Introduction

If you are a taxpayer with significant investment income, understanding IRS Form 8960 is crucial. This form is used to calculate the Net Investment Income Tax (NIIT), a tax on income derived from investments. In this blog post, we’ll explore the purpose of IRS 8960, who needs to file it, and how it can impact your overall tax situation. Whether you’re an individual investor or a business owner, understanding how IRS 8960 works is an important step toward effective tax planning.

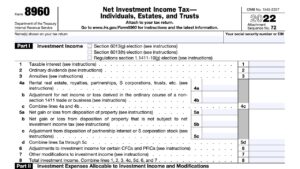

What is IRS Form 8960?

IRS Form 8960 is a tax form used to calculate the Net Investment Income Tax (NIIT). The NIIT was introduced as part of the Affordable Care Act (ACA) and applies to individuals, estates, and trusts that have income from investments. This tax is imposed on net investment income, which includes income from interest, dividends, capital gains, rental income, and certain other sources.

The IRS Form 8960 is required for anyone whose modified adjusted gross income (MAGI) exceeds a certain threshold. The form helps determine whether or not an individual or business is subject to the additional 3.8% tax on net investment income.

Who Needs to File IRS Form 8960?

Not everyone needs to file Form 8960. The IRS requires the form only if your net investment income exceeds certain income thresholds.

-

For individuals, the NIIT applies if your modified adjusted gross income (MAGI) is above $200,000 for single filers or $250,000 for married couples filing jointly.

-

Trusts and estates are required to file IRS 8960 if they have income above a set threshold, which varies depending on the type of income.

If your income exceeds these thresholds and you have net investment income, you may owe the additional 3.8% tax, which is calculated using IRS Form 8960.

What is Net Investment Income?

Net investment income is a broad category of income that is subject to the 3.8% tax. It includes the following sources of income:

-

Interest – From bonds, savings accounts, and other interest-bearing assets.

-

Dividends – From stocks and mutual funds.

-

Capital Gains – From the sale of stocks, real estate, or other investment properties.

-

Rental Income – If you rent property that generates income.

-

Royalty Income – From intellectual property or other similar assets.

-

Annuities – Income received from annuity contracts.

Certain types of income, like wages, retirement plan distributions, and Social Security benefits, are not subject to the Net Investment Income Tax (NIIT). It is important to distinguish between income subject to the tax and income that is exempt.

How to Calculate Net Investment Income Tax with IRS Form 8960

To calculate the Net Investment Income Tax on Form 8960, you need to follow a series of steps:

-

Determine Your Modified Adjusted Gross Income (MAGI):

The IRS defines MAGI as your gross income with specific adjustments, such as deducting contributions to retirement accounts. This is the first step in determining whether you meet the income threshold for the NIIT. -

Calculate Your Net Investment Income:

Once you determine your MAGI, you need to calculate your net investment income. This involves adding up all sources of income that are considered “net investment income” and subtracting any allowable deductions, such as investment-related expenses. -

Compare MAGI and Net Investment Income Against the Threshold:

The next step is to compare your MAGI to the IRS threshold of $200,000 (for single filers) or $250,000 (for married couples filing jointly). If your MAGI is above the threshold and you have net investment income, the 3.8% NIIT applies. -

Apply the NIIT Rate:

The 3.8% NIIT is applied to the lesser of your net investment income or the amount by which your MAGI exceeds the income threshold. The IRS Form 8960 helps you calculate this precisely. -

File the Form:

If you meet the requirements for IRS Form 8960, you must include it with your annual tax return. The IRS provides instructions on how to complete the form and calculate the exact amount of tax owed.

Common Mistakes to Avoid When Filing IRS Form 8960

While filing Form 8960 might seem straightforward, many taxpayers make errors that could cost them money or lead to penalties. Here are some common mistakes to avoid:

-

Failing to Include All Sources of Net Investment Income: Ensure that you account for all sources of investment income, such as rental income, dividends, and capital gains.

-

Incorrectly Reporting MAGI: It’s essential to correctly calculate your MAGI, as errors could lead to underreporting or overreporting your liability.

-

Not Filing When Required: If your income exceeds the threshold and you have investment income, you must file IRS Form 8960, even if your income is primarily from wages or self-employment.

-

Not Planning for the Impact of NIIT: The 3.8% tax can be significant, so understanding how it applies to your income is crucial for tax planning. Failing to plan for this additional tax could result in unexpected liability at tax time.

How to Minimize Your Net Investment Income Tax

There are strategies to minimize the impact of the Net Investment Income Tax (NIIT). While the tax is imposed on investment income, some strategies can help reduce or eliminate its effect:

-

Tax-Deferred Investment Accounts: Contributing to tax-advantaged retirement accounts, such as a 401(k) or IRA, can reduce your MAGI, potentially lowering your tax liability.

-

Capital Losses: If you have investment losses, you can offset your net investment income by selling underperforming assets to generate capital losses. This is known as tax-loss harvesting and can help lower the tax burden on your investment income.

-

Municipal Bonds: Income from municipal bonds is often exempt from the Net Investment Income Tax. Consider investing in these bonds if you are concerned about NIIT.

-

Tax-Efficient Funds: Investing in tax-efficient mutual funds or exchange-traded funds (ETFs) can help minimize taxable income, potentially reducing the impact of NIIT.

-

Strategic Timing of Income and Deductions: Plan your income and deductions strategically to stay below the NIIT thresholds, if possible. This could involve timing capital gains or charitable contributions to reduce your MAGI in a particular year.

Conclusion

IRS Form 8960 plays a vital role in determining whether you are subject to the Net Investment Income Tax (NIIT), which could impact individuals with significant investment income. Understanding how to calculate and minimize this tax is crucial for proper tax planning.

If you’re uncertain about how Form 8960 applies to your tax situation or need assistance with the filing process, Syed Professional Services can help. Our expert tax professionals specialize in tax compliance and planning, ensuring you stay informed and minimize any unnecessary tax liabilities.

Contact Syed Professional Services today for expert advice on IRS Form 8960 and how it affects your tax situation.