Paycheck Calculator

A paycheck calculator is one of the most powerful financial tools available to employees, employers, and self-employed professionals today. Whether you’re managing payroll, preparing for tax season, or simply trying to understand your take-home pay, a paycheck calculator gives you clarity and control.

At Syed Professional Services, we regularly assist clients with tax planning, payroll compliance, and financial structuring. One of the most common questions we receive is: “How much will I actually take home after taxes?” That’s exactly where a paycheck calculator becomes essential.

If you’re not using a paycheck calculator regularly, you could be making costly mistakes without even realizing it. Let’s explore how this simple yet powerful tool can protect your income and improve your financial confidence.

What Is a Paycheck Calculator and Why It Matters

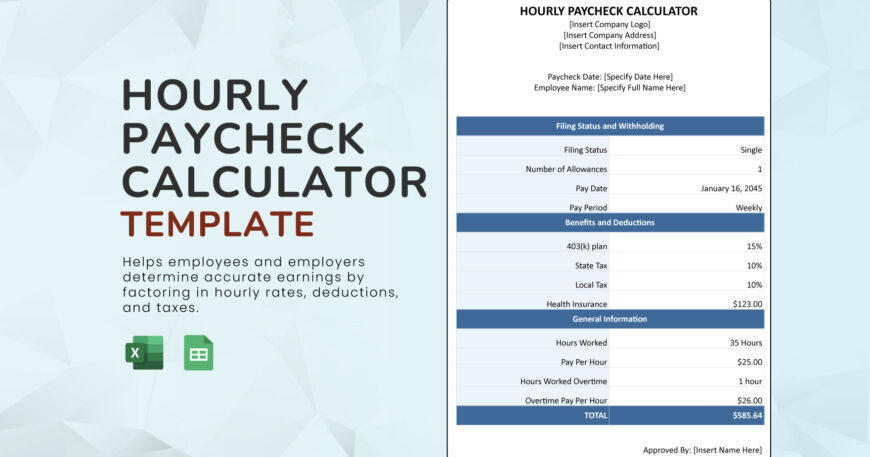

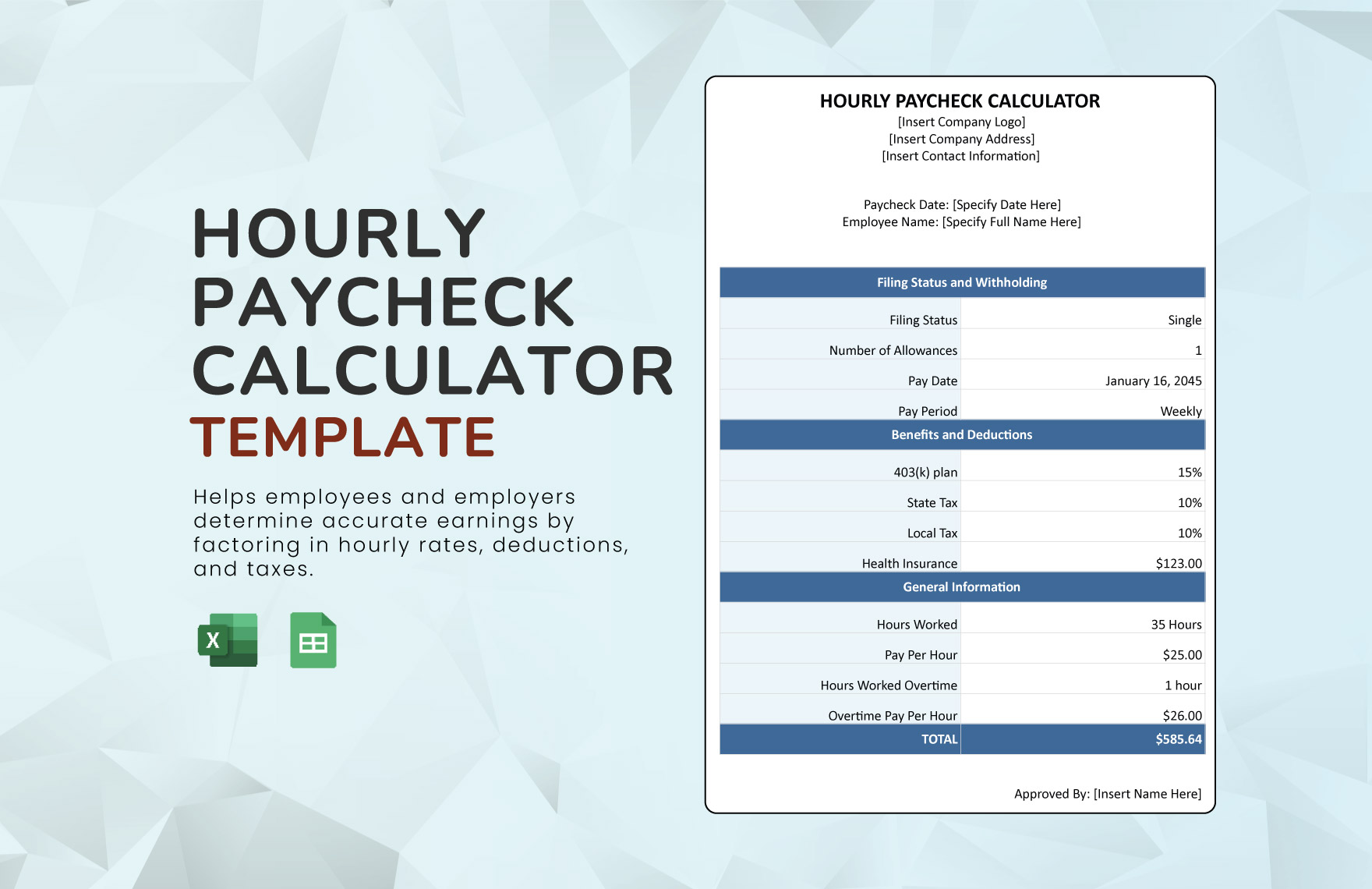

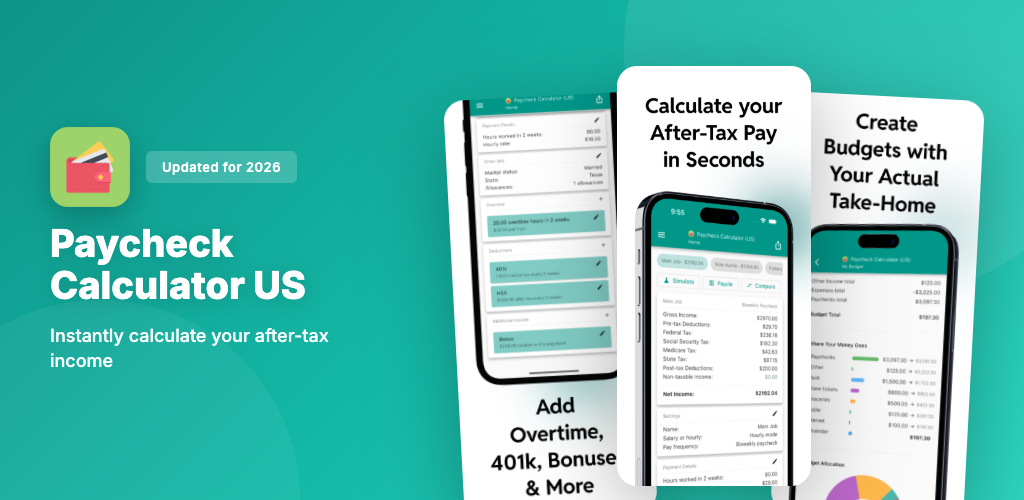

A paycheck calculator is an online or software-based tool that estimates your net pay after taxes and deductions. It calculates federal income tax, state tax, Social Security, Medicare, and other deductions to determine your actual take-home pay.

Many people assume their salary equals their take-home income. Unfortunately, that’s rarely true.

Understanding Gross Pay vs. Net Pay

Your gross pay is your total earnings before deductions. Your net pay is what you actually receive after taxes and other withholdings. A paycheck calculator bridges that gap and helps you understand:

-

Federal income tax deductions

-

State income tax deductions

-

FICA contributions

-

Health insurance premiums

-

Retirement contributions

Without a paycheck calculator, you’re essentially guessing your real income.

Why Accuracy Is Critical

Inaccurate payroll calculations can lead to underpayment, overpayment, or compliance issues. Businesses that fail to calculate wages properly may face penalties, audits, or legal complications.

Using a paycheck calculator reduces that risk significantly.

How a Paycheck Calculator Protects Employees

Employees often rely solely on HR departments or payroll systems without double-checking calculations. While payroll software is generally reliable, mistakes do happen.

A paycheck calculator gives employees financial visibility.

Avoiding Tax Withholding Surprises

Have you ever been shocked by a lower-than-expected paycheck? A paycheck calculator helps prevent that surprise. By entering your salary and withholding details, you can estimate exactly what to expect before payday.

This is especially helpful when:

-

Changing jobs

-

Adjusting W-4 withholdings

-

Receiving bonuses

-

Working overtime

When you use a paycheck calculator, you take control of your earnings.

Budget Planning Made Easier

Accurate income forecasting helps you:

-

Plan monthly expenses

-

Calculate savings goals

-

Manage debt payments

-

Estimate rent affordability

A paycheck calculator turns financial uncertainty into confidence.

Why Businesses Must Use a Paycheck Calculator

For employers, payroll errors are more than embarrassing — they can be expensive. Tax miscalculations may trigger penalties from the IRS or state agencies.

At Syed Professional Services, we recommend every small business regularly verify payroll using a paycheck calculator.

Ensuring Payroll Compliance

Federal and state tax laws change frequently. A paycheck calculator that updates tax rates automatically helps maintain compliance.

Employers benefit from:

-

Accurate withholding calculations

-

Reduced audit risk

-

Improved employee trust

-

Fewer payroll disputes

Even small miscalculations can add up over time. A paycheck calculator helps prevent those cumulative errors.

Supporting Multi-State Payroll

If your employees work in multiple states, tax rules can vary significantly. A paycheck-calculator helps businesses apply the correct state withholding rates, reducing compliance complications.

Key Components of a Paycheck-Calculator

A reliable paycheck-calculator considers several critical factors.

Federal Income Tax

The paycheck-calculator uses IRS tax brackets to determine how much federal income tax to withhold based on filing status and income level.

State and Local Taxes

State tax rates vary widely. Some states have no income tax, while others impose progressive rates. A paycheck-calculator ensures accurate local compliance.

FICA Contributions

Social Security and Medicare contributions are mandatory for most workers. A paycheck-calculator automatically calculates these percentages.

Pre-Tax and Post-Tax Deductions

Health insurance, retirement contributions, and wage garnishments can affect take-home pay. A paycheck-calculator accounts for these variables.

Common Payroll Mistakes a Paycheck Calculator Prevents

Even experienced payroll administrators can make mistakes. A paycheck-calculator acts as a safeguard.

Misclassifying Employees

Independent contractors and employees have different tax obligations. A paycheck-calculator helps clarify withholding requirements.

Incorrect Overtime Calculations

Overtime must be calculated accurately to comply with labor laws. A paycheck-calculator ensures proper wage computation.

Failure to Update Tax Rates

Tax rates change annually. A paycheck-calculator that reflects current regulations protects both employers and employees.

Without using a paycheck-calculator, these errors can result in fines or employee dissatisfaction.

Using a Paycheck-Calculator for Tax Planning

A paycheck-calculator is not just a payroll tool — it’s a powerful tax planning resource.

Adjusting W-4 Elections

Employees can test different withholding scenarios using a paycheck-calculator to determine how changes affect their net pay.

Estimating Annual Tax Liability

By projecting earnings across the year, a paycheck calculator can help estimate total tax liability and avoid year-end surprises.

For official tax guidance, visit the IRS website:

https://www.irs.gov

Paycheck Calculator for Self-Employed Professionals

Freelancers and independent contractors often overlook tax planning until it’s too late. A paycheck-calculator helps estimate quarterly tax payments.

Managing Estimated Taxes

Self-employed individuals must pay estimated taxes throughout the year. A paycheck-calculator can simulate net income after projected tax deductions.

Separating Business and Personal Income

A paycheck-calculator supports better financial discipline by clarifying actual disposable income.

Why Professional Guidance Still Matters

While a paycheck-calculator is powerful, it doesn’t replace professional tax advice.

At Syed Professional Services, we combine technology with expertise. A paycheck-calculator provides estimates, but our professionals ensure compliance, strategic planning, and long-term financial optimization.

Working with experienced tax and accounting professionals ensures:

-

Accurate filings

-

Reduced liability

-

Immigration-related income compliance

-

Audit protection

A paycheck-calculator is a tool. Professional guidance turns that tool into a strategy.

Frequently Asked Questions

What is a paycheck-calculator?

A paycheck-calculator estimates your take-home pay after taxes and deductions.

Is a paycheck-calculator accurate?

Yes, when updated with current tax rates and accurate information.

Can a paycheck-calculator help reduce taxes?

It can’t reduce taxes directly, but it helps plan withholding strategies effectively.

Should employers use a paycheck-calculator?

Absolutely. It reduces payroll errors and compliance risks.

Is a paycheck-calculator useful for freelancers?

Yes, especially for estimating quarterly taxes.

How often should I use a paycheck-calculator?

Whenever your income, tax status, or deductions change.

Conclusion

A paycheck-calculator is more than a convenience — it’s a financial safeguard. Whether you’re an employee seeking clarity or a business owner striving for compliance, using a paycheck-calculator regularly can prevent costly mistakes.

At Syed Professional Services, we help clients maximize income, maintain compliance, and achieve financial confidence. A paycheck-calculator provides transparency, but expert guidance ensures long-term success.

If you want peace of mind in your payroll and tax planning, combining a paycheck-calculator with professional expertise is the smartest decision you can make.