11 Shocking Reasons You Must File Form 4868 in 2026 — And How to Avoid IRS Penalties Fast

Every year, millions of Americans rush to file their tax returns by the April deadline. But many of them don’t realize they can request a simple extension using Form 4868, which gives taxpayers an additional six months to file. As we move toward the 2026 tax year, more people than ever will need help understanding how Form 4868 works, when to file it, and how to avoid penalties.

At Syed Professional Services, we guide individuals, families, businesses, and immigrants through every tax requirement — including accurate and timely filing of Form 4868. This detailed guide explains the most shocking reasons why you may need an extension, the biggest mistakes taxpayers make, and how to submit Form 4868 correctly in 2026.

What Is Form 4868?

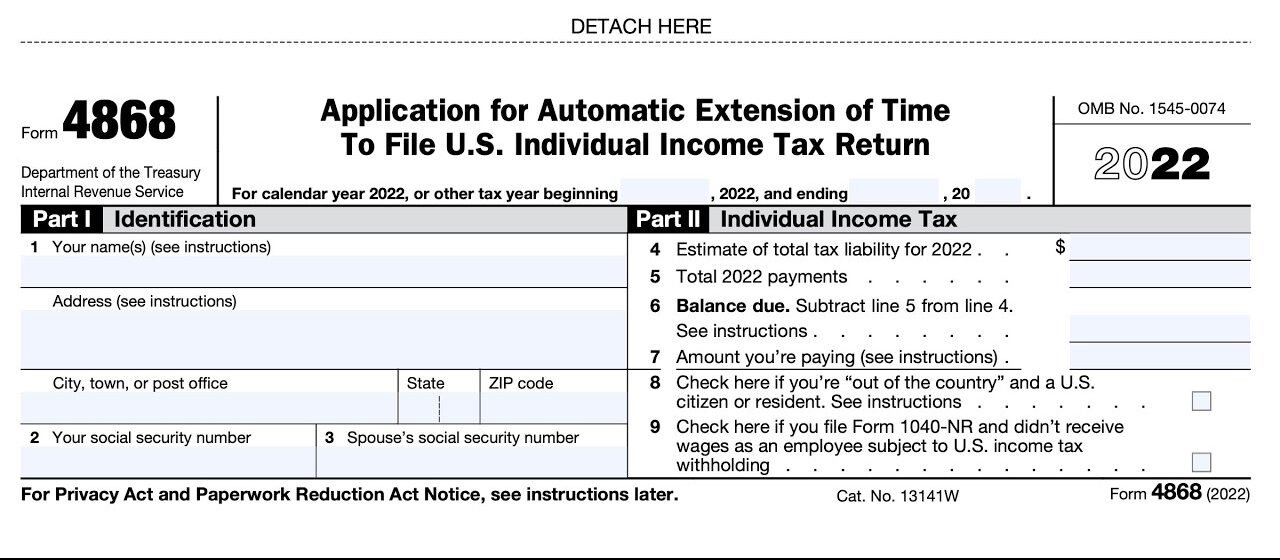

Form 4868 is the official IRS “Application for Automatic Extension of Time to File U.S. Individual Income Tax Return.” When submitted correctly, Form 4868 automatically gives you an additional six months to file your tax return.

Important:

✔ Form 4868 extends the filing deadline — not the payment deadline.

✔ You still must estimate and pay your taxes by April.

✔ If you don’t pay on time, penalties and interest apply even if your Form-4868 was approved.

This form is often misunderstood, which is why many taxpayers end up with IRS notices, incorrect filings, or unnecessary penalties.

Why Taxpayers Will Rely More on Form 4868 in 2026

The IRS is introducing new systems and stricter rules for reporting income, verifying identities, and matching employer data. Because of this, many taxpayers will need more time to gather documents and avoid filing errors — which makes Form-4868 more important than ever in 2026.

Reason #1: Missing Income Documents

Many people file Form-4868 simply because they don’t have all their documents in time.

Common delays include:

-

Late W-2 from employers

-

Missing 1099-NEC or 1099-K

-

Delayed bank interest statements

-

Incorrect forms needing re-issuance

When your documents are incomplete, filing without Form-4868 increases the risk of IRS corrections or audits.

Reason #2: Complex Self-Employment or Business Income

Self-employed individuals, freelancers, and small business owners must sort through expenses, receipts, mileage logs, and income reports. This makes filing time-consuming.

When income records are not ready, Form-4868 becomes the safest way to avoid filing errors.

Reason #3: Late Arrival of Foreign Income or Overseas Records

Individuals with foreign income or assets often receive documents later than U.S. taxpayers. A Form 4868 extension helps avoid mistakes with:

-

Foreign bank interest

-

Overseas business income

-

Foreign tax credit documentation

-

International student income

For immigrants and expats, Form 4868 is often essential.

Reason #4: ITIN or Identity Issues Delaying Filing

If you need an ITIN renewal or name correction, filing your tax return on time may be impossible. Filing Form-4868 gives you extra time while the IRS updates your identity records.

Reason #5: Complex Deductions or Credits

Taxpayers claiming credits such as the Child Tax Credit, Earned Income Tax Credit, or education credits must ensure documents are correct. Filing too quickly can lead to IRS adjustments or audits.

A Form-4868 extension allows time for accurate calculation.

Reason #6: Alcohol, Job Change, or Major Life Event

Events such as:

-

Marriage

-

Divorce

-

Moving states

-

Having a baby

-

Buying a house

-

Changing jobs

-

Losing employment

…all require updated tax information. Filing Form-4868 prevents mistakes in filing status, dependents, and credits.

Reason #7: Unexpected Tax Liability

If you realize that you owe tax and need time to prepare funds, filing Form-4868 prevents filing errors. Remember: You must still pay your estimated amount by April even if you file Form 4868.

Reason #8: Incomplete Business or Investment Records

Investment activities that may require Form-4868 include:

-

Cryptocurrency trades

-

Stock or ETF sales

-

Real estate transactions

-

Rental property income

-

K-1 partnership forms

These forms can arrive as late as March or April, making Form-4868 necessary.

Reason #9: Incorrect or Miscalculated Tax Returns

If you discover errors on your return close to the deadline, it is better to file Form 4868 and take extra time to correct them than to submit a rushed and incorrect return.

Reason #10: Estate, Trust, or Inheritance Complications

If someone passed away and you are handling their taxes, you may need additional time to gather documents. Filing Form 4868 prevents filing mistakes that could affect estate distributions.

Reason #11: Avoiding Last-Minute Filing Stress

Many people file Form 4868 simply to avoid rushing through paperwork. Filing taxes under pressure leads to missed deductions, incorrect income reporting, and unnecessary IRS letters.

How to File Form 4868 Correctly

There are three primary ways to submit Form 4868:

1. File Electronically (Recommended)

You can use online IRS-approved tax software or file through a professional service like Syed Professional Services.

2. Mail the Paper Form

Complete Form 4868 and mail it to the IRS. This process takes longer and increases the chance of errors.

3. Let a Tax Professional File for You

This ensures accurate numbers and avoids the most common mistakes.

What You Must Include on Form 4868

When submitting Form 4868, you need to provide:

-

Your name

-

Address

-

SSN or ITIN

-

Estimated total tax liability

-

Total taxes paid so far

-

Expected balance due

-

Amount you are paying with the extension

Incorrect numbers often lead to penalties, which is why it’s important to calculate correctly.

Common Form 4868 Mistakes That Lead to Penalties

Many taxpayers incorrectly believe that filing Form 4868 automatically protects them from penalties. But mistakes still lead to IRS issues.

Here’s what to avoid:

❌ Mistake 1: Not paying estimated taxes

You must pay estimated taxes by April 15 even if you file Form 4868.

❌ Mistake 2: Filing Form 4868 after the deadline

Extensions must be filed on or before the original tax deadline.

❌ Mistake 3: Guessing income without calculation

Poor estimates can still trigger penalties.

❌ Mistake 4: Forgetting to file the tax return after six months

Form 4868 gives you six months — not unlimited time.

❌ Mistake 5: Thinking extension = extra time to pay

You must pay now, file later.

How Syed Professional Services Helps You File Form 4868

At Syed Professional Services, our experts ensure clean, accurate, and penalty-free tax extension filings.

We help with:

✔ Preparing your estimated tax liability

✔ Filing Form 4868 electronically

✔ Setting up your payment correctly

✔ Avoiding late-payment penalties

✔ Making sure you file your return before the extension deadline

✔ Handling self-employment, business, or investment records

Our team supports both U.S. citizens and immigrants with ITINs, making Form 4868 filing fast and stress-free.

What Happens After Filing Form-4868?

Once your Form-4868 is accepted, you get an automatic six-month extension. The new deadline becomes:

October 15

During these six months, you should focus on:

-

Organizing documents

-

Requesting missing forms

-

Correcting errors

-

Reviewing deductions

-

Filing accurately

Who Should Not File Form-4868?

You should NOT file Form-4868 if:

-

You already have all documents and can file on time

-

You will owe penalties because you didn’t pay your estimated tax

-

You misunderstand your tax situation

-

You plan to ignore the return later

If you file Form-4868, be sure you follow through with the final return.

Final Thoughts: Use Form-4868 Wisely in 2026

Filing Form-4868 is not a sign of irresponsibility — it’s a smart move for taxpayers who need more time to file accurately. Whether you’re missing documents, dealing with a complex tax situation, managing business records, or navigating immigration-related tax requirements, the extension helps you avoid mistakes and protect your refund.

At Syed Professional Services, we help taxpayers at every stage of the filing process — from preparing Form-4868, to calculating estimated tax, to filing the final return with 100% accuracy.