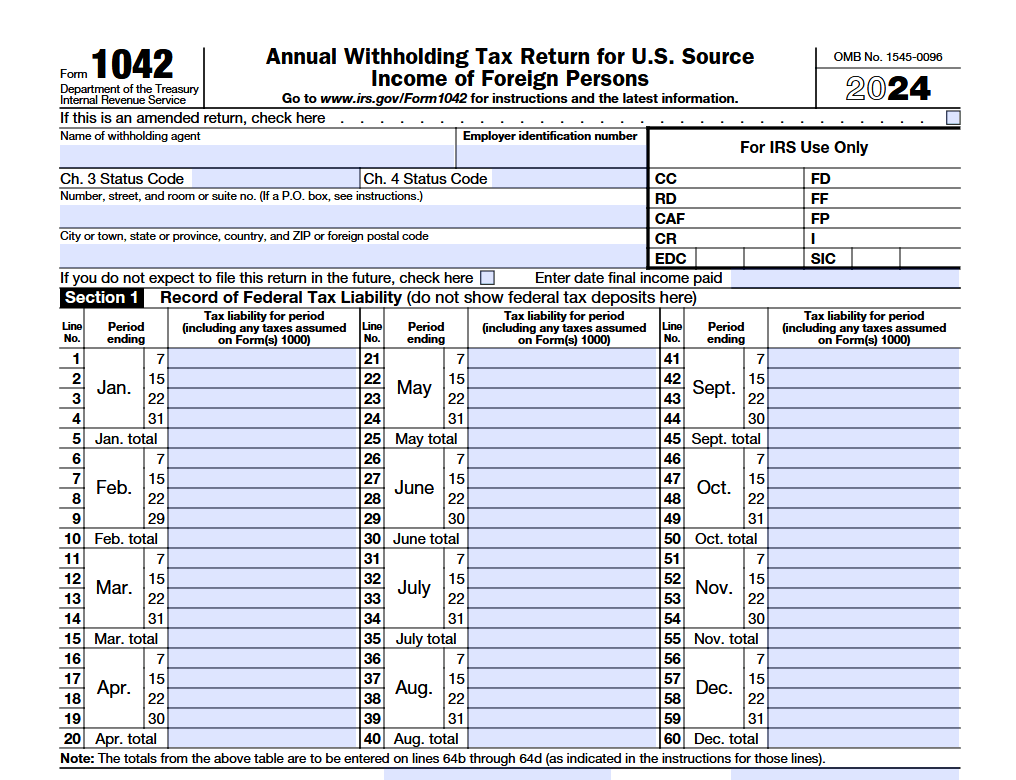

How to File Form 1042 Correctly: Step-by-Step

Filing Form-1042 correctly starts with organization. Here’s a quick guide:

| Step | Task |

|---|---|

| 1 | Collect valid W-8 documentation |

| 2 | Identify all U.S.-source payments to foreign individuals/entities |

| 3 | Apply correct withholding and deposit using EFTPS |

| 4 | Complete Form-1042-S for each payee |

| 5 | Reconcile totals and file Form-1042 by March 15 |

| 6 | Keep records securely for at least 3 years |

Partnering with a qualified tax professional can ensure these steps are followed accurately.

How Form 1042 Differs From Other IRS Forms

| Form | Purpose |

|---|---|

| 1042 | Annual summary of all U.S.-source income paid to foreign entities |

| 1042-S | Individual detail for each payment to foreign recipient |

| W-8BEN | Certifies foreign status and treaty eligibility |

| W-9 | For U.S. persons, not foreign recipients |

Only Form-1042 summarizes withholding activity—it’s different from income tax returns.

IRS Penalties Related to Form 1042

Here are key penalty triggers:

-

Failure to file on time

-

Failure to deposit taxes

-

Inaccurate reporting

-

Lack of backup documentation

-

Failing to file 1042-S forms

The IRS imposes strict monetary and compliance penalties for Form-1042 errors. In some cases, even criminal prosecution is possible.

Top Industries That Must File Form-1042

• Universities & Academic Institutions

For scholarships, fellowships, and international visiting professors

• Financial Institutions

For dividends, interest, and portfolio investments

• Real Estate Investors

Rent paid to foreign owners

• Tech Companies

Royalties or licensing fees to overseas entities

If you’re in one of these industries, Form-1042 compliance is non-negotiable.

Why Work With Syed Professional Services on Form 1042?

At Syed Professional Services, we provide tailored tax solutions for individuals and organizations with cross-border obligations. Our services include:

-

IRS representation for audits

-

Withholding agent advisory

-

Review of W-8 forms and treaty positions

-

Form-1042 and 1042-S preparation

-

Annual compliance checklists

We help ensure you’re not only compliant—but audit-ready.

FAQs About Form 1042

Who must file Form-1042?

Any U.S. withholding agent who pays U.S.-source income to foreign persons must file Form-1042 annually.

When is Form-1042 due?

March 15 of the following year. Extensions can be filed using Form 7004.

Do I have to file if I had no withholding?

Yes, if you made reportable payments—even with zero withholding—you still must file.

Can I file Form-1042 electronically?

Yes, especially if you’re filing 250 or more 1042-S forms. The IRS mandates electronic filing in this case.

What’s the difference between Form-1042 and 1042-S?

Form-1042 summarizes total withholdings. 1042-S provides details for each foreign payee.

How do I fix errors after filing?

File an amended Form-1042 and corrected 1042-S forms as soon as possible to avoid escalating penalties.

Conclusion

Form-1042 compliance is a high-stakes responsibility—especially if you’re dealing with international payments. The IRS is cracking down on withholding errors, and even honest mistakes can lead to significant financial penalties.

Understanding Form-1042 and avoiding these seven costly mistakes will help you stay compliant, avoid audits, and protect your bottom line.

Let Syed Professional Services be your trusted partner in international tax compliance. Our expertise in Form-1042 filings ensures your obligations are handled with precision and professionalism.