Complete Nonprofit Guide to Form 990N

If you operate a small nonprofit organization, one of your most important annual IRS responsibilities is filing Form 990-N, often referred to as the “e-Postcard.” Many small charities mistakenly overlook 990n filings, but doing so can lead to serious consequences — including automatic loss of tax-exempt status.

This guide explains everything you need to know about 990-N, who must file it, how to file it, common mistakes, deadlines, and how filing protects your organization.

Understanding Form 990N

What Is Form 990N?

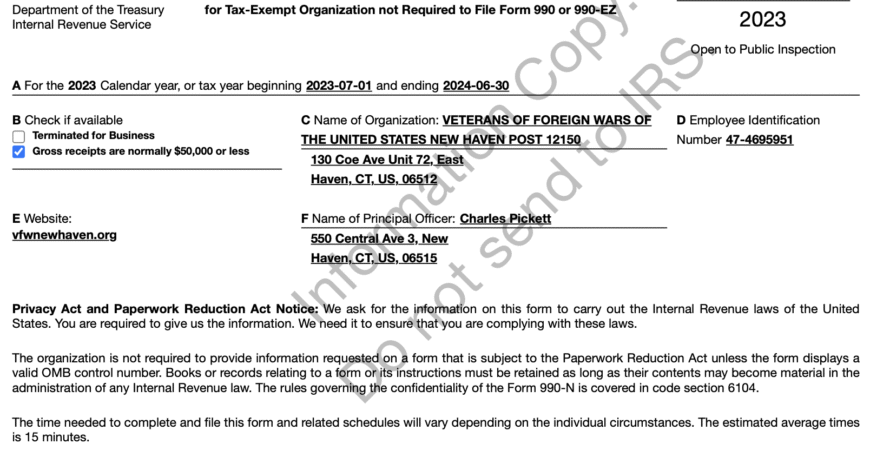

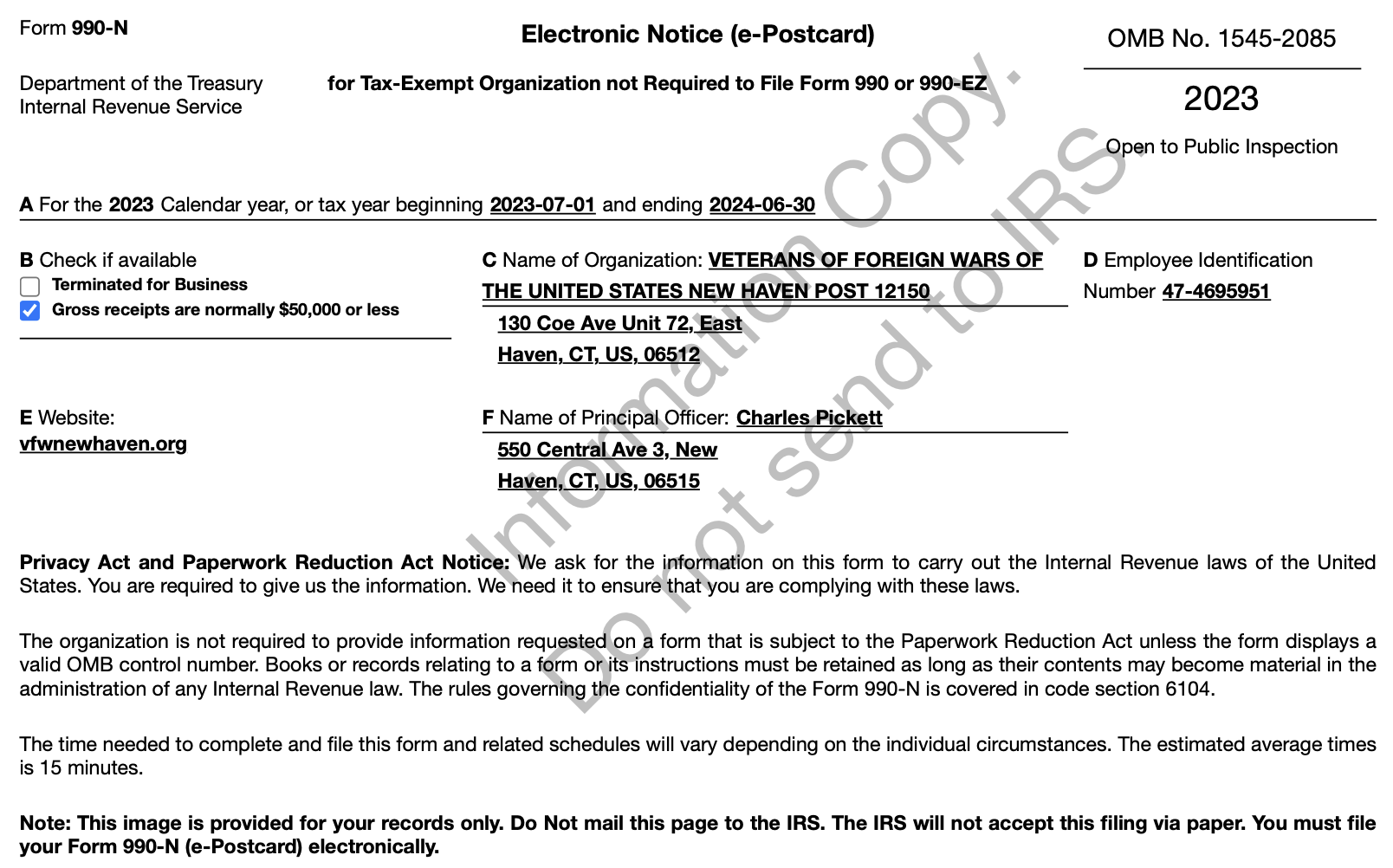

Form 990-N is the simplest annual tax filing required by the IRS for small nonprofit organizations. The 990-n form is only eight fields long and must be filed electronically. It confirms that your organization still exists and remains active.

Even though 990-n requires minimal information, it is still a mandatory filing — skipping it for three consecutive years results in automatic revocation of tax-exempt status.

Why the IRS Requires Form 990-N

The IRS requires 990-n filings to maintain transparency and ensure nonprofit organizations meet federal compliance rules. Even though it’s a short form, filing 990-n each year helps the IRS track active charities and prevent fraudulent registrations.

Who Must File Form 990N

Small Nonprofits with Gross Receipts Under $50,000

Organizations must file 990n if:

-

They are tax-exempt under IRS code 501(c)

-

Their annual gross receipts are $50,000 or less

-

They are not required to file Form 990EZ or full Form 990

If your nonprofit crosses the $50,000 threshold, filing 990-n is no longer appropriate — you’ll need the larger form.

Churches and Religious Organizations

Most churches are exempt from filing any form, but affiliated ministries that are separately incorporated and small enough may need to file 990-n to stay compliant.

How to File Form 990N

H3 — Creating an IRS Online Account

To file 990-n, nonprofits must create an account with the IRS Modernized e-File (MeF) system or the IRS 990-n submission portal. This step is mandatory and ensures your organization’s data stays secure.

Filing Steps for Form 990-N

When you sign in, the 990-n filing process includes:

-

Selecting your organization from the IRS database

-

Confirming your Employer Identification Number (EIN)

-

Entering your tax year

-

Providing the organization’s legal name

-

Confirming your mailing address

-

Providing a website URL (optional)

-

Declaring that your gross receipts are below $50,000

After submitting your 990-n, the IRS instantly confirms receipt.

What Information Do You Need Before Filing

To file 990-n, prepare:

-

EIN

-

Legal nonprofit name

-

Principal officer name

-

Organization address

-

Annual accounting period

Having accurate details helps avoid 990-n rejection.

Filing Deadline for Form 990N

Fiscal Year-Based Deadlines

You must file 990-n by the 15th day of the 5th month after your tax year ends.

For example:

-

If your nonprofit uses a calendar year (ends Dec 31) → 990-n is due May 15.

-

If your fiscal year ends June 30 → 990-n is due November 15.

What Happens If You File Late

Missing one 990-n filing causes no penalty.

Missing three consecutive 990n filings results in automatic revocation of tax-exempt status, meaning:

-

Your organization must reapply

-

You must pay IRS reinstatement fees

-

Donations made during the revoked period may not be deductible

This is why timely 990n filing is critical.

Common Mistakes Nonprofits Make with Form 990N

Using the Wrong Form

Many organizations assume 990n is always correct, but if your receipts exceed $50,000, you must upgrade to Form 990EZ or 990.

Incorrect EIN or Organization Details

Entering the wrong EIN is one of the most common 990n mistakes, which can cause rejection or delays.

Failing to File for Multiple Years

Some nonprofits mistakenly believe 990n isn’t required because they have no financial activity. This misunderstanding leads to multi-year filing gaps and revoked status.

Benefits of Filing Form 990N on Time

Filing 990n annually:

-

Protects your tax-exempt status

-

Ensures donor confidence

-

Keeps IRS records accurate

-

Helps your nonprofit stay compliant

Timely 990n filing also demonstrates strong financial stewardship — something donors and grant providers value.

Difference Between Form 990N, 990EZ, and 990

Financial Threshold Comparisons

| Form | Required When… |

|---|---|

| 990n | Gross receipts under $50,000 |

| 990EZ | Gross receipts between $50,000–$200,000 |

| 990 | Revenue over $200,000 or assets over $500,000 |

As your nonprofit grows, you may eventually transition out of 990-n and into higher-level IRS filings.

When You Must Upgrade from Form 990-N

If your nonprofit receives a large grant or increases revenue:

-

You cannot file 990-n

-

You must file Form 990EZ or 990

How to Reinstate Tax-Exempt Status After Missed 990-N Filings

If your organization fails to file 990-n for three years, you must:

-

Submit IRS Form 1023 or 1023-EZ

-

Pay the IRS user fee

-

File any late 990-n returns

-

Request retroactive reinstatement

Reinstating tax-exempt status can be time-consuming, making annual 990-n filing essential.

Frequently Asked Questions About Form 990-N

1. Who is required to file 990-n?

Nonprofits with gross receipts under $50,000.

2. Can I file 990-n on paper?

No, the IRS only accepts electronic submissions.

3. What happens if my EIN isn’t recognized?

You may need to contact the IRS or check the spelling of your entity name.

4. Can a CPA file 990-n for me?

Yes — a tax professional can complete your annual 990-n filing.

5. Is there a penalty for late filing?

Not immediately, but failing to file three 990-n forms in a row revokes your nonprofit status.

6. Can a nonprofit reactivate after missing 990-n filings?

Yes — through IRS reinstatement procedures.

Conclusion

Filing 990-n is one of the simplest responsibilities for small nonprofits, yet it remains crucial. The 990-n form protects your organization’s tax-exempt status, ensures IRS compliance, boosts donor confidence, and maintains transparency.

Whether you’re just starting your nonprofit or have been operating for years, staying consistent with 990-n filings is key to long-term success.

For more details, you may visit the IRS official website:

➡️ https://www.irs.gov (safe external link)