Introduction

Thinking of electing S corporation status for your small business? Smart move—S Corporations can save you thousands on self-employment taxes and simplify your tax reporting. But there’s one form that stands between you and those benefits: Form 2553.

This critical IRS form notifies the IRS of your intent to be taxed as an S Corporation. However, mistakes and delays in filing Form 2553 can derail your tax strategy, trigger audits, and cost you big. In this comprehensive guide, we’ll walk you through what Form 2553 is, why it matters, and how to file it flawlessly.

At Syed Professional Services, we help businesses like yours optimize entity selection, tax strategy, and compliance—so you can focus on growth.

What Is Form 2553?

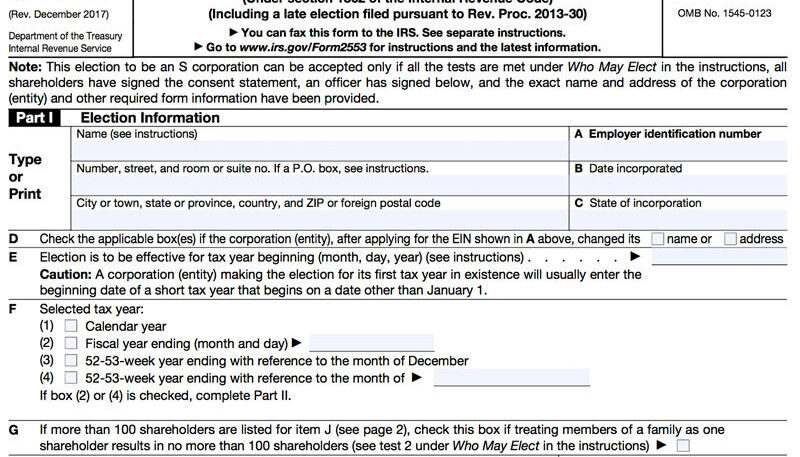

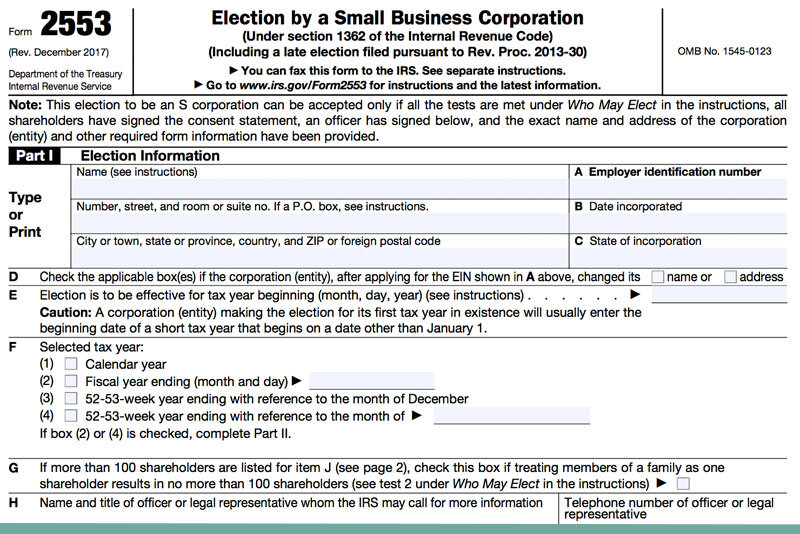

Form 2553, officially known as Election by a Small Business Corporation, is the IRS document that a corporation or LLC must file to elect S Corporation tax treatment under Internal Revenue Code Section 1362(a).

S Corporation status allows pass-through taxation, meaning business income, deductions, and credits flow to the owners’ personal tax returns—often reducing overall tax liability.

To file Form 2553, your entity must meet the IRS qualifications:

-

Be a domestic corporation or LLC

-

Have no more than 100 shareholders

-

Shareholders must be individuals, certain trusts, or estates (no corporations or partnerships)

-

Only one class of stock

Why Filing Form 2553 Matters So Much

Failing to file Form 2553—or filing it incorrectly—can:

-

Prevent your S Corp election from taking effect

-

Force you to file as a C Corporation

-

Trigger double taxation

-

Lead to IRS rejection

-

Create compliance problems with state taxes

That’s why it’s critical to understand Form 2553 rules, timelines, and strategies to avoid common mistakes.

10 Powerful Reasons Why Filing Form 2553 Late Could Wreck Your S Corp Status

1. You Miss Out on S Corp Tax Savings

If you don’t file Form 2553 on time, you remain taxed as a C Corporation or sole proprietorship—both of which may result in higher taxes.

S Corps allow owners to split income between salary and dividends, reducing self-employment tax exposure. Delaying the Form 2553 filing delays those benefits.

2. You Risk IRS Rejection of S Corp Status

Late filings of Form 2553 are one of the most common reasons for IRS rejection of S Corporation elections. The IRS generally requires the form to be filed:

-

Within 75 days of the beginning of the tax year in which the election is to take effect

-

OR within 75 days of incorporation

Missing the window? You’ll need to request Late Election Relief—which isn’t guaranteed.

3. You May Have to Pay Double Taxation

Without S Corp status, your profits may be taxed at both the corporate and shareholder levels. Filing Form 2553 on time protects you from this dreaded double taxation scenario.

4. You Complicate Bookkeeping and Tax Filing

If you forget or delay your Form 2553 submission, you might need to reclassify income, amend prior tax filings, or prepare dual returns. It creates confusion and opens the door to IRS scrutiny.

5. You Can’t Retroactively Elect S Corp Without Relief

Many business owners assume they can “go back” and file Form 2553 for a prior year. The truth? It’s only possible if you qualify for Rev. Proc. 2013-30 late election relief.

This process requires you to:

-

Show reasonable cause for the delay

-

Prove consistent S Corp treatment

-

Obtain written shareholder approval

6. You Lose Credibility with Lenders and Investors

Investors and lenders prefer businesses that are structured properly and tax-efficiently. Failing to file Form 2553 reflects poor planning and can undermine your business’s financial credibility.

7. You May Incur Penalties for Incorrect Filing Status

Filing as an S Corp without having submitted Form 2553 is a major red flag. The IRS could impose penalties or revoke deductions taken under the wrong entity status.

8. You Delay Payroll and Salary Structuring

With Form 2553 approved, owners can pay themselves a “reasonable salary” and take additional profits as dividends. Delay the filing, and you delay this strategy—often increasing your tax bill.

9. You Miss Annual Election Windows

Even if you realize the mistake mid-year, you may need to wait until the next tax year for your Form 2553 election to take effect—losing another year of S Corp benefits.

10. You Create State-Level Compliance Issues

Some states require additional filings after Form 2553 is submitted to the IRS. Late or forgotten S Corp elections at the state level can lead to penalties, back taxes, and audit exposure.

How to Fill Out Form 2553 Correctly

Here’s a section-by-section breakdown of Form 2553:

| Part | What to Complete |

|---|---|

| Part I | Basic info about the corporation, EIN, election date, and tax year |

| Part II | Fiscal year election if you’re not a calendar-year filer |

| Part III | Qualified subchapter S trust (QSST) information, if applicable |

| Part IV | Late election explanation if you’re filing after the deadline |

Need help? The experts at Syed Professional Services can prepare and file Form 2553 for you, ensuring full compliance.

Common Form 2553 Mistakes to Avoid

-

Choosing the wrong effective date

-

Failing to obtain all shareholder signatures

-

Using an incorrect tax year

-

Submitting incomplete forms

-

Not mailing to the correct IRS address

-

Forgetting to confirm IRS approval letter

These can all result in Form-2553 rejection—so double-check your paperwork or consult a professional.

When to File Form 2553

The IRS rules are strict:

-

File Form-2553 within 75 days of the beginning of the tax year

-

New businesses must file within 75 days of incorporation

-

Late elections must include justification under Rev. Proc. 2013-30

We recommend filing Form-2553 immediately upon forming your LLC or Corporation to avoid missing the deadline.

FAQs About Form 2553

What is the purpose of Form-2553?

To elect S Corporation tax treatment for eligible LLCs and corporations.

Is Form-2553 mandatory?

Only if you want to be taxed as an S Corporation. If you don’t file it, your default tax classification remains.

Can Form-2553 be filed electronically?

As of now, no. Form-2553 must be filed by fax or mail to the IRS service center.

How long does IRS take to process Form-2553?

Typically 60–90 days. You’ll receive an approval letter (CP261) once accepted.

Can I file Form-2553 late?

Yes, but you must qualify under Rev. Proc. 2013-30 and include an explanation.

What happens if my Form-2553 is rejected?

You’ll be taxed under default classification rules and may need to amend returns or refile the form.

Get Help with Form 2553 from Syed Professional Services

Navigating Form-2553 can be tricky—but it doesn’t have to be. At Syed Professional Services, we offer:

-

Entity selection and tax planning

-

IRS-compliant Form-2553 preparation

-

Late election guidance and Rev. Proc. filing

-

Ongoing business tax support

Whether you’re forming a new business or correcting a past mistake, we’re here to help you avoid penalties and maximize your S Corp benefits.

Conclusion

Filing Form-2553 is more than paperwork—it’s a gateway to smarter tax strategy and business efficiency. But missing deadlines or submitting the wrong info can lead to IRS headaches, financial penalties, and years of frustration.

Don’t let poor planning cost your business its S Corp status. Let the experts at Syed Professional Services guide you through the Form-2553 process, file on time, and protect your future.