Introduction to Foreign Income Exclusion: What You Need to Know

As an expatriate or someone earning income outside the United States, understanding the foreign income exclusion is essential to minimize your tax liabilities. The foreign income exclusion allows U.S. citizens and resident aliens to exclude a significant portion of their foreign-earned income from federal income taxes. But how does it work? What are the requirements, and how can you benefit from it? In this guide, we will break down everything you need to know about the foreign income exclusion, from eligibility criteria to maximizing the benefits.

What is Foreign Income Exclusion?

The foreign income exclusion is a tax benefit offered by the Internal Revenue Service (IRS) that permits U.S. citizens and resident aliens working abroad to exclude a portion of their foreign-earned income from U.S. taxation. For the tax year 2025, the foreign income exclusion allows individuals to exclude up to $120,000 of their foreign-earned income. This exclusion helps to prevent double taxation, where you might be taxed by both the U.S. and the foreign country on the same income.

Positive Impact of the Foreign Income Exclusion

For U.S. citizens or residents working abroad, the foreign income exclusion is a fantastic tool for reducing your overall tax burden. By excluding a portion of your foreign income, you can significantly reduce the amount of taxable income you report to the IRS, which leads to a lower tax bill. This benefit is particularly valuable for individuals who live in countries with high income tax rates, as it prevents you from being taxed twice on the same income.

Here’s how the foreign income exclusion can benefit you:

-

Lower Tax Liability: By excluding a portion of your foreign-earned income, you reduce the amount subject to U.S. federal income tax.

-

Simplicity: The foreign income exclusion simplifies your tax filing process by reducing the income subject to U.S. taxes.

-

Double Taxation Relief: If you are living in a country that taxes your income, the foreign income exclusion ensures you are not taxed twice on the same income.

Eligibility for Foreign Income Exclusion

Not everyone is eligible to claim the foreign income exclusion, and it’s crucial to understand the requirements to ensure you qualify. The key factors for eligibility are your tax home and the physical presence or bona fide residence test.

Tax Home Requirement

To claim the foreign income exclusion, you must have a tax home in a foreign country. Your tax home is generally the place where you regularly live and work. This could be a foreign country where you have established residency or a place where you are working temporarily for an extended period.

Physical Presence Test

To meet the foreign income exclusion requirements, you must also pass the physical presence test. This test requires that you live in a foreign country or countries for at least 330 full days during a 12-month period. This does not have to be a consecutive 12-month period, but the days spent in the foreign country must total at least 330 days.

Bona Fide Residence Test

Alternatively, you can qualify for the foreign income exclusion if you are a bona fide resident of a foreign country. This means you must establish residency in a foreign country with no intention of returning to the U.S. anytime soon. This test is more flexible than the physical presence test but requires clear evidence that you are living in the foreign country with the intention of making it your permanent home.

How to Claim the Foreign Income Exclusion

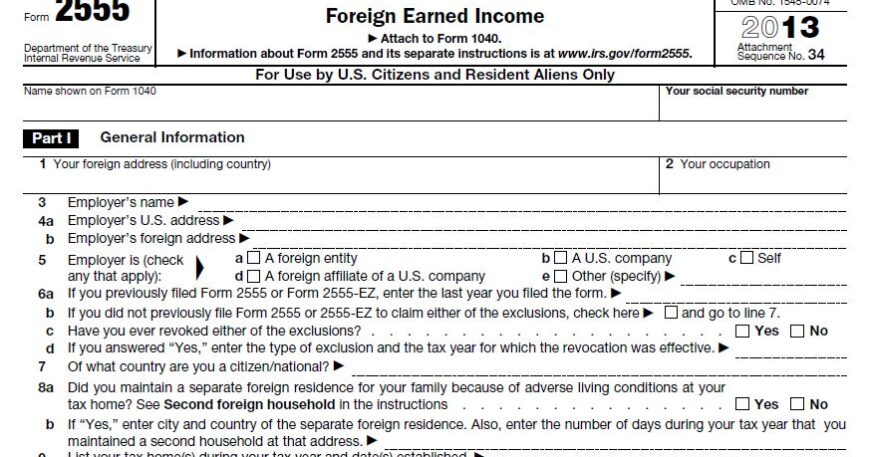

To claim the foreign income exclusion, you will need to file IRS Form 2555 (Foreign Earned Income). This form requires detailed information about your income, the country where you are living and working, and your physical presence or residency status.

Steps to Claim the Foreign Income Exclusion:

-

File IRS Form 2555: This is the primary form used to claim the foreign income exclusion.

-

Provide Documentation: You will need to submit evidence that you meet the eligibility requirements, such as proof of residency or time spent in a foreign country.

-

Report Your Foreign Earned Income: In the form, you will report the income you earned while working abroad. Only income earned while living and working outside the U.S. is eligible for exclusion.

Limitations of the Foreign Income Exclusion

While the foreign income exclusion offers significant benefits, there are a few limitations to keep in mind.

-

Exclusion Cap: For 2025, the exclusion limit is $120,000. Any income earned beyond this amount is subject to regular U.S. taxation.

-

Foreign Housing Exclusion: In addition to the foreign income exclusion, you may also be eligible for a foreign housing exclusion. This helps cover the cost of housing in a foreign country, but it is also subject to limitations based on location and other factors.

-

No Double Dipping: You cannot use the foreign income exclusion for income that has already been excluded under other IRS provisions, such as the foreign tax credit.

Foreign Income Exclusion vs. Foreign Tax Credit: Which is Better?

Many people wonder whether it’s better to claim the foreign-income exclusion or the foreign tax credit. Both are excellent ways to reduce your tax burden, but they work differently.

-

Foreign-Income Exclusion: This allows you to exclude up to $120,000 (for 2025) of foreign-earned income from U.S. taxes.

-

Foreign Tax Credit: This allows you to claim a credit for taxes paid to a foreign government, potentially reducing your U.S. tax liability dollar-for-dollar.

Choosing Between the Two:

The foreign-income exclusion is beneficial if you have foreign-earned income below the exclusion limit, and you want to completely exclude that income from U.S. taxation. However, if you are paying high foreign taxes, the foreign tax credit might be more advantageous since it can reduce your U.S. tax liability dollar-for-dollar.

Common Pitfalls to Avoid When Claiming the Foreign-Income Exclusion

-

Not Meeting the Residency Requirement: The most common mistake is not meeting the residency or physical presence test. Make sure you track your time spent abroad carefully and meet the minimum required days.

-

Failing to File on Time: You must file your taxes by the deadline to claim the foreign-income exclusion. Failing to do so may result in penalties or the loss of the exclusion.

-

Incorrectly Reporting Your Income: Ensure that all foreign income is correctly reported on your tax forms. The IRS has strict reporting requirements, and mistakes can lead to audits or penalties.

Negative Aspects of Foreign-Income Exclusion

While the foreign-income exclusion offers many benefits, it does not come without its drawbacks. These potential negatives include:

-

Complex Filing Requirements: Filing for the foreign-income exclusion can be complicated, especially when you are dealing with multiple sources of income or foreign tax systems.

-

Limited to U.S. Citizens and Residents: The exclusion does not apply to non-U.S. citizens, so foreign nationals working in the U.S. are not eligible.

-

Income Beyond the Cap: If you earn more than the exclusion limit, the excess income will still be subject to U.S. taxes, making it less beneficial for higher earners.

Conclusion

The foreign-income exclusion is a valuable tax benefit for U.S. citizens and resident aliens who live and work abroad. By excluding a portion of your foreign-earned income, you can reduce your tax liability and avoid double taxation. However, understanding the requirements and limitations of the exclusion is crucial to maximize its benefits. If you are considering applying for the foreign-income exclusion, make sure to consult with a tax professional who can guide you through the process and help ensure you are meeting all necessary requirements.

At Syed Professional Services, we specialize in providing expert tax and immigration advice to help expatriates maximize their tax savings. Contact us today for a consultation to ensure you are getting the most out of your foreign-income exclusion and other tax benefits.