9 Shocking Reasons You May Need a Tax Adjustment in 2026 — And How to Fix Them Fast

A tax adjustment can be one of the most frustrating and unexpected issues taxpayers face each year. Whether you’re an employee, business owner, freelancer, or immigrant filing taxes for the first time, the IRS may request corrections or adjustments to your tax return — sometimes long after you file.

As we move toward the 2026 filing year, more Americans will deal with tax adjustment notices due to tighter IRS monitoring, new reporting rules, and digital tracking systems. Understanding what causes these adjustments — and how to fix them — can save you from penalties, delays, and unnecessary stress.

At Syed Professional Services, our experts specialize in tax preparation, tax planning, accounting, and immigration-related tax services. In this guide, we break down everything you need to know about tax adjustment issues in 2026 and how to prevent them.

What Is a Tax Adjustment?

A tax adjustment happens when the IRS finds something incorrect or missing in your tax return. This may involve:

-

Wrong income numbers

-

Incorrect deductions

-

Missing credits

-

Mismatched employer reports

-

Incorrect filing status

-

ITIN or SSN errors

-

Banking issues

-

Underpayment or overpayment of taxes

When errors appear, the IRS automatically sends a notice explaining the tax adjustment they made and what you owe (or what they will refund you).

In 2026, due to more advanced verification systems, the number of tax adjustment notices may increase significantly.

Reason #1: Income Mismatch Between Your Return & IRS Records

The most common cause of a tax adjustment is income mismatch.

For example:

-

Your employer reports your income differently than you entered it.

-

You worked multiple jobs but forgot one W-2.

-

You received a 1099 for freelance work that you didn’t report.

-

Digital payment apps reported your income under the new IRS rules.

If your return does not match the IRS database, an immediate tax adjustment is triggered.

How to fix it:

Keep all W-2s, 1099s, invoices, and gig-work statements before filing.

Reason #2: Missing or Incorrect Tax Credits

Tax credits such as the Child Tax Credit, Earned Income Tax Credit, or educational credits are heavily audited by the IRS. Incorrect claims almost always trigger a tax adjustment.

Common mistakes include:

-

Claiming a dependent who is not eligible

-

Missing proof of school enrollment

-

Incorrect income limits

-

Filing with an ITIN and claiming restricted credits

How to fix it:

Always confirm credit eligibility and use proper documentation.

Reason #3: Errors with Filing Status

A surprising number of tax adjustment notices come from wrong filing statuses.

Examples:

-

Filing “Head of Household” without qualifying dependents

-

Filing “Single” even though you’re legally married

-

Filing “Married Filing Jointly” with mismatched information

A status error causes major calculation problems, forcing the IRS to send a tax adjustment correction.

How to fix it:

Choose your filing status carefully and disclose family information accurately.

Reason #4: Payroll & Withholding Mistakes

Incorrect withholding throughout the year can also lead to a tax-adjustment, especially when your employer sends updated payroll data to the IRS.

Common causes:

-

Wrong W-4 settings

-

Changing jobs mid-year

-

Multiple employers

-

Misreported tips

-

Wrong dependent count

If your taxes withheld were too low, the IRS may issue a tax-adjustment and charge additional taxes.

Reason #5: ITIN, SSN, or Identity Verification Issues

Identity and verification issues cause thousands of tax-adjustment notices every year. This is especially common among immigrants, visa holders, and new residents.

Common issues:

-

Expired ITIN

-

Mismatched names (passport vs. tax return)

-

Incorrect SSN entry

-

Duplicate filings

-

Immigration status changes

During 2026, identity verification rules will become stricter, leading to even more tax-adjustment cases.

Reason #6: Incorrect Business or Self-Employment Deductions

If you are self-employed or run a small business, your deductions must be accurate and reasonable. Incorrect business deductions often trigger an IRS tax-adjustment.

Risky deductions include:

-

Personal expenses listed as business expenses

-

Inflated mileage

-

Incorrect home office calculations

-

Missing receipts

-

Unreported cash income

The IRS is heavily scanning deductions in 2026, so errors will quickly turn into tax-adjustment notices.

Reason #7: Bank or Direct Deposit Errors

Many taxpayers are surprised to learn that incorrect banking information can cause a tax-adjustment. When refunds fail to deposit, the IRS reviews the return and may adjust it before reissuing the refund.

Problems include:

-

Wrong routing number

-

Closed bank account

-

Misspelled name

-

Failed deposit verification

These issues delay refunds and often result in IRS correction notices.

Reason #8: Tax Law Changes for 2026

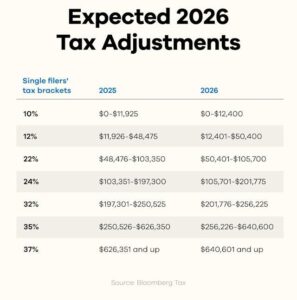

Tax law changes expected for 2026 include:

-

New tax brackets

-

Possible Child Tax Credit updates

-

Gig-work reporting changes

-

New IRS automation systems

-

Increased earning threshold reviews

All of this means more chances of errors — and more tax-adjustment notices.

Taxpayers who are unaware of updated rules often face problems with credits, deductions, and income reporting.

Reason #9: Math or Form Errors That Trigger IRS Review

Even simple mistakes can cause a tax-adjustment:

-

Wrong totals

-

Typing errors

-

Incorrect subtraction or addition

-

Misplaced decimal points

-

Old IRS forms

While software prevents many mistakes, people who file manually or use outdated systems are especially at risk.

How Syed Professional Services Helps You Avoid a Tax Adjustment

Our specialists at Syed Professional Services provide full-service tax preparation, accounting, immigration support, and tax planning to ensure your return is accurate and compliant.

Here’s how we prevent a tax-adjustment before it happens:

✔ Accurate Tax Return Preparation

We verify all forms, income, credits, and deductions to eliminate errors.

✔ ITIN & Immigration-Based Tax Filing

We ensure name, identity, and filing details match perfectly — avoiding identity-related tax-adjustment issues.

✔ Business & Self-Employment Support

We prepare clean expense reports, deductions, mileage logs, and financial records.

✔ IRS Notice Handling

If you already received a tax-adjustment notice, we respond and fix the issue professionally.

✔ Tax Planning for 2026

Preparation strategies that reduce your risk of owing taxes or being flagged for corrections.

✔ Refund Maximization

We uncover deductions and credits you may qualify for.

How to Prevent a Tax-Adjustment in 2026: Step-by-Step Guide

1. Gather All Forms Before Filing

Don’t file early if you haven’t received all W-2s or 1099s.

2. Track All Side Income

Digital payments, freelance earnings, and gig jobs must be reported.

3. Verify Identity Information

Make sure your ITIN or SSN is active and accurate.

4. Review Deductions Carefully

Ensure expenses are allowable and well documented.

5. Use a Professional Service

DIY online systems can miss important details that trigger tax-adjustment notices.

6. Keep Records for 3–7 Years

Store receipts, invoices, logs, and bank statements.

7. Double-Check Banking Information

Incorrect bank details often cause IRS adjustments.

8. Understand New Tax Laws

Updated regulations for 2026 may impact income and credits.

What to Do If You Receive a Tax-Adjustment Notice

Don’t panic — contact Syed Professional Services immediately.

Here’s what we do:

✔ Review the IRS notice

We confirm if the tax-adjustment is correct or a mistake.

✔ Request corrections

If the IRS is wrong, we file a dispute on your behalf.

✔ Calculate new refund or tax amount

We make sure the amount you owe is accurate.

✔ Communicate directly with the IRS

We handle all contact so you don’t have to.

✔ Prevent future notices

We update your filing strategy for 2026 and beyond.

Final Thoughts: Stay Ahead of Tax Adjustment Problems in 2026

A tax-adjustment notice can be stressful — but most issues can be prevented by filing accurately, maintaining records, and using professional support. With IRS systems becoming stricter every year, especially toward 2026, avoiding filing mistakes is more important than ever.

At Syed Professional Services, we help individuals, families, immigrants, and business owners stay compliant and stress-free. Our expert team ensures your return is accurate, your deductions are legitimate, and your tax filing is fully protected from tax-adjustment issues.