Introduction:

Navigating the world of taxes, accounting, and immigration can often be complex, especially when you’re managing a business or thinking about structuring it for tax purposes. One of the essential forms you may encounter in the tax process is Form 8832. This IRS form is crucial for businesses that want to select how they want to be taxed — either as a corporation, partnership, or disregarded entity. Understanding this form and its impact on your business’s tax obligations is essential for long-term success.

At Syed Professional Services, we strive to provide our clients with the most accurate and up-to-date information regarding tax filing and planning. This guide will walk you through everything you need to know about Form 8832, including its purpose, eligibility, filing process, and how it can benefit your business.

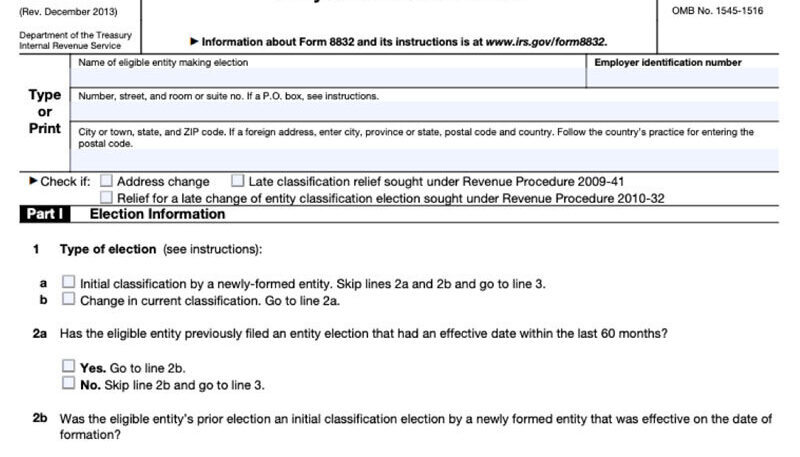

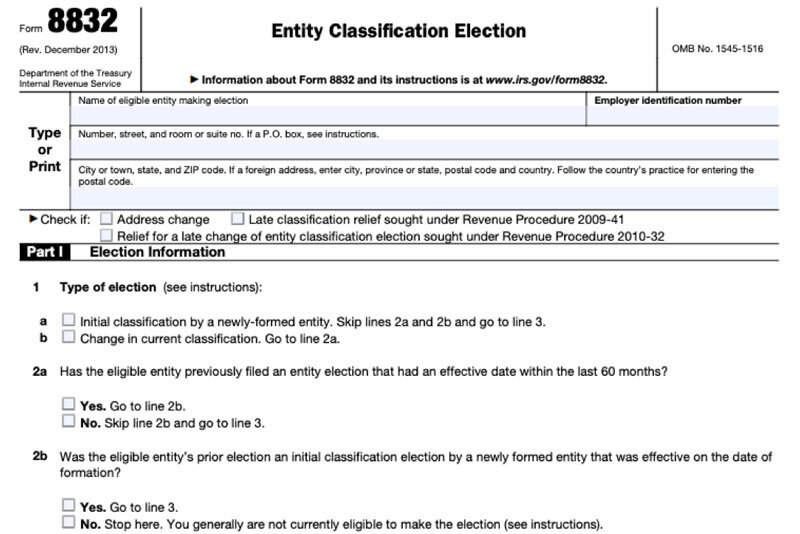

What Is IRS Form 8832?

Form 8832, also known as the “Entity Classification Election” form, is used by businesses to choose how they want to be classified for federal tax purposes. This form allows eligible entities to elect to be treated as a corporation, partnership, or disregarded entity (a single-member LLC, for example). By making the appropriate election, businesses can ensure that they are taxed in the most advantageous way for their situation.

This form is especially useful for LLCs and other business structures that have the option to select their tax classification. It provides the flexibility to change how your entity is taxed to better align with your business needs.

Who Should File Form 8832?

While many businesses may benefit from Form 8832, it’s particularly useful for LLCs or other small business owners who wish to have more control over how they are taxed. If you’re an LLC owner and prefer to be taxed as a corporation or partnership, Form 8832 is the form you’ll need to file. It’s essential to remember that Form 8832 isn’t just for businesses looking to change their tax classification — it also allows you to confirm the structure if you have not filed the form before.

LLC owners may find that filing Form 8832 helps them avoid double taxation (which corporations may face) or may provide better self-employment tax advantages. The form allows flexibility and ensures you are paying the correct amount of taxes based on your entity’s classification.

When Should You File Form 8832?

The timing of when you file Form 8832 is critical. Ideally, businesses should file Form 8832 within 75 days after the formation of their business or after they decide to change their tax classification. You can also file it up to 75 days before the effective date of the election you wish to make.

It’s essential to keep in mind that once you file Form 8832, your election is generally effective for five years. After this time, you can refile and make a new election, allowing you to adjust your tax strategy if your business needs evolve.

If you fail to file the form on time, your business may be classified under the default tax classification (such as being taxed as a disregarded entity for an LLC), which might not be ideal depending on your business structure and tax goals.

Benefits of Filing Form 8832

-

Flexibility in Tax Classification:

One of the most significant advantages of filing Form 8832 is the ability to choose how you want your business taxed. Instead of being forced into a default classification, you have the flexibility to choose a tax structure that best fits your business goals. -

Avoid Double Taxation:

Corporations often face double taxation — once at the corporate level and again when dividends are distributed to shareholders. By filing Form 8832 and electing a more suitable tax classification (like an S Corporation), businesses can potentially avoid or reduce double taxation. -

Simplified Tax Filing for LLCs:

LLCs that are treated as disregarded entities for tax purposes may face challenges with self-employment taxes. Filing Form 8832 can allow LLCs to elect for corporate taxation, which may help minimize some self-employment taxes. -

Simplicity and Control:

By filing Form 8832, you can simplify your tax planning process. Choosing the right entity classification ensures that you have control over how your business is taxed, helping you plan for future financial success. -

Access to Additional Tax Benefits:

Filing Form 8832 opens up various tax benefits available for corporations, partnerships, and other specific tax classifications. This can include deductions, credits, and potentially lower tax rates.

How to File Form 8832

Filing Form 8832 can be done by completing the required form and submitting it to the IRS. Here are the steps to file Form 8832:

-

Download the Form:

You can download Form 8832 from the official IRS website. -

Complete the Form:

The form requires basic information about your business, including the name, address, employer identification number (EIN), and details about your entity’s structure. You will also need to indicate the specific tax classification election you are making. -

Review the Instructions:

It’s crucial to follow the instructions provided with Form 8832 to ensure accuracy. The IRS has specific guidelines for who can file, when to file, and how to properly complete the form. -

Submit the Form:

After completing the form, mail it to the appropriate IRS address listed in the form’s instructions. Keep a copy of the completed form for your records.

Key Considerations When Filing Form 8832

-

Eligibility Requirements:

Not every business entity is eligible to file Form 8832. For example, certain foreign entities or certain types of corporations may not be eligible to use this form. It’s crucial to confirm eligibility before proceeding. -

Potential Delays:

IRS processing times for Form 8832 can vary. It’s important to submit your form early and allow for any potential delays, especially if you’re planning the filing for a specific tax year. -

Consult a Tax Professional:

Given the complexity of tax classifications and the potential for significant financial impact, it’s often advisable to consult with a tax professional before filing Form 8832. An experienced accountant or tax advisor can help ensure that your election aligns with your business goals.

Common Mistakes to Avoid

-

Missed Deadlines:

One of the most common mistakes businesses make when filing Form 8832 is missing the deadline. Remember, you must file within 75 days of starting your business or making the election. Missing this deadline could result in your business being taxed under the default classification. -

Incorrect Information:

Providing incorrect information on Form 8832 can delay processing or result in the form being rejected. Double-check your entity’s details, tax identification number, and classification choice before submitting the form. -

Failure to Seek Professional Advice:

Tax planning can be complicated, and Form 8832 is a crucial document. Failing to seek professional advice can lead to a poor election that doesn’t suit your business’s needs. Always consult with a tax professional before proceeding.Detailed Explanation of IRS Form 8832 Elections

Form 8832 gives business owners the ability to select how their entity will be taxed. The IRS provides several tax classifications to choose from, each with its own set of benefits and limitations. Let’s dive deeper into these options and understand the implications of each.

1. Disregarded Entity (Single-Member LLC)

A disregarded entity is a business structure in which the entity itself is not recognized for federal tax purposes. Instead, all income, deductions, and credits are reported on the owner’s personal tax return. This option is available to single-member LLCs and can offer a straightforward and simplified tax filing process.

By filing Form 8832 and electing disregarded entity status, the LLC is not subject to corporate tax filings. Instead, its earnings pass through to the owner’s personal return, subjecting them to self-employment taxes. This is the default classification for LLCs unless the owner elects otherwise. However, Form 8832 can be used to change this classification, for instance, if you want to elect to be taxed as a corporation.

2. Partnership

For multi-member LLCs or partnerships, Form 8832 allows the business to elect to be taxed as a partnership. In this case, the business itself does not pay taxes; instead, the owners (partners) report their share of the profits and losses on their personal tax returns. This election can be advantageous for businesses that want the flexibility of a pass-through taxation system while maintaining a formal partnership structure.

Electing partnership status via Form 8832 allows business owners to avoid the issue of double taxation while still taking advantage of partnership-level deductions and credits. It’s important to note that partnerships have their own complexities, such as the need for separate tax filings (Form 1065) and the allocation of income and expenses among partners.

3. Corporation (C Corporation)

Filing Form 8832 to elect to be taxed as a C Corporation means the business is treated as a separate entity for tax purposes. The corporation itself pays taxes on its earnings, and then any dividends paid to shareholders are taxed again on their personal returns. This is known as double taxation, which is one of the main disadvantages of electing this classification.

However, some businesses may still prefer C Corporation status for various reasons, such as the ability to retain earnings within the company, attract investors, or deduct employee benefits. Businesses that plan to reinvest their profits back into the company and do not intend to distribute profits as dividends may find C Corporation taxation beneficial.

4. S Corporation (S Corp)

An S Corporation is another type of corporation that allows for pass-through taxation, similar to a partnership. However, it has additional requirements, such as a limit on the number of shareholders. An S Corporation avoids double taxation by allowing profits to pass directly through to the shareholders, who report their income on their individual tax returns. Form-8832 can be used in combination with Form 2553 to elect S Corporation status.

For businesses that qualify, electing S Corporation status can offer tax savings, particularly when it comes to self-employment taxes. Shareholders who also work for the company can pay themselves a reasonable salary (subject to payroll taxes), while the remaining income can be distributed as dividends, which are not subject to self-employment tax.

Key Advantages of Using Form 8832 for Your Business

-

Tax Savings Through Strategic Election: Whether you’re seeking to minimize self-employment taxes or avoid double taxation, Form-8832 gives you the ability to select the tax classification that provides the most tax benefits for your business.

-

Increased Control Over Your Business’s Taxation: Many businesses find that they can achieve greater flexibility and efficiency by controlling their tax structure. Whether you want the simplicity of a disregarded entity, the partnership-style taxation, or the corporate structure with its own benefits, Form-8832 gives you the flexibility to make that choice.

-

Improved Planning for Future Growth: Filing Form-8832 allows business owners to structure their taxes in a way that supports long-term growth. Whether that means accessing corporate tax advantages or benefiting from the pass-through taxation system, this form provides the tools to plan for future business success.

-

Avoiding Unexpected Tax Penalties: By proactively filing Form-8832 to establish your preferred tax classification, you can avoid the potential pitfalls of having your business taxed under the default tax rules. This helps ensure that your business is compliant with IRS regulations while also minimizing unnecessary tax burdens.

Mistakes to Avoid When Filing Form-8832

While Form-8832 provides flexibility, it’s also crucial to approach the filing process carefully to avoid common mistakes. Below are some additional errors to watch out for when completing the form:

-

Failing to Understand the Election’s Impact: Choosing the wrong tax classification could result in unintended tax consequences. For instance, electing to be taxed as a corporation might lead to double taxation, or electing a partnership tax structure could expose you to additional self-employment taxes. It’s important to fully understand how each classification affects your tax obligations.

-

Not Considering Future Business Plans: It’s vital to think ahead when filing Form-8832. Tax structures that work well for a startup or small business may not be as advantageous as your business grows. Consider how your business may evolve over the next few years and whether the election you make today still makes sense in the future.

-

Not Consulting a Professional: Tax laws can be complex, and the implications of choosing the wrong entity classification can be costly. At Syed Professional Services, we highly recommend consulting with a tax professional who can help you navigate the nuances of Form-8832 and ensure that your business is taxed correctly.

-

Missed Deadlines: As previously mentioned, failing to file Form-8832 on time can result in your business being stuck with the default tax classification. Missing deadlines can also delay your ability to take advantage of the tax benefits associated with your desired classification. Always ensure that your form is submitted within the IRS timeframe.

Common FAQs about IRS Form-8832

Here are some frequently asked questions regarding Form-8832 and how it works:

Q: Can I change my tax classification after filing Form-8832?

A: Yes, you can change your tax classification, but it requires filing another Form-8832 and may involve waiting five years before making another election. If you need to change your classification before that period, you will need to request approval from the IRS.Q: Is Form-8832 required for all businesses?

A: No, only businesses that want to change their default tax classification or select a specific tax structure need to file Form-8832. Some businesses, like LLCs, will automatically be treated as disregarded entities unless they choose otherwise.Q: How long does it take for the IRS to process Form-8832?

A: Processing times for Form-8832 can vary, but generally, it takes 60 to 90 days for the IRS to process your election and confirm the tax status change.Q: Do I need to file Form-8832 every year?

A: No, Form 8832 is typically filed once when you make your election, and the election is valid for five years. However, if you change your tax classification during this time, you will need to file a new form. -