Introduction: Why “Check My Refund” Is the Most Searched Tax Question

It’s tax season, and one phrase seems to echo across every household, inbox, and social feed: “check my refund.” Millions of Americans anxiously wait for their tax refunds to arrive, often checking IRS tools daily—sometimes multiple times per day.

But what happens when those tools don’t work as expected? Or when your refund status shows nothing at all? That moment of stress—why can’t I check my refund?—can quickly escalate into confusion and panic.

At Syed Professional Services, we’ve helped thousands of clients not only file their taxes but navigate the entire refund process with clarity and confidence. Whether you’re using the IRS “Where’s My Refund” tool, the IRS2Go app, or relying on your tax preparer, this guide will break down everything you need to know.

In this article, we’ll explore the top 5 reasons why you can’t check your refund, what each message means, and exactly how to troubleshoot the issue.

Reason 1: Your Tax Return Hasn’t Been Processed Yet

One of the most common reasons taxpayers can’t check their refund is that their return hasn’t been processed yet by the IRS.

The “Where’s My Refund” tool won’t show any information until:

-

At least 24 hours after e-filing your return.

-

Or 4 weeks after mailing a paper return.

If you’re obsessively refreshing the page and still seeing “no information available,” it’s likely too early.

What You Can Do:

-

Wait 24–72 hours after e-filing before checking your refund status.

-

Confirm that your e-file was accepted, not just submitted.

-

Double-check your return for any errors that might delay processing.

💡 Pro Tip: Use the IRS2Go mobile app for a smoother experience when checking your refund on-the-go.

Reason 2: The IRS Needs to Verify Your Identity or Income

If you’re seeing vague status messages like “Your tax return is still being processed” for several weeks, this could indicate that your return was flagged for identity or income verification.

This delay is especially common when:

-

You have inconsistencies in reported income.

-

There’s a history of ID theft or fraud alerts on your file.

-

The IRS needs to verify your W-2 or 1099 information.

When this happens, checking your refund won’t provide clear answers—you’ll often receive a letter or 5071C notice asking for verification.

How to Fix It:

-

Respond immediately to any IRS letters.

-

Use the Identity Verification Service if instructed.

-

Don’t call the IRS unless the notice explicitly requests it — you’ll need your letter and ID ready.

🚨 Until this verification is complete, you won’t be able to check your refund with any accuracy.

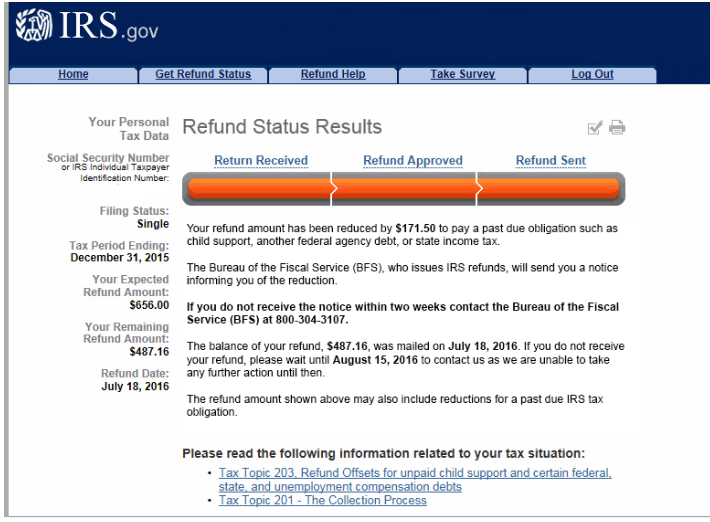

Reason 3: Your Refund Was Offset for Past-Due Debts

A surprising shocker for many taxpayers occurs when they try to check their refund, only to find out it was reduced or completely taken to pay back-due debts.

Your federal refund can be offset for:

-

Child support arrears

-

Unpaid student loans

-

State taxes

-

Other federal debts

This offset is often communicated after the fact, leaving taxpayers frustrated and confused.

What to Do If This Happens:

-

Contact the Treasury Offset Program at 1-800-304-3107.

-

You can also write to the Bureau of the Fiscal Service for detailed info.

-

If you disagree with the debt, request a hearing or appeal ASAP.

Once the offset is applied, the IRS will still process your return—but your refund may be partially or fully withheld.

Even if you’re asking “how do I check my refund” through the IRS portal, you’ll only get a general status update, not specific details about the offset.

Reason 4: You Made a Mistake on Your Return

One small error—like entering the wrong Social Security Number, filing status, or bank info—can cause your refund to be delayed or misdirected.

Worse, checking your refund status will still return ambiguous messages, like “We cannot provide any information about your refund.”

Common Mistakes That Affect Your Refund Status:

| Mistake | Consequence |

|---|---|

| Wrong SSN or DOB | System won’t find your record |

| Incorrect bank routing number | Refund goes to wrong account |

| Math miscalculations | IRS holds your return for review |

| Filing status mismatch | Processing delay or audit risk |

What You Can Do:

-

Double-check all entries before e-filing.

-

If you’ve already filed, wait for a correction notice.

-

You may need to amend your return (Form 1040X).

Unfortunately, until corrected, trying to check your refund will only lead to stress and unanswered questions.

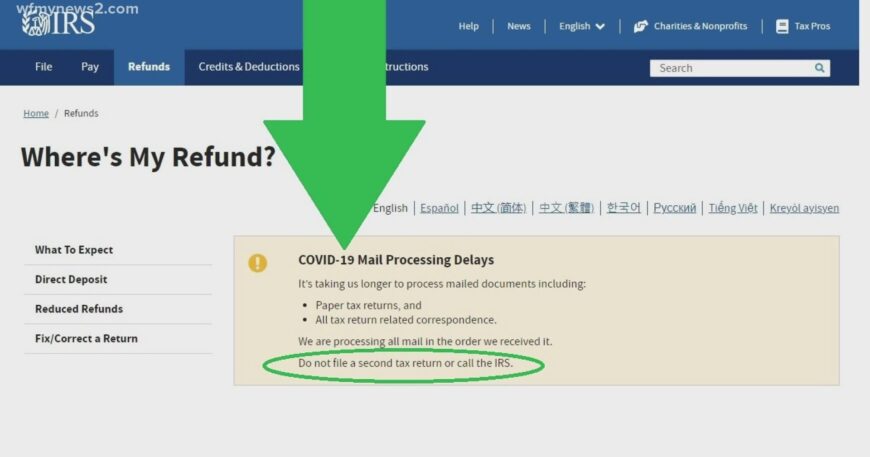

Reason 5: IRS System Backlogs or Seasonal Delays

Sometimes the problem isn’t your fault at all. During peak season (January to April), the IRS often experiences processing backlogs.

System upgrades, staff shortages, and high volumes of paper returns can all contribute to delays in refunds showing up in the system.

If you’re asking “how can I check my refund faster?” — the answer is to file electronically and choose direct deposit.

When Should You Actually Worry?

-

If it’s been 21 days or more since you e-filed.

-

Or 6 weeks or more for mailed returns.

-

And you still can’t check your refund or see any updates.

In that case, it’s time to contact the IRS directly or consult your tax preparer for support.

How to Check My Refund (The Right Way)

Here’s a simple table outlining your best options to track refund status:

| Method | Details |

|---|---|

| IRS “Where’s My Refund” Tool | irs.gov/refunds — Best for e-filers |

| IRS2Go Mobile App | Downloadable on iOS & Android |

| Call IRS Refund Hotline | 1-800-829-1954 — Use only if past 21 days |

| Ask Your Tax Preparer | They may have IRS e-file receipt number |

Make sure you have this info handy:

-

Social Security Number

-

Filing status

-

Exact refund amount

Without these details, you won’t be able to check your refund successfully.

Top Tips to Avoid Refund Delays in the Future

-

Always file electronically. Paper returns slow down processing.

-

Use direct deposit. It’s faster and safer than a mailed check.

-

Triple-check your personal info. SSNs, DOBs, bank details — they matter.

-

Keep records of your filing confirmation. Especially the IRS e-file acknowledgment.

-

Respond quickly to any IRS letters. Ignoring them = delays.

Real Client Story: From “Check My Refund” Panic to Instant Payout

At Syed Professional Services, one of our clients came to us after 6 weeks of trying to “check my refund” with zero success.

They had filed using free software online, missed a signature on a dependent verification form, and didn’t know they were flagged for identity verification.

We intervened by:

-

Contacting the IRS

-

Submitting the necessary documentation

-

Correcting minor errors

Within 7 business days, their refund was approved — and the stress was gone.

Don’t waste time wondering. Let a professional take over when you hit refund delays.

FAQs: Everything You Need to Know When You Can’t Check My Refund

Why can’t I check my refund online?

Your return might not be processed yet, or the IRS needs more information to verify your identity or income.

How long does it take for my refund to show up in the system?

For e-filers: 24-72 hours. For paper filers: 3-4 weeks.

What if my refund was taken for debts?

Contact the Treasury Offset Program at 1-800-304-3107 to learn why and how much was taken.

Is the IRS “Where’s My Refund” tool accurate?

Yes, but it only updates once a day (usually overnight) and won’t show exact deposit dates until processing is complete.

Can a tax professional help if I can’t check my refund?

Absolutely. At Syed Professional Services, we specialize in resolving refund issues fast.

How often should I check my refund status?

Once per day is sufficient. Multiple checks won’t speed up the process.

Conclusion: Check My Refund Without Stress or Confusion

There’s nothing more frustrating than a delayed refund, especially when you’re counting on it. But the next time you feel like shouting “WHY can’t I check my refund?!”, take a breath—then take action.

From identity verification to input errors and IRS backlogs, we’ve seen every possible scenario—and helped fix them all.

At Syed Professional Services, we’re not just here to file your taxes. We’re here to help you check your refund, resolve IRS issues, and get what’s rightfully yours—faster, smarter, and with zero guesswork.