Introduction: Why the L1A Visa Is a Game-Changer for Global Businesses

The L1A visa is one of the most powerful yet misunderstood U.S. immigration options for multinational businesses. Designed specifically for executives and managers, the L1A visa allows companies to transfer key leadership personnel to the United States while maintaining operations abroad.

For many entrepreneurs, investors, and corporate decision-makers, the L1A visa opens doors that other visa categories simply can’t. Unlike employment-based visas with strict caps, the L1A visa offers flexibility, speed, and a direct path to permanent residency.

At Syed Professional Services, we regularly help clients navigate the legal, tax, and compliance complexities tied to the L1A visa. This guide breaks down everything you need to know—without fluff, without confusion, and without false promises.

L1A Visa Explained: A Strategic Immigration Tool for Executives

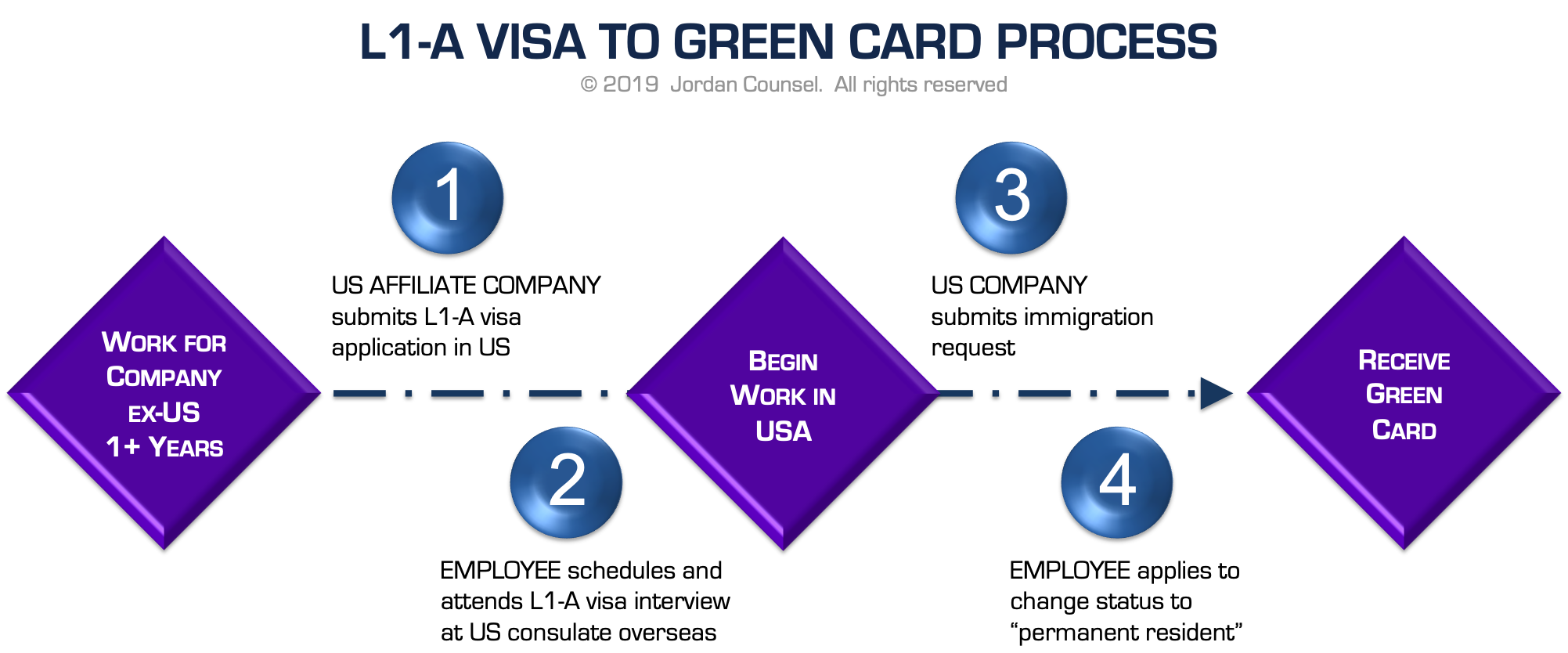

The L1A visa is a non-immigrant visa created for multinational companies seeking to transfer executives or managers to a U.S. office. The employee must have worked for the foreign company for at least one continuous year within the past three years.

What makes the L1A visa so attractive is its business-centric design. It recognizes real leadership, not just technical skills. Executives who qualify under the L1A visa must demonstrate decision-making authority, oversight of departments or teams, and strategic responsibility.

Another major advantage of the L1A visa is that it does not require labor certification, making it faster and more predictable than many alternatives. For companies launching new U.S. offices, the L1A visa can be granted initially for one year, with extensions available.

Unlike many visas, the L1A visa supports dual intent, meaning you can pursue permanent residency without jeopardizing your visa status. This feature alone makes the L1A visa one of the most business-friendly options in U.S. immigration.

Key Eligibility Requirements for the L1A Visa

To qualify for the L1A visa, both the employer and the employee must meet strict eligibility standards enforced by U.S. Citizenship and Immigration Services.

Employer Requirements

-

Must have a qualifying relationship (parent, subsidiary, affiliate, or branch)

-

Must be actively doing business in the U.S. and at least one other country

-

Must demonstrate the ability to support an executive-level role

Employee Requirements

-

Must have worked abroad for one continuous year

-

Must serve in a managerial or executive capacity

-

Must oversee people, functions, or organizational divisions

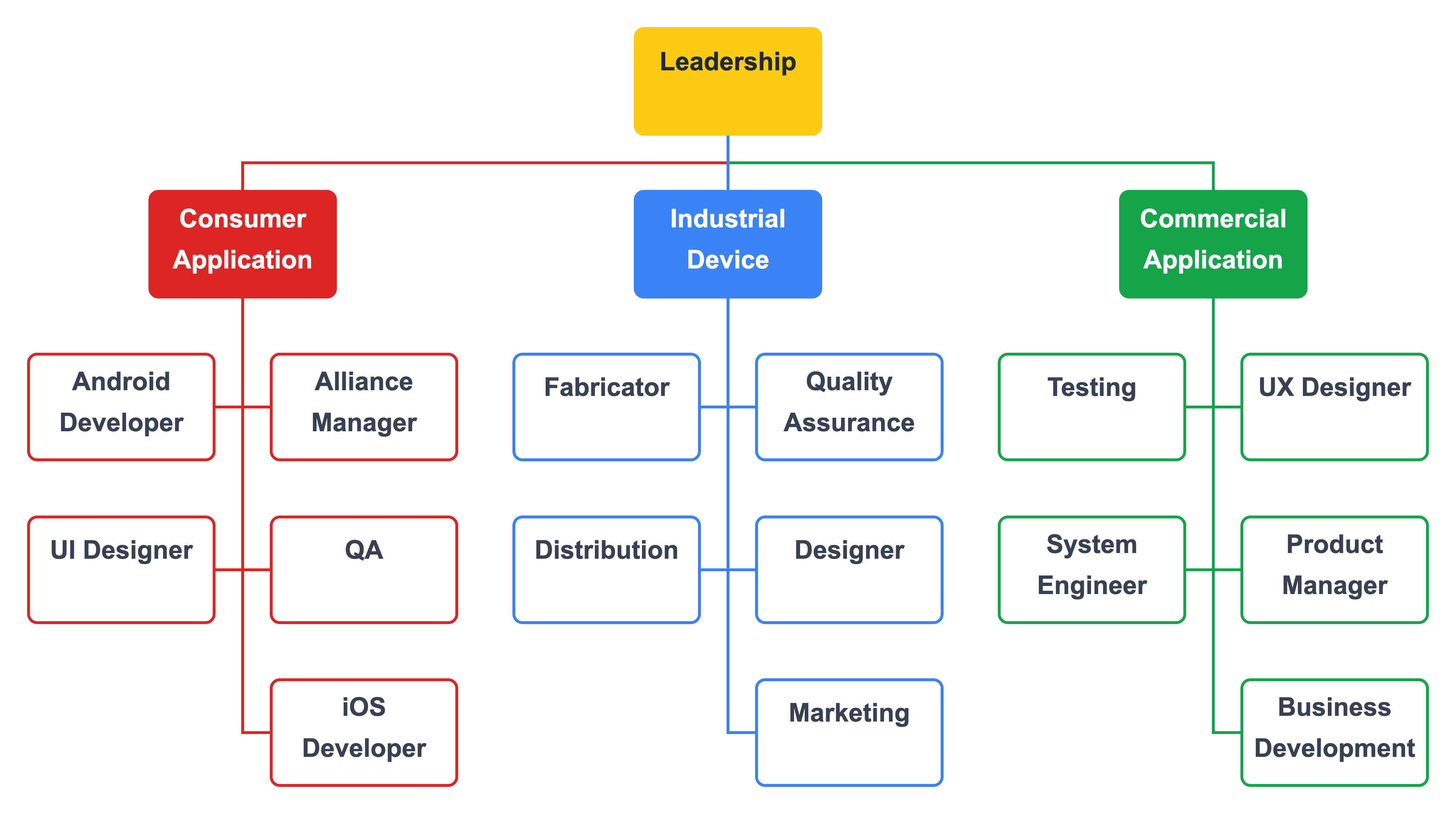

A common reason L1A visa petitions are denied is insufficient documentation proving executive authority. Titles alone are not enough—the role must be clearly supported by organizational charts, payroll records, and operational evidence.

At Syed Professional Services, we ensure every L1A visa petition is structured, documented, and defensible.

Benefits of the L1A Visa That Other Visas Can’t Match

The L1A visa offers a rare combination of speed, flexibility, and long-term opportunity.

Major Advantages

-

No annual cap like H-1B

-

No prevailing wage requirement

-

Faster processing options available

-

Valid for up to 7 years

-

Direct pathway to EB-1C green card

One of the biggest advantages of the L1A-visa is its connection to permanent residency. Executives on an L1A visa often qualify for the EB-1C immigrant category, bypassing lengthy PERM labor certification processes.

For growing companies, the L1A-visa is not just an immigration tool—it’s a strategic growth asset.

Common L1A-Visa Mistakes That Lead to Costly Denials

Despite its advantages, the L1A-visa carries risks when handled improperly.

Frequent Errors Include:

-

Overstating executive responsibilities

-

Weak U.S. business plans

-

Poor organizational structure

-

Inadequate financial documentation

-

Lack of compliance with tax obligations

A denied L1A-visa can delay expansion plans, disrupt operations, and increase scrutiny on future filings. That’s why integrating immigration strategy with accounting and tax planning is essential.

Syed Professional Services uniquely combines immigration support with financial compliance—ensuring your L1A-visa petition is not just approved, but sustainable.

L1A-Visa for New Office vs. Existing Office

The L1A-visa rules differ depending on whether you’re opening a new U.S. office or transferring to an existing one.

| Category | New Office L1A Visa | Existing Office L1A Visa |

|---|---|---|

| Initial Validity | 1 Year | Up to 3 Years |

| Documentation | Extensive | Moderate |

| Business Plan | Required | Optional |

| Extensions | Closely Reviewed | More Predictable |

New office L1A-visa applications require detailed projections, hiring plans, and revenue forecasts. This is where professional accounting and tax insight becomes invaluable.

How Tax & Accounting Impact Your L1A-Visa Approval

Many L1A-visa applicants underestimate the importance of financial credibility. USCIS closely reviews:

-

Payroll records

-

Corporate tax filings

-

Revenue streams

-

Operating expenses

-

Ability to pay executive salary

Weak accounting practices can undermine an otherwise strong L1A-visa case. At Syed Professional Services, we align immigration filings with IRS-compliant financial reporting, dramatically increasing approval confidence.

Frequently Asked Questions About the L1A-Visa

How long does L1A-visa processing take?

Processing usually ranges from 1–6 months. Premium processing can reduce this to 15 days.

Can my family come with me on an L1A-visa?

Yes. Dependents can enter on L-2 visas, and spouses can work legally.

Is the L1A-visa better than the H-1B?

For executives and managers, the L1A-visa is often superior due to no cap and faster green card options.

Can an L1A-visa lead to a green card?

Yes. Many L1A-visa holders qualify for EB-1C permanent residency.

What happens if my L1A-visa is denied?

You may reapply with stronger documentation or explore alternative visa options.

Do I need a lawyer and accountant for an L1A-visa?

Absolutely. Immigration, tax, and accounting issues are deeply interconnected.

Conclusion: Why Professional Guidance Makes All the Difference

The L1A-visa is one of the most powerful tools available for global executives—but only when handled correctly. From eligibility and documentation to tax compliance and long-term planning, every detail matters.

At Syed Professional Services, we bring together immigration insight, accounting precision, and tax expertise under one roof. That integrated approach helps our clients secure approvals, avoid denials, and build lasting success in the United States.

If you’re considering the L1A-visa, don’t leave your future to chance. Strategic planning today prevents costly mistakes tomorrow.