7 Powerful Reasons the SS4 Form Can Make or Break Your Business

Starting a business comes with a long list of forms, filings, and acronyms. But few are as misunderstood — yet vital — as the SS4 form. Whether you’re launching a new business, hiring employees, or applying for a business bank account, the SS4 form is more than just paperwork. It’s your ticket to obtaining an Employer Identification Number (EIN), and without it, you’re flying blind in the eyes of the IRS.

In this detailed guide from Syed Professional Services, we’ll explore what the SS4 form is, who needs it, how to file it, and why it’s so important for tax, immigration, and business compliance. We’ll also cover 7 powerful reasons why getting it right is critical — and how mistakes can lead to serious consequences.

Let’s dive in and decode the secrets behind the SS4 form — your key to building a compliant and successful business foundation.

What is the SS4 Form?

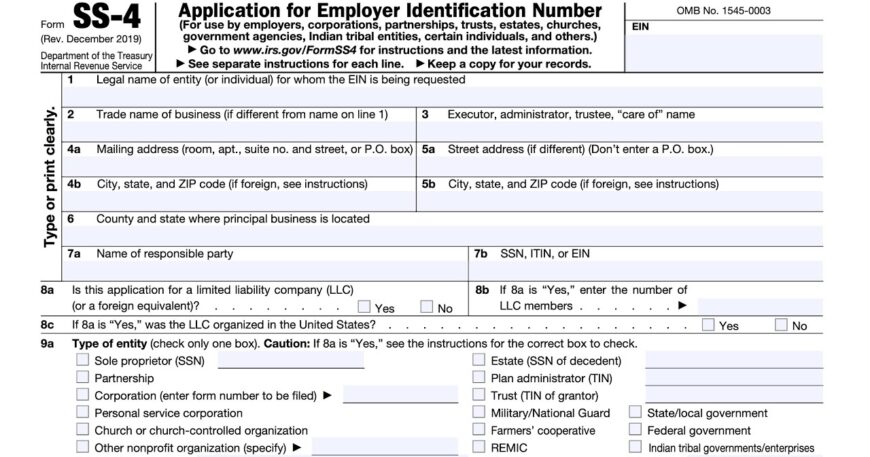

The SS4 form is an official IRS document titled “Application for Employer Identification Number (EIN)”. The EIN — often called a Federal Tax ID — is like a Social Security Number for your business. It identifies your company with the IRS and is used for tax filing, hiring employees, banking, and more.

The SS4 form is used by:

-

Sole proprietors

-

Partnerships

-

Corporations

-

LLCs

-

Nonprofits

-

Trusts and estates

-

Government agencies

-

International entities doing business in the U.S.

The process seems simple, but filling out the SS4 form incorrectly can delay business operations or even result in fines. That’s why understanding it fully is critical.

How the SS4 Form Works

Filing the SS4 form requires specific business information, including:

-

Legal name of the entity or individual

-

Trade name (if applicable)

-

Business address

-

Type of entity (LLC, partnership, etc.)

-

Reason for applying

-

Expected number of employees

-

Date business started or was acquired

Once completed, the SS4 form can be submitted:

-

Online through the IRS EIN Assistant (fastest option)

-

By fax (response in ~4 business days)

-

By mail (response in ~4 weeks)

-

By phone for international applicants only

Once approved, the IRS issues your EIN, which is used for taxes, banking, and hiring employees.

Why the SS4 Form Matters More Than You Think

Now let’s get to the heart of the matter. These 7 powerful reasons explain why the SS4 form can make or break your business success — and how to stay on the right side of the law.

You Can’t Pay Employees Without an EIN

One of the most common reasons to file an SS4 form is hiring staff. The IRS requires all employers to have an EIN for:

-

Payroll reporting

-

Federal and state tax withholding

-

Issuing W-2s and 1099s

If you plan to grow, hire staff, or outsource work, filing your SS4 form early is essential. Delaying this step can result in hiring delays, IRS penalties, and worker misclassification issues.

Banks Won’t Open Business Accounts Without It

Most banks require an EIN before opening a business bank account. Why? It proves that your business is recognized by the IRS and legally separate from your personal finances.

Filing the SS4 form helps:

-

Establish business credit

-

Accept payments under your business name

-

Apply for loans and credit cards

Failure to obtain an EIN can make your business seem untrustworthy — and can even trigger fraud alerts when applying for accounts.

It’s Required for Business Licenses and Permits

Many states and cities require proof of an EIN before issuing local business licenses. By submitting your SS4 form early, you avoid delays when registering your:

-

Sales tax license

-

Health department permit

-

Home occupation license

No SS4 form? You may not be able to legally operate your business in your jurisdiction.

The SS4 Form Proves Business Legitimacy for Immigration and Tax Filings

If you’re a non-U.S. resident starting a business in the United States, filing the SS4 form is your first step toward compliance.

At Syed Professional Services, we’ve helped many immigrants and non-citizens use the SS4 form to:

-

Launch U.S. LLCs or corporations

-

Comply with IRS non-resident filing requirements

-

Build a strong financial and legal foundation

Filing the SS4 form properly is especially critical for international business owners who need to prove legitimacy in visa or residency applications.

Errors on the SS4 Form Can Delay IRS Approvals

Submitting the wrong information — or even making a typo — on the SS4 form can lead to weeks of delays or incorrect EIN issuance.

Common mistakes include:

-

Using incorrect entity types

-

Mixing personal and business addresses

-

Leaving fields blank or incomplete

-

Not clearly stating the reason for applying

To avoid these issues, use a tax or legal professional to review your SS4 form before submitting it.

IRS Audits Often Start with EIN Misuse

If you file taxes using the wrong EIN or fail to update the IRS about changes in your business, you could trigger an audit. The SS4 form is not a “set it and forget it” document — your EIN must always match your current business structure and ownership.

Examples of red flags:

-

Using your personal SSN for business taxes

-

Reporting employee wages without a valid EIN

-

Changing your business structure (e.g., from sole proprietor to LLC) but not notifying the IRS

Proper use and updates of your SS4 form and EIN records protect your business from compliance issues.

The SS4 Form Builds a Foundation for Long-Term Growth

More than just a form, the SS4 form sets the stage for your business journey. With an EIN, you can:

-

Apply for government contracts

-

Build business credit history

-

Join wholesale or supplier programs

-

Expand to new states or markets

Without it, you’ll constantly hit barriers and face limitations in how your business can grow.

Filing the SS4 Form Online vs. Offline

Let’s break down the pros and cons of the different submission methods for the SS4 form:

| Method | Processing Time | Best For | Notes |

|---|---|---|---|

| Online | Immediate | Most U.S.-based businesses | Only during IRS business hours |

| Fax | 4-5 business days | Entities with special situations | Use cover sheet and signed form |

| 4 weeks | Non-urgent filings | High chance of delay | |

| Phone | For international filers only | Foreign business owners | Must call IRS Business & Specialty Tax Line |

When Should You File the SS4 Form?

Don’t wait until tax time. File your SS4 form when:

-

Starting a new business

-

Hiring employees

-

Opening a bank account

-

Applying for licenses or permits

-

Changing your business structure

The sooner you have your EIN, the more prepared you’ll be to operate legally and efficiently.

How Syed Professional Services Can Help

At Syed Professional Services, we specialize in helping individuals, immigrants, and business owners file the SS4 form correctly and quickly. Whether you’re:

-

A startup founder

-

An international entrepreneur

-

A freelancer hiring your first team

-

A tax client needing IRS compliance

…we’re here to guide you through the process.

Our experts will:

-

Prepare and review your SS4-form

-

Submit it on your behalf

-

Help you understand EIN use for taxes, banking, and more

-

Avoid the costly errors we see every day

Get professional help today — your business deserves a clean start.

Contact Us Now to file your SS4-form the right way.

Frequently Asked Questions

What is the SS4-form used for?

The SS4-form is used to apply for an Employer Identification Number (EIN) from the IRS, required for taxes, hiring, banking, and more.

Can individuals file an SS4-form?

Yes. Sole proprietors, freelancers, and non-residents can all file the SS4-form if they need an EIN.

Is it better to file the SS4-form online or by mail?

Filing online is fastest. Mailing it can take weeks, while online processing is usually immediate.

Do immigrants need an SS4-form?

Yes, if they’re starting a U.S.-based business. The SS4-form helps obtain an EIN even without a Social Security Number.

Can I file an SS4-form without an SSN?

Yes. Foreign nationals can apply using specific instructions — it’s best to get help from a professional to ensure accuracy.

How long does it take to get an EIN?

Online: instantly. Fax: 4 business days. Mail: 4 weeks. International: varies depending on call volume.

Conclusion

The SS4-form may seem like just another piece of government paperwork, but it plays a critical role in your business journey. From hiring employees and opening bank accounts to proving your legitimacy with the IRS — filing the SS4-form correctly is non-negotiable.

At Syed Professional Services, we help clients like you get it done right, fast, and with zero stress. Don’t leave your business success up to chance — let’s file your SS4-form together.