Introduction

For nonprofit organizations, compliance isn’t optional—it’s survival. One document, in particular, plays a massive role in how the IRS, donors, regulators, and even the public perceive your organization: Form 990. Whether you’re running a small charity or managing a large tax-exempt organization, understanding Form 990 can mean the difference between long-term success and unnecessary trouble.

At Syed Professional Services, we’ve seen firsthand how nonprofits thrive when they handle Form 990 correctly—and how costly errors can derail even well-intentioned organizations. This in-depth guide breaks down everything you need to know about Form 990, from who must file to common mistakes, deadlines, and expert strategies to stay compliant and confident.

Form 990 and Its Role in Nonprofit Compliance

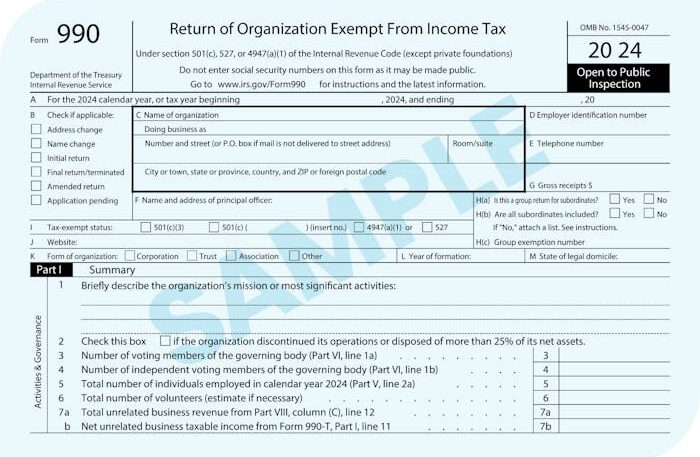

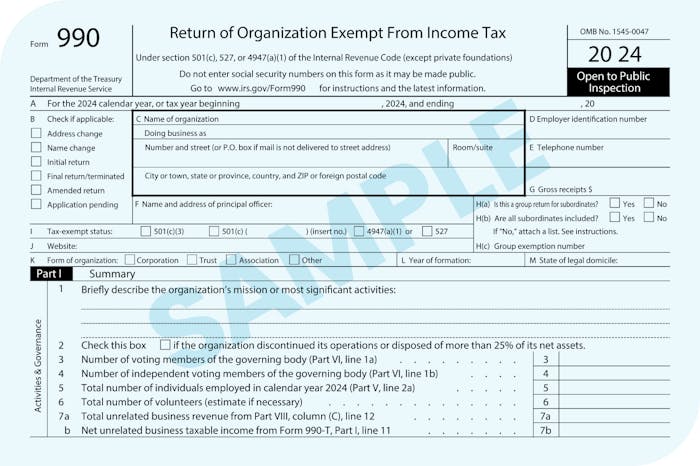

Form 990 is not just another tax form—it’s a public disclosure document that tells the story of your nonprofit’s mission, finances, governance, and accountability. Filed annually with the IRS, Form 990 allows regulators and the public to evaluate how responsibly an organization operates.

Unlike for-profit tax returns, Form 990 is designed to promote transparency. It reports revenue, expenses, executive compensation, program activities, and governance policies. Anyone—donors, journalists, watchdog groups—can review your Form 990, making accuracy absolutely critical.

Nonprofits that underestimate the importance of Form-990 often face reputational damage, increased IRS scrutiny, or loss of donor trust. On the flip side, a properly prepared Form-990 reinforces credibility and strengthens confidence among stakeholders.

At its core, Form 990 is both a compliance requirement and a strategic communication tool.

Who Must File Form 990 and Which Version Applies

Not every nonprofit files the same version of Form 990, but most tax-exempt organizations are required to submit one annually. The specific version depends on your organization’s size, revenue, and assets.

Organizations with gross receipts normally above $200,000 or total assets exceeding $500,000 must file the full Form-990. Smaller nonprofits may qualify for Form-990-EZ, while very small organizations can file Form 990-N, also known as the e-Postcard.

Churches and certain religious organizations are generally exempt from filing Form-990, but many affiliated organizations still must comply. Failing to file the correct Form-990 version can result in penalties or unnecessary IRS correspondence.

Choosing the right filing option—and confirming eligibility—is one of the most overlooked but critical steps in nonprofit compliance.

Why Form 990 Accuracy Directly Impacts Your Reputation

Here’s the hard truth: donors look at Form-990. Grant-making institutions review Form-990. The IRS analyzes Form-990. Errors, inconsistencies, or red flags can quickly raise concerns.

Executive compensation disclosures, fundraising efficiency ratios, and program expense percentages are all visible on Form-990. If these figures appear excessive or unclear, donors may hesitate to contribute—even if your mission is noble.

A carefully prepared Form 990 tells a clear, compelling story of impact and responsible management. Poorly prepared filings, however, can paint an inaccurate or damaging picture that lingers online for years.

That’s why many nonprofits turn to experienced professionals to review and prepare Form-990 filings with precision and strategic insight.

Common Form 990 Mistakes That Trigger IRS Penalties

Even well-run nonprofits make avoidable mistakes on Form-990. Some of the most common issues include incorrect revenue classification, incomplete governance disclosures, and inconsistent financial data.

Missing schedules is another frequent problem. Form-990 includes numerous schedules depending on activities such as foreign operations, fundraising events, or donor-advised funds. Omitting required schedules can result in IRS follow-up notices.

Late filing is especially dangerous. Failure to file Form-990 for three consecutive years results in automatic revocation of tax-exempt status. Reinstatement is time-consuming, expensive, and damaging to credibility.

Accuracy, consistency, and timeliness are non-negotiable when dealing with Form-990.

Form 990 Deadlines and Extension Rules Explained

The standard deadline for filing Form 990 is the 15th day of the fifth month after the end of your organization’s fiscal year. For most calendar-year nonprofits, that means May 15.

If more time is needed, nonprofits may request an automatic six-month extension by filing Form 8868. However, an extension to file Form-990 is not an extension to fix inaccurate records or disorganized bookkeeping.

Late or incomplete Form-990 filings may trigger penalties that accumulate daily. These fines can become substantial, especially for larger organizations.

Planning ahead and maintaining clean financial records ensures your Form-990 is filed correctly and on time.

How Professional Preparation Improves Form 990 Outcomes

Professional preparation of Form-990 isn’t just about compliance—it’s about strategy. Experienced tax professionals understand how to present financial information clearly, accurately, and favorably while staying fully compliant.

At Syed Professional Services, we analyze your organization’s activities to ensure Form-990 aligns with your mission, governance policies, and financial reality. We help identify potential red flags before the IRS does.

Professional oversight also ensures consistency between Form-990, internal financial statements, and public communications. This level of alignment strengthens credibility and minimizes risk.

For growing nonprofits, professional Form-990 preparation becomes an essential investment rather than an optional expense.

Form 990 and Public Transparency in the Digital Age

Once filed, Form-990 becomes publicly available through IRS databases and third-party websites like GuideStar and Charity Navigator. That means your Form-990 lives online indefinitely.

In today’s digital environment, transparency is expected. A clean, well-organized Form-990 supports donor confidence and enhances your nonprofit’s public image. A sloppy filing does the opposite.

Nonprofits that proactively manage how Form-990 represents them gain a competitive advantage in fundraising, partnerships, and grant opportunities.

Transparency isn’t just compliance—it’s credibility.

How Syed Professional Services Supports Form 990 Compliance

At Syed Professional Services, we specialize in tax and accounting solutions tailored for nonprofits. Our approach to Form-990 preparation is thorough, strategic, and personalized.

We work closely with nonprofit leaders to understand operations, governance structures, and financial goals. This allows us to prepare Form-990 filings that are accurate, compliant, and reflective of your organization’s true impact.

From small charities to established nonprofits, our team ensures your Form-990 meets IRS standards while minimizing risk and stress.

Learn more about nonprofit tax compliance directly from the IRS at IRS

Frequently Asked Questions

What happens if a nonprofit does not file Form 990?

Failure to file Form-990 for three consecutive years results in automatic loss of tax-exempt status.

Is Form 990 available to the public?

Yes, Form-990 is a public document accessible online through IRS-approved platforms.

Can Form 990 be amended after filing?

Yes, nonprofits can file an amended Form-990 to correct errors or omissions.

Does Form 990 show executive salaries?

Yes, Form-990 discloses compensation for key officers and executives.

Are small nonprofits required to file Form 990?

Most small nonprofits must file Form-990-N or Form-990-EZ, depending on revenue.

Should a CPA prepare Form 990?

While not required, professional preparation significantly reduces risk and improves accuracy.

Conclusion

Form 990 is more than a regulatory requirement—it’s a powerful document that shapes how your nonprofit is viewed by the IRS, donors, and the public. When handled correctly, Form-990 strengthens trust, supports transparency, and safeguards your tax-exempt status. When mishandled, it creates unnecessary risk and long-term consequences.

At Syed Professional Services, we help nonprofits navigate Form-990 with confidence, clarity, and compliance. If your organization wants peace of mind and professional expertise, partnering with the right tax advisor makes all the difference.