LLC vs S Corp: Which Structure is Right for Your Business?

When you’re starting a business, one of the most important decisions you’ll make is choosing the right legal structure. Two of the most popular options are LLC (Limited Liability Company) and S Corp (S Corporation). But how do you decide between the two? Which one will help you save the most on taxes, offer the best liability protection, and fit your business needs?

In this blog post, we will provide a detailed comparison of LLC vs S Corp, helping you understand the advantages and disadvantages of each structure. By the end of this article, you’ll be well-equipped to make an informed decision about the right business structure for your company.

What is an LLC?

An LLC, or Limited Liability Company, is a business structure that provides its owners with limited liability protection, meaning the personal assets of the owners are separate from the business’s liabilities. LLCs are flexible and can be taxed as a sole proprietorship, partnership, or corporation. This flexibility makes the LLC a popular choice for small businesses and startups.

The LLC structure offers several key benefits, including:

-

Limited Liability Protection: Owners (also known as members) are generally not personally responsible for the debts and liabilities of the business.

-

Flexible Management Structure: LLCs can be managed by the members (owners) or by appointed managers, allowing for greater flexibility.

-

Pass-Through Taxation: By default, LLCs enjoy pass-through taxation, meaning that the business’s profits and losses are passed through to the members’ personal tax returns, avoiding double taxation.

-

Fewer Compliance Requirements: LLCs have fewer formalities and compliance requirements compared to corporations, making them easier and more affordable to maintain.

What is an S Corp?

An S Corp, or S Corporation, is a tax designation that a corporation or LLC can elect to have. This designation allows the business to avoid double taxation, which is a key benefit. Unlike a traditional corporation, an S Corp is not taxed at the corporate level. Instead, income, losses, deductions, and credits are passed through to shareholders, who report them on their individual tax returns.

Some advantages of choosing an S Corp include:

-

Pass-Through Taxation: Similar to an LLC, an S Corp is a pass-through entity, so income and losses are reported on the shareholders’ personal tax returns.

-

Tax Savings on Self-Employment Taxes: One of the most significant benefits of an S Corp is the potential to save on self-employment taxes. Unlike LLC members, S Corp owners who are also employees can take a reasonable salary and avoid paying self-employment taxes on the business’s profits beyond that salary.

-

Liability Protection: Like an LLC, an S Corp provides limited liability protection, keeping the shareholders’ personal assets safe from business liabilities.

However, there are some limitations and requirements for an S Corp that may not make it suitable for every business:

-

Eligibility Requirements: An S Corp must meet specific eligibility requirements, such as having fewer than 100 shareholders and only allowing U.S. citizens or residents as shareholders.

-

Strict Formalities: S Corps are subject to more formalities and regulations than LLCs, including regular meetings and keeping detailed minutes.

-

Limited Ownership Options: S Corps cannot have corporate shareholders or other S Corps as shareholders, which can limit growth potential for certain businesses.

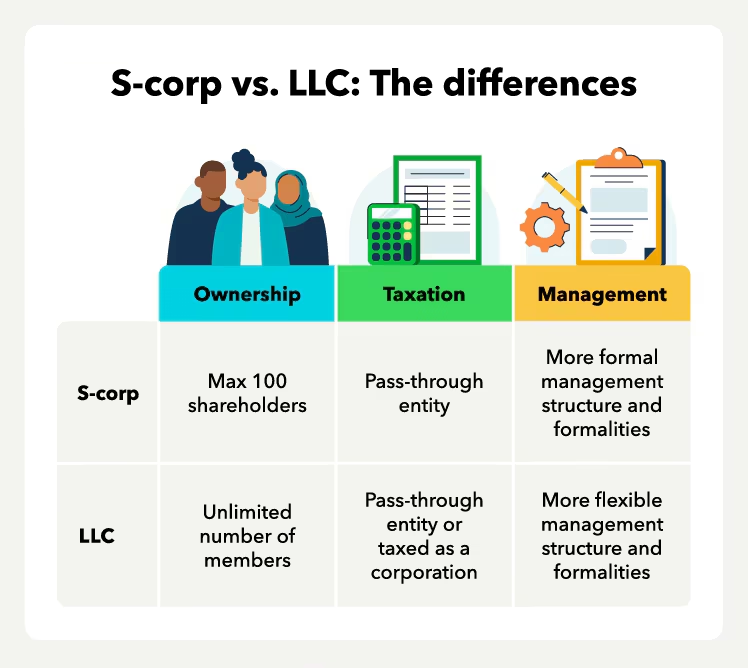

LLC vs S Corp: Key Differences

Now that we’ve covered the basics of both LLCs and S Corps, let’s dive deeper into the key differences between the two structures. These differences can help you determine whether LLC vs S Corp is the right comparison for your business.

1. Taxation

One of the most significant differences between LLC vs S Corp is how they are taxed.

-

LLC Taxation: By default, an LLC is taxed as a pass-through entity, meaning the LLC’s profits and losses are reported on the individual tax returns of the members. LLC members also pay self-employment taxes (Social Security and Medicare) on the entire income from the business.

-

S Corp Taxation: An S Corp, on the other hand, is also a pass-through entity for tax purposes, but there is a crucial distinction. S Corp owners who actively work in the business are required to pay themselves a reasonable salary. This salary is subject to payroll taxes (Social Security and Medicare), but any profits beyond the salary are not subject to self-employment taxes. This can result in significant tax savings.

2. Liability Protection

Both LLC vs S Corp offer limited liability protection, meaning that the personal assets of the business owners are generally protected from business debts and liabilities. However, the extent of this protection depends on how the business is managed and the legal steps taken to maintain its corporate status. In general, both structures provide similar protection, but an S Corp may have more legal formalities to ensure this protection.

3. Management Structure

-

LLC Management: LLCs have a flexible management structure, and members can choose to run the business themselves or appoint managers. This allows LLCs to be more adaptable to the needs of the business.

-

S Corp Management: S Corps are more rigid in their management structure. An S Corp is required to have a board of directors, officers, and shareholders, and there are stricter rules about how decisions are made and how meetings are conducted.

4. Ownership and Shareholder Restrictions

-

LLC Ownership: An LLC can have an unlimited number of owners (members), and these members can be individuals, other LLCs, corporations, or foreign entities. This makes an LLC more flexible in terms of ownership.

-

S Corp Ownership: An S Corp has more limitations on ownership. It can have no more than 100 shareholders, and all shareholders must be U.S. citizens or residents. Additionally, an S Corp cannot have corporate shareholders, and all shareholders must agree to the S Corp status.

5. Cost and Complexity

-

LLC Costs: LLCs tend to be easier and less expensive to form and maintain. They have fewer ongoing requirements and are not subject to the same level of scrutiny as S Corps.

-

S Corp Costs: The process of electing S Corp status is more complex, and the S Corp requires more formalities, including annual meetings and record-keeping. This can lead to higher administrative costs and the need for professional help.

LLC vs S Corp: Which is Right for Your Business?

The decision between LLC vs S Corp depends largely on the specific needs of your business, your long-term goals, and your financial situation. Here are some factors to consider:

-

If you are looking for simplicity and flexibility, an LLC might be the better option for you. It provides limited liability protection, pass-through taxation, and is easier to maintain.

-

If tax savings are a priority and your business is profitable, an S Corp might offer greater tax benefits due to the ability to pay a reasonable salary and avoid self-employment taxes on business profits.

-

If you plan to have multiple owners or investors, an LLC might be more suitable since it allows for more flexible ownership structures.

-

If you plan to grow and issue stock, an S Corp might be beneficial, but it comes with more restrictions on ownership and shareholders.

Conclusion: LLC vs S Corp – Making the Right Choice

Choosing between LLC vs S Corp is an important decision for any business owner. Both structures have their own advantages and disadvantages, and what works for one business may not be the best choice for another. Whether you’re looking for tax advantages, liability protection, or flexibility, understanding the differences between LLC vs S Corp will help you make an informed decision.

If you’re still unsure about which business structure is best for you, don’t hesitate to reach out to us at Syed Professional Services. Our experienced team of tax, accounting, and immigration professionals can help you evaluate your options and guide you through the process of setting up the right structure for your business.