Introduction

The IRS (Internal Revenue Service) plays a vital role in the tax system of the United States. Whether you’re an individual or a business owner, understanding how IRS payments work is crucial for staying compliant and avoiding unnecessary penalties. If you are struggling with tax payments or simply want to understand the process better, you’ve come to the right place. In this comprehensive guide, we will break down everything you need to know about IRS payments, from basic concepts to more advanced payment strategies. By the end, you will have the confidence to manage your tax obligations effectively and avoid common pitfalls.

Understanding IRS Payments: What Are They?

IRS payments are simply the payments made by taxpayers to the Internal Revenue Service to settle their tax liabilities. These payments are a legal obligation for individuals and businesses who earn income, and failing to make timely payments can result in penalties, interest, or even legal action. The IRS offers several ways to make payments, depending on the amount due, your financial situation, and whether you prefer online, by mail, or over the phone methods.

When you file your taxes, you calculate the amount you owe to the IRS. This could include federal income taxes, self-employment taxes, payroll taxes, and other obligations. IRS payments are how you settle these amounts, either in full or over a period of time.

Why Are IRS Payments Important?

The importance of IRS payments cannot be overstated. The U.S. tax system is based on self-assessment, which means it’s up to individuals and businesses to report their income and determine how much they owe. If you fail to make your IRS payment on time or in full, you risk being hit with penalties and interest, which can add up quickly and cause your financial burden to increase exponentially.

Additionally, not making your IRS payment can lead to other serious consequences, such as:

-

Garnishments: The IRS can garnish your wages or bank accounts to recover owed taxes.

-

Tax Liens: The IRS may file a lien against your property, reducing your credit score and making it harder to borrow money.

-

Tax Levies: In severe cases, the IRS may seize your property to satisfy your unpaid tax debt.

To avoid these consequences, it is important to understand the various options available for making your IRS payments.

Types of IRS Payments

There are multiple methods for making IRS payments. Depending on your situation, you may find one method more convenient or suitable than another. Below are some of the common ways to make IRS payments:

-

Online Payments

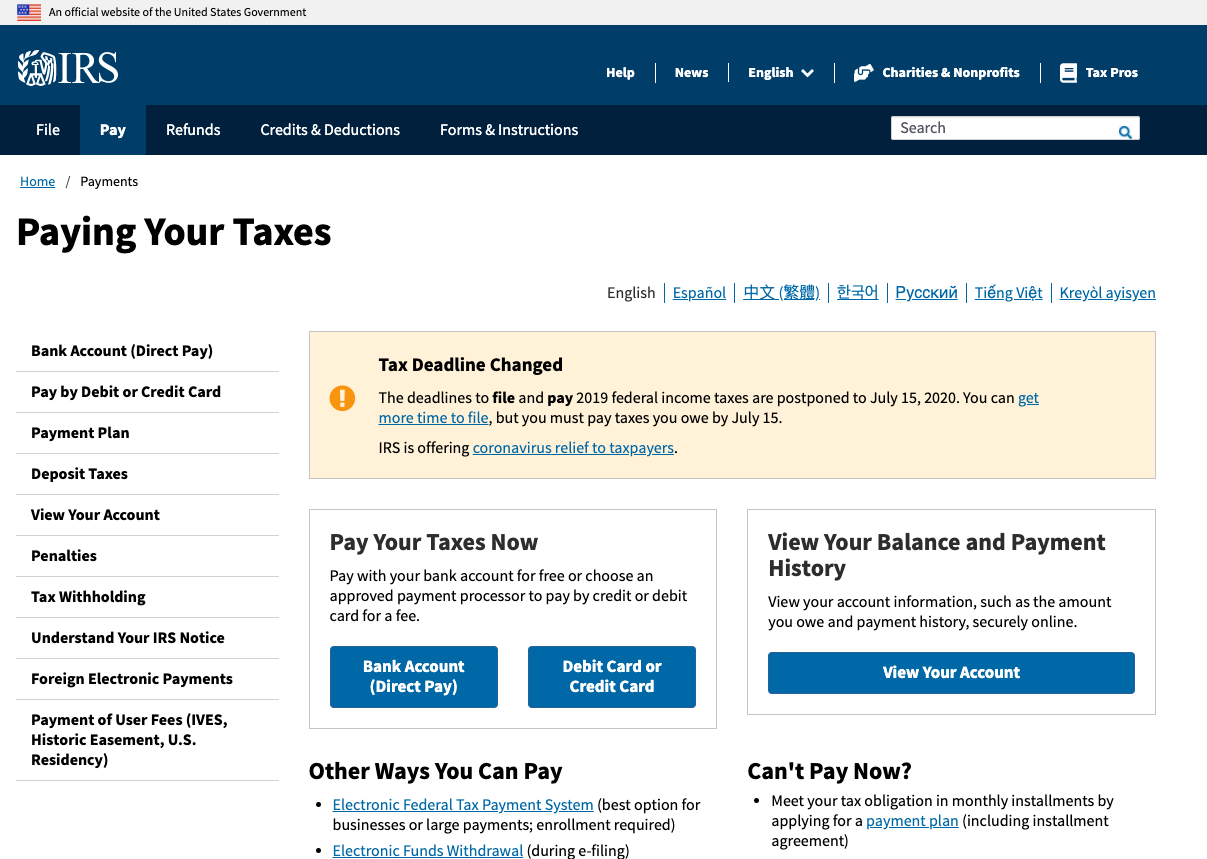

One of the easiest ways to make IRS payments is through the IRS website. The IRS allows taxpayers to make payments through several online portals, including:-

Direct Pay: This allows you to pay directly from your bank account without needing to create an account. It’s fast and secure.

-

Debit or Credit Card: The IRS accepts payments through third-party processors via debit or credit cards. However, be aware of processing fees that apply.

-

Electronic Federal Tax Payment System (EFTPS): This system is ideal for businesses and individuals who make regular payments. It allows you to schedule payments in advance and track your payment history.

-

-

Mail Payments

If you prefer, you can send your IRS payment by mail. You will need to include a payment voucher along with your check or money order made out to the “United States Treasury.” Be sure to send your payment to the correct IRS address based on your location and the form you are filing. -

Installment Agreements

If you’re unable to pay your tax debt in full, the IRS offers installment agreements. An installment agreement allows you to pay off your taxes in smaller, more manageable payments over time. This can help alleviate the stress of paying a large lump sum upfront and keep you in good standing with the IRS. -

Other Payment Plans

-

Offer in Compromise: If you can’t afford to pay your tax liability in full, you may qualify for an Offer in Compromise (OIC), where the IRS agrees to accept less than what you owe. However, this is a lengthy process and requires careful documentation.

-

Currently Not Collectible: If you’re facing severe financial hardship, you may qualify for the IRS to temporarily suspend collection actions.

-

Common Mistakes to Avoid When Making IRS Payments

It’s easy to make mistakes when dealing with IRS payments, especially if you’re not familiar with the process. Here are some common errors taxpayers often make when making IRS payments:

-

Missing Deadlines: Failing to make your payment by the due date can result in penalties and interest. If you’re unable to pay by the deadline, make sure you set up an installment agreement before the due date.

-

Not Paying the Correct Amount: Always double-check the amount due before making your payment. Paying too little can result in the IRS applying penalties and interest.

-

Incorrect Payment Method: Choose the appropriate payment method based on your needs. Sending the wrong payment type or to the wrong address can cause delays in processing your IRS payment.

-

Ignoring Communication from the IRS: If the IRS sends you a notice regarding your tax balance or payment status, don’t ignore it. Responding promptly can help you avoid additional penalties or collection actions.

IRS Payment Solutions for Businesses

Business owners face different challenges when it comes to IRS payments. The most common tax responsibilities for businesses include:

-

Payroll Taxes: Businesses are responsible for withholding payroll taxes from employee wages and submitting those payments to the IRS. Failure to pay payroll taxes can lead to severe penalties.

-

Self-Employment Taxes: If you are self-employed, you will need to pay both the employer and employee portions of Social Security and Medicare taxes.

-

Estimated Taxes: If your business earns income outside of regular wages, you may need to make estimated IRS payments throughout the year.

To make IRS payments easier for your business, consider using the EFTPS system, which allows you to schedule recurring payments and monitor your tax obligations.

How to Handle IRS Payment Disputes

In some cases, you might disagree with the amount the IRS claims you owe. Whether you believe you overpaid or the IRS made a mistake, it’s essential to handle payment disputes promptly. You can take the following steps:

-

Review Your IRS Payment Records: Double-check your tax returns and payments to ensure that the IRS has accurate information.

-

Contact the IRS: If you notice discrepancies, call the IRS or use the online portals to resolve the issue.

-

Appeal the Decision: If you’re unable to resolve the dispute, you may need to appeal the decision by filing a formal appeal with the IRS.

What to Do If You Can’t Afford Your IRS Payment

If you’re facing financial hardship and cannot afford to make an IRS payment, there are options to help you manage the debt. These options include:

-

Installment Payment Plans: As mentioned earlier, the IRS allows taxpayers to pay off their taxes in installments if they can’t pay the full amount upfront.

-

Offer in Compromise: In some cases, you may be able to settle your tax debt for less than the full amount if you qualify for an Offer in Compromise.

-

Currently Not Collectible Status: If you are experiencing extreme financial hardship, you may qualify for this status, which temporarily halts IRS collection efforts.

How to Prevent IRS Payment Issues in the Future

The best way to avoid IRS payment issues is to plan ahead. Here are some tips for staying on top of your tax obligations:

-

Keep Accurate Records: Maintain clear and organized records of your income, expenses, and tax payments. This will help you when filing your tax returns and ensure accurate IRS payments.

-

Set Aside Funds for Taxes: If you’re self-employed or run a business, set aside a percentage of your income for taxes. This will ensure that you have enough funds when it’s time to make your IRS payment.

-

Make Estimated Payments: If you earn income outside of regular wages, consider making estimated IRS payments throughout the year to avoid a large tax bill at the end of the year.

-

Use Tax Software or Professionals: Utilize tax software or hire a tax professional to help you calculate your taxes and ensure that your payments are correct and timely.

Conclusion

IRS payments are an essential part of the tax system, and it’s crucial to understand how they work to avoid unnecessary penalties and complications. Whether you’re an individual or business owner, staying on top of your IRS payments will ensure that you stay compliant with the law and avoid costly mistakes. With the information provided in this guide, you should now have a solid understanding of the IRS payment process and how to navigate it effectively. If you need assistance with your IRS payments, consider reaching out to a tax professional who can provide expert guidance and help you manage your tax obligations.