Everything You Need to Know About Form 7004: A Guide to Filing Your Extension with Confidence

Filing taxes can be a daunting task, especially for business owners who need to ensure everything is in order before the deadline. Sometimes, life or business operations get in the way, and you may not be able to file your tax return on time. This is where Form 7004 comes into play. In this comprehensive guide, we’ll walk you through Form 7004, how to file it, and everything you need to know about the tax extension process. Whether you’re a seasoned business owner or a first-time filer, understanding Form 7004 can save you from penalties and stress.

What is Form 7004?

Form 7004 is the IRS form used by businesses to request an automatic extension of time to file certain business tax returns. This form is critical for taxpayers who need more time to complete their tax filings accurately. Filing Form 7004 gives you an automatic extension of up to six months, depending on the type of tax return you’re requesting an extension for.

Types of Tax Returns Covered by Form 7004

Form 7004 is used for a variety of business tax returns, including:

-

Partnerships (Form 1065)

-

Corporations (Form 1120)

-

S Corporations (Form 1120S)

-

Estates and Trusts (Form 1041)

This means if your business is filing any of these returns, you can file Form 7004 to get an extension, so you don’t miss the deadline.

Who Should File Form 7004?

If you’re a business owner, including sole proprietors, partnerships, LLCs, or corporations, and you need extra time to file your tax return, Form 7004 might be the right choice for you. However, it’s important to remember that Form 7004 only provides an extension for filing your return, not for paying any taxes owed. You must still pay any taxes due by the original deadline to avoid penalties and interest.

Key Benefits of Filing Form 7004

Filing Form 7004 comes with several key benefits:

-

Avoid Penalties and Interest: By filing for an extension on time, you avoid late filing penalties, which can be significant. Filing the form gives you extra time to file without the worry of penalties.

-

More Time to Prepare Your Return: Sometimes, businesses need more time to gather the necessary documents, assess their finances, or simply make sure everything is accurate. Form 7004 allows businesses to do this without the pressure of the original deadline.

-

Peace of Mind: Knowing that you’ve filed the extension correctly and have more time to file your taxes gives you peace of mind to focus on other important aspects of your business.

How to File Form 7004?

Filing Form 7004 is fairly straightforward, but it’s important to follow all instructions carefully. Here’s how you can file Form 7004:

1. Gather Your Information

Before you fill out Form 7004, make sure you have the following information:

-

Your business name and address

-

Your Employer Identification Number (EIN) or Social Security Number (SSN)

-

The type of tax return you are requesting an extension for (e.g., Form 1120, Form 1065, etc.)

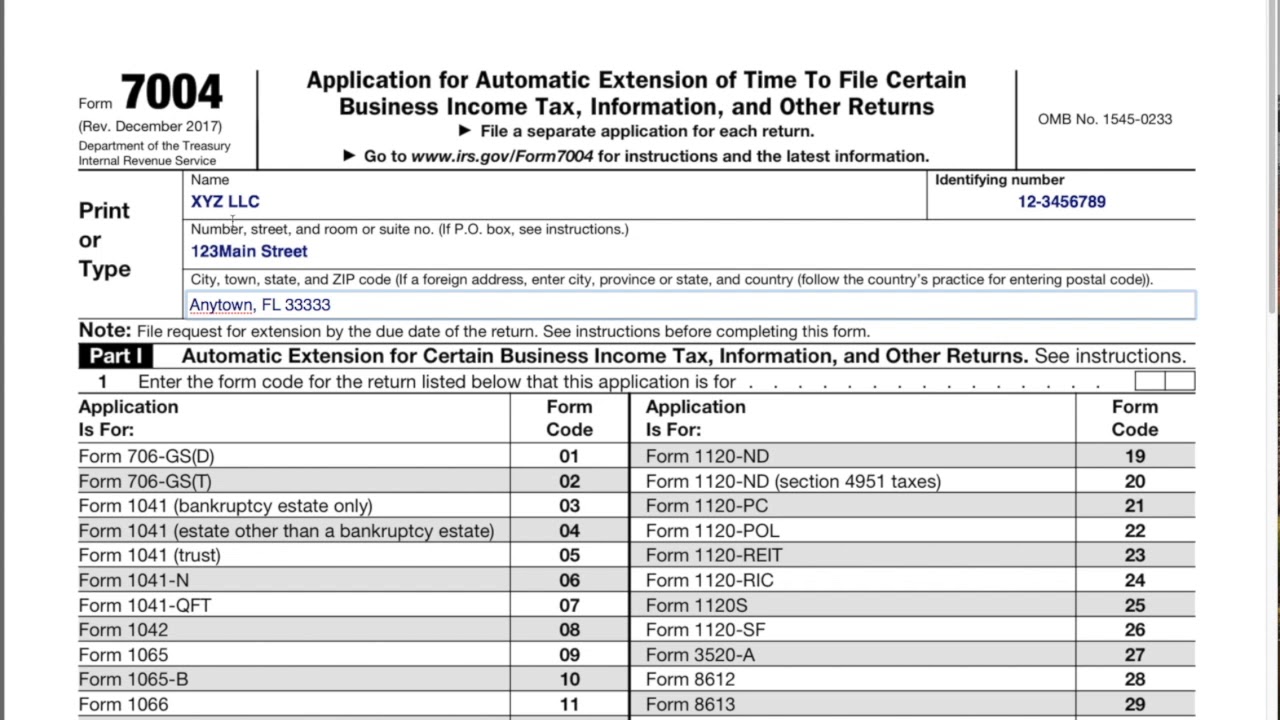

2. Complete Form 7004

Form 7004 consists of basic identification information about your business, along with the tax return form number that you’re requesting an extension for. You’ll also need to estimate any tax you owe. While the extension is automatic, paying any tax due by the original deadline can save you from additional penalties.

3. Submit the Form

You can file Form 7004 electronically via the IRS e-file system, or you can mail a paper version of the form to the IRS. The e-filing method is faster and provides immediate confirmation that your request has been received.

4. Pay Any Taxes Due

While Form 7004 extends the time to file your return, it does not extend the time to pay any taxes owed. You must pay your estimated tax liability by the original due date to avoid interest and penalties. You can make your payment online using the IRS Direct Pay system or other payment methods accepted by the IRS.

When Should You File Form 7004?

You must file Form 7004 by the original due date of the tax return you are requesting an extension for. The IRS recommends filing Form-7004 early to ensure it is processed on time. If you’re unsure about the specific deadline, here are the general due dates for business tax returns:

-

Partnership returns (Form 1065): Due on March 15 for most businesses

-

Corporate returns (Form 1120): Due on April 15 for most corporations

-

S Corporation returns (Form 1120S): Due on March 15 for most S corporations

-

Estates and Trusts returns (Form 1041): Due on April 15 for most estates and trusts

If the original due date falls on a weekend or holiday, the due date is typically moved to the next business day.

What Happens If You Miss the Filing Deadline for Form 7004?

If you miss the filing deadline for Form-7004, you could face penalties for both late filing and late payment. The IRS will typically impose a penalty if you do not file Form-7004 on time or if you fail to pay any taxes owed by the original due date. To avoid these penalties, it’s essential to file Form-7004 ahead of time and pay your taxes promptly.

Common Mistakes When Filing Form 7004

While Form-7004 is relatively simple to fill out, many taxpayers make common mistakes that can delay their extension or result in penalties. Here are some frequent errors to avoid:

-

Not Paying Estimated Taxes: Even if you file Form-7004 on time, if you don’t pay your taxes, you’ll still incur penalties. Make sure you pay your estimated taxes by the original deadline.

-

Filing After the Due Date: If you file Form-7004 after the due date for your tax return, your extension won’t be valid. Always file on time to avoid penalties.

-

Incorrect Information: Double-check all the information on Form-7004 to avoid errors, especially your EIN, business name, and the type of return you’re requesting an extension for.

-

Not Filing Electronically: While you can file Form-7004 on paper, filing electronically is faster and more efficient. Consider e-filing to ensure quick confirmation.

Conclusion

In conclusion, Form-7004 is an essential tool for business owners who need more time to file their tax returns. Filing the form on time can give you a six-month extension, avoiding penalties and providing the time you need to file your return accurately. Remember that while Form-7004 extends the time to file, it does not extend the time to pay any taxes owed. Paying your taxes by the original deadline is crucial to avoid penalties and interest.

If you’re unsure about the filing process, need help with tax planning, or have any questions about Form-7004, don’t hesitate to reach out to Syed Professional Services. Our team of experts is here to guide you through the process and ensure your taxes are filed correctly and on time.