Introduction

Navigating the world of immigration and taxation can be overwhelming, especially when dealing with various forms and documentation that are required for processing. Among these, Form G-1450 is one of the key documents you may need to be familiar with when applying for certain immigration benefits with the U.S. Citizenship and Immigration Services (USCIS). In this blog post, we will explain what G-1450 is, why it is important, and how it plays a role in your immigration and taxation matters. We’ll also discuss how Syed Professional Services can help you manage the form as part of your overall tax, accounting, and immigration services.

What is Form G-1450?

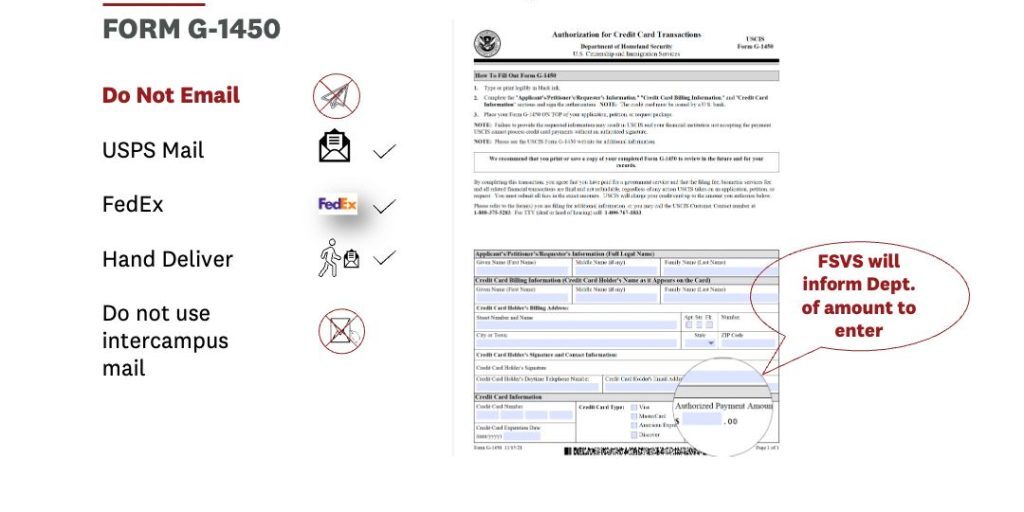

Form G-1450, officially known as the “Authorization for Credit Card Transactions”, is a document provided by USCIS. This form allows applicants to pay their application fees using a credit card when submitting certain forms, such as immigration petitions or requests. It provides applicants with an alternative method for payment, which can simplify the submission process.

The form itself is relatively simple. It requires basic information about the applicant, including their credit card details and the specific USCIS form for which the payment is being made. Once completed and submitted, USCIS will process the payment and proceed with the review of the application.

Why is G-1450 Important for Immigration Applications?

For many immigration-related processes, there are application fees that need to be paid to USCIS for services like petitions, naturalization applications, work permits, and more. Traditionally, these payments were made by check or money order, but with the advancement of technology, USCIS introduced G-1450 as a way for applicants to pay their fees using a credit card.

Here are some key reasons why G-1450 is crucial:

-

Convenience: G-1450 allows applicants to make payments online or by phone using their credit card, which can be more convenient than mailing a check or money order. This reduces the time spent waiting for payments to clear.

-

Faster Processing: Credit card payments through G-1450 are processed almost instantly, ensuring that there are no delays due to postal services or check clearing. This is particularly important when time-sensitive immigration applications are involved.

-

Record Keeping: Using a credit card for payment allows applicants to easily keep a record of the transaction. The credit card statement will show the payment made to USCIS, which can be helpful for tracking and reference purposes.

-

Global Access: Applicants from around the world who may not have access to U.S.-based banks or money orders can benefit from the ability to use a credit card, making the application process more inclusive and accessible.

-

Security: Payment through a credit card provides an added layer of security, as applicants are not required to send sensitive bank information via the mail.

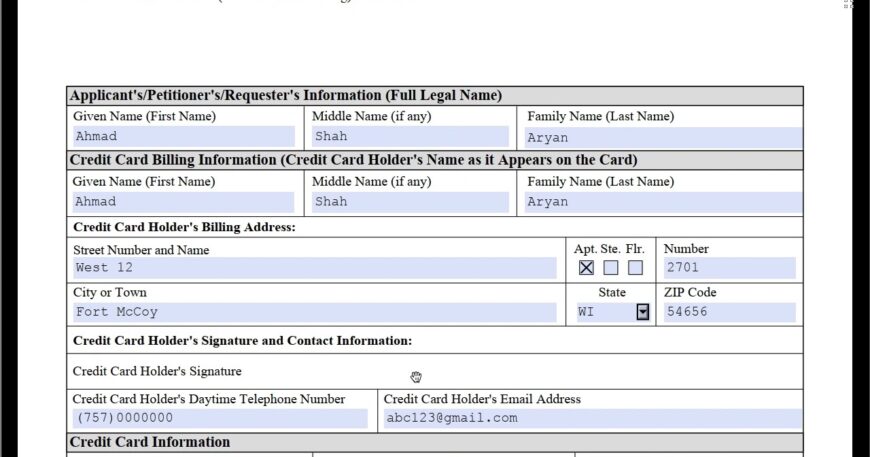

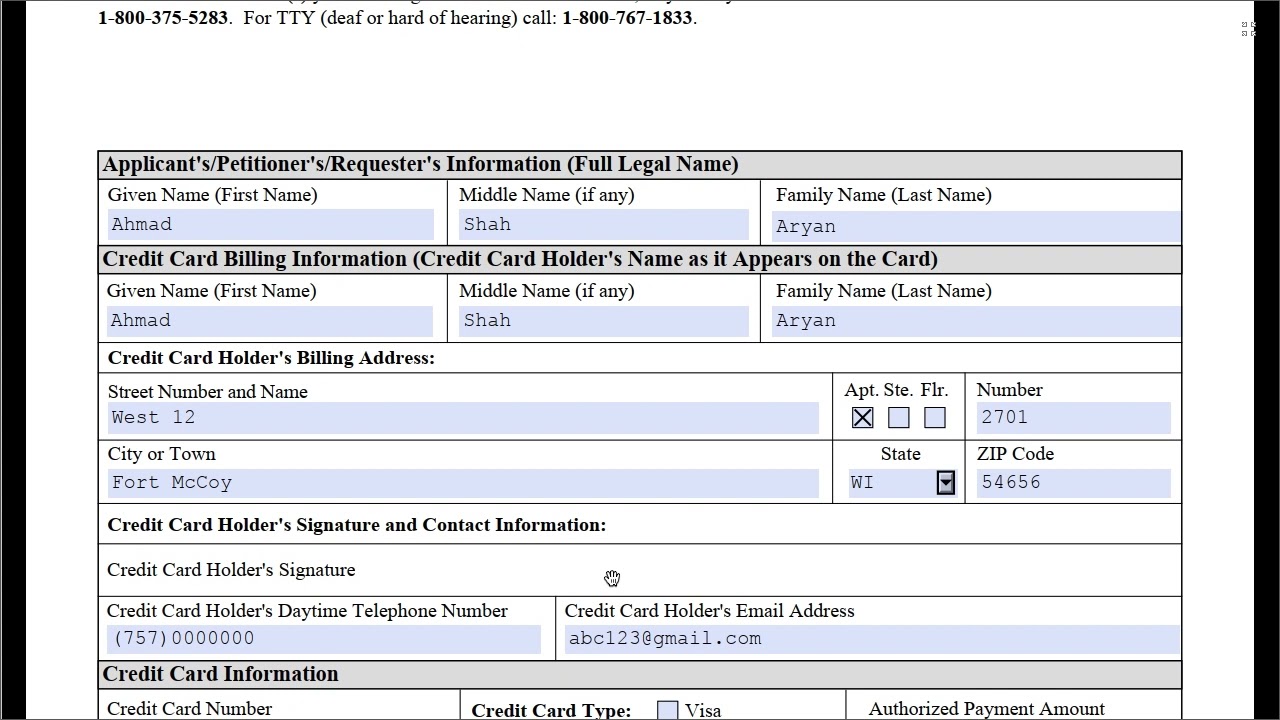

How to Fill Out G-1450

Filling out G-1450 is straightforward, but it’s essential to provide accurate information to avoid delays or errors in processing. Here are the steps to follow when filling out the form:

-

Section 1: Applicant Information

-

Enter your full name, address, and date of birth.

-

Include your email address, phone number, and other contact details to ensure USCIS can reach you if needed.

-

-

Section 2: Credit Card Information

-

Provide your credit card number, expiration date, and security code.

-

You’ll also need to include the name on the credit card and the billing address associated with the card.

-

-

Section 3: USCIS Forms Being Paid

-

Indicate the specific USCIS form for which you are making the payment. For example, you may be paying the fee for an I-485 (Application to Register Permanent Residence) or I-130 (Petition for Alien Relative).

-

-

Section 4: Signature

-

Sign and date the form to authorize the use of your credit card for payment.

-

Common Errors to Avoid on G-1450

While G-1450 is a simple form, mistakes can still occur. Here are some common errors that applicants should avoid:

-

Incorrect Credit Card Information: Ensure that the credit card number, expiration date, and security code are entered correctly. A small error here can delay payment processing.

-

Missing Information: All required fields must be filled out completely. Missing information, especially on the credit card section, can cause delays.

-

Choosing the Wrong USCIS Form: Double-check that you are using the correct form code for the application you are paying for. USCIS forms have specific fees associated with them, and selecting the wrong one can result in payment issues.

-

Failure to Sign: Don’t forget to sign the form before submitting it. Without a signature, USCIS cannot process the payment.

How G-1450 Relates to Tax and Accounting Services

As a tax and accounting firm, Syed Professional Services is committed to providing comprehensive services that extend beyond traditional financial management. When dealing with immigration matters, taxes, and accounting, proper documentation and payment management are critical to ensure everything is processed correctly.

Using G-1450 as part of your immigration application process requires a clear understanding of its role in overall financial management. Here’s how it ties into your tax and accounting needs:

-

Tax Filing: Immigration-related forms, such as work permits and visa applications, may have tax implications. It’s important to track payments made to USCIS, as these expenses may be relevant to your tax filings or deductions.

-

Financial Records: G-1450 provides a clear record of payment transactions to USCIS, which can be valuable when preparing your annual tax returns, especially if you have multiple immigration-related expenses.

-

Accounting for Immigration Fees: For businesses and individuals who frequently deal with immigration processes, tracking fees paid to USCIS is an essential part of accounting. Syed Professional Services can help ensure that these expenses are accounted for in your financial statements.

-

Global Clients: If you have clients from outside the U.S. who are involved in immigration processes, understanding G-1450 and its role in facilitating payments is important. This knowledge ensures that payments are handled securely and efficiently.

G-1450 and its Impact on Business and Personal Immigration Cases

Whether you’re filing for yourself or your employees, understanding G-1450 can have a significant impact on how smoothly your immigration-related matters are handled. For businesses, G-1450 can streamline the process of submitting multiple petitions for employees seeking work permits or green cards. Individuals filing for family-based immigration benefits can also rely on G-1450 to ensure they don’t encounter unnecessary delays due to payment issues.

How Syed Professional Services Can Assist with G-1450

At Syed Professional Services, we specialize in a range of services, including tax filing, accounting, and immigration assistance. Understanding the intricacies of G-1450 and other USCIS forms is part of our comprehensive service offering. Our experts are available to help guide you through the complexities of immigration documentation, ensure that payments are made accurately and on time, and offer advice on how these fees impact your overall financial management.

Conclusion

G-1450 plays a critical role in ensuring that immigration applications are processed smoothly, especially when it comes to making payments for USCIS services. By offering a simple and efficient way to handle payment transactions, G-1450 helps applicants avoid delays and confusion. Understanding the form, its importance, and how it integrates into your overall financial strategy can make a big difference when navigating the U.S. immigration system.

If you need assistance with completing G-1450 or any other immigration-related forms, or if you require help with accounting and tax matters, Syed Professional Services is here to help. Contact us today to learn more about how we can assist you in managing your immigration, tax, and accounting needs efficiently and professionally.