Understanding the I9 Form: A Complete Guide for 2025

In 2025, the I9 form remains an essential document for employers and employees in the United States. Whether you’re a new hire or an HR manager, understanding the purpose, process, and requirements of the I9 form is crucial. This blog post will walk you through everything you need to know about the I9 form, including what it is, how to fill it out, and the types of IDs needed. We’ll also look at the 2025 updates to ensure you’re fully compliant.

What Is an I9 Form?

The I9 form is a document used by U.S. employers to verify the identity and employment eligibility of their employees. Both employees and employers are required to complete this form under U.S. law. The form ensures that workers are authorized to work in the U.S., whether they are citizens, permanent residents, or eligible foreign nationals.

The Importance of the I9 Form in Employment

The I9 form plays a critical role in maintaining the integrity of the U.S. workforce. It helps employers avoid hiring unauthorized workers, ensuring that their staff is legally eligible to work. This is crucial not only for legal compliance but also for avoiding penalties, which can be steep if the form is not completed correctly.

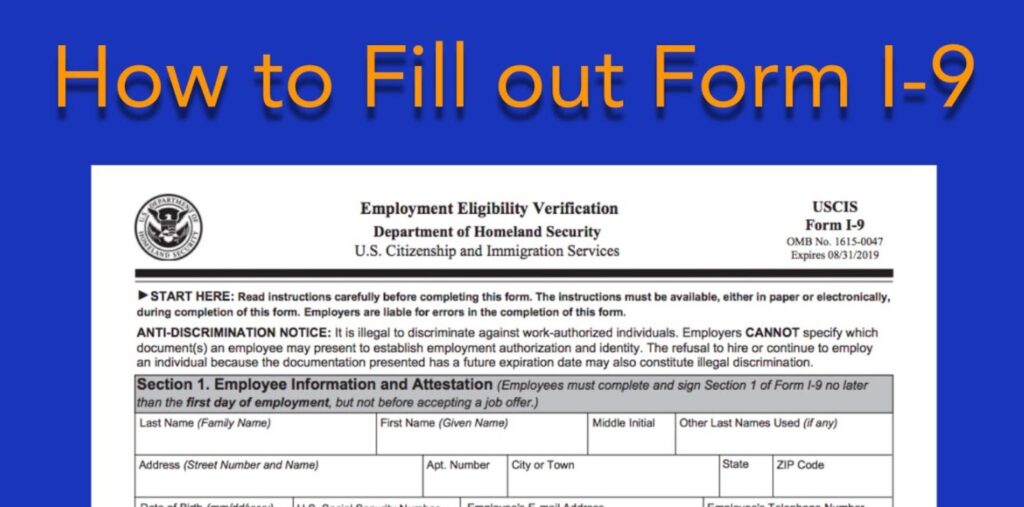

How to Fill Out the I9 Form in 2025

Filling out the I9 form may seem intimidating, but with a little guidance, it’s a straightforward process. Here’s a step-by-step breakdown of how to complete the form in 2025:

Step 1: Employee Information (Section 1)

- Employee’s Full Name: Start by entering your full legal name, including your first, middle, and last name.

- Date of Birth: Provide your birth date in the MM/DD/YYYY format.

- Address: Include your full address.

- Email and Phone Number: Optional, but helpful for employers.

- Citizenship Status: You must select whether you’re a U.S. citizen, a permanent resident, or a non-citizen authorized to work in the U.S.

Step 2: Employer Information (Section 2)

Employers need to complete this section to verify the employee’s identity and eligibility to work. They will also need to review and record the employee’s documents (such as a passport, social security card, or driver’s license).

Step 3: Document Verification

Employees must present documents that prove their identity and eligibility. You must show one document from either List A or a combination of documents from List B and List C.

Step 4: Employer Certification (Section 3)

Employers must certify the information on the form and sign it. They must also enter the date on which the employee began work.

What Types of IDs Are Accepted on the I9 Form?

The I9 form requires specific documentation to verify identity and employment authorization. These documents are categorized into three lists:

- List A: This list includes documents that establish both identity and employment authorization, for example, a U.S. passport or a permanent resident card.

- List B: These documents establish identity only. Examples include a driver’s license or a state ID.

- List C: These documents establish employment authorization only, such as a Social Security card or birth certificate.

Employers and employees must review the I9 form carefully to ensure that the correct documents are provided.

What Is the I9 Form Used for?

The primary purpose of the I9 form is to verify the identity and employment authorization of individuals hired for employment in the United States. Employers must keep I9 forms on file for all employees, whether they are hired temporarily or permanently. These forms may be audited by U.S. Citizenship and Immigration Services (USCIS), so proper completion and storage are essential to avoid legal complications.

The I9 Form 2025 Updates

In 2025, there are a few updates and changes to the I9 form that employers and employees must be aware of:

- Online Filing Option: The I9 form can now be completed and submitted online. Employers should be familiar with this new feature to streamline the hiring process.

- Document Review Flexibility: The I9 form now allows employees to upload scanned copies of their documents for verification. This is particularly helpful in remote work environments.

- Increased Focus on E-Verify: Employers are encouraged to use E-Verify, a system that allows them to verify the information provided on the I9 form electronically. This system reduces human error and ensures compliance with immigration laws.

Where Can You Get the I9 Form in PDF Format?

If you need to complete the I9 form, the U.S. Citizenship and Immigration Services (USCIS) website offers the form as a downloadable PDF. It’s essential to use the most recent version of the I9 form to avoid compliance issues. Be sure to download it from the official USCIS website to ensure you’re using the correct and updated version.

- Download the I9 Form PDF: USCIS I9 Form PDF

How to Submit the I9 Form

Once completed, the I9 form must be stored by the employer for a certain period. The form does not need to be submitted to any government agency, but employers must retain it in their records for at least three years after the date of hire or one year after employment ends, whichever is later.

Employers can store the form in physical or electronic format, but it must be available for inspection by authorized government representatives when requested.

Common Mistakes to Avoid When Completing the I9 Form

Filling out the I9 form may seem simple, but common errors can lead to serious issues. Some of the most frequent mistakes include:

- Incorrect Documentation: Employees may present expired or inappropriate documents. Employers must ensure that all documentation is valid and matches the employee’s information.

- Missing Signatures: Both the employee and the employer must sign the I9 form. Missing signatures can lead to penalties.

- Late Completion: The I9 form must be completed no later than the third day of employment. Delays in completion can result in fines.

Frequently Asked Questions About the I9 Form

What is the I9 form used for?

The I9 form is used to verify the identity and employment eligibility of individuals hired in the United States. It helps employers ensure they are complying with immigration laws.

What types of documents can I use for the I9 form?

You can use documents from three categories: List A (which establishes both identity and work authorization), List B (which establishes identity only), and List C (which establishes employment authorization only).

Do I need to submit the I9 form to USCIS?

No, the I9 form is not submitted to USCIS. Employers must retain the form in their records for inspection if requested.

Can I complete the I9 form online?

Yes, the I9 form can now be completed online, and employers can submit the form electronically. This feature is particularly helpful for remote hiring.

What happens if the I-9 form is filled out incorrectly?

Errors on the I9 form can result in penalties or fines for the employer. It’s essential to ensure the form is filled out accurately and completely.

How long should I keep the I9 form?

Employers must retain the I9 form for at least three years after the date of hire or one year after employment ends, whichever is later.

Conclusion

Filling out the I9 form accurately and understanding its purpose are crucial steps in ensuring a smooth and compliant hiring process in the United States. As we move through 2025, staying updated on the latest changes to the I9 form will keep employers and employees on the right track. Whether you’re an HR professional, a business owner, or a new hire, knowing how to complete and manage the I9 form properly is vital for maintaining legal compliance.

The Role of Employers in Ensuring I9 Form Compliance

Employers play a significant role in ensuring that the I-9 form is filled out correctly and promptly. Besides verifying the identity and employment eligibility of new hires, employers are responsible for making sure the form is completed properly and retained according to legal requirements. Here are a few key responsibilities employers should be aware of:

Timely Completion and Storage

Employers must ensure that the I9 form is completed no later than the third business day after an employee begins work for pay. It’s also important that the form is kept on file for the required retention period (either three years after hire or one year after employment ends, whichever is later). Failing to meet these deadlines can lead to severe penalties from the Department of Homeland Security.

Document Review and Verification

It’s important that employers carefully review the documents provided by the employee to ensure that they are valid and that the details match the employee’s information. In some cases, an employee may need to present alternative documentation to meet the form’s requirements. Employers should be aware of the rules for documents and follow them closely.

E-Verify: A Powerful Tool for Employers

E-Verify is an online system that compares the information on the I9 form with government databases to ensure the employee’s eligibility to work in the U.S. While the use of E-Verify is voluntary for most employers, certain employers, particularly federal contractors and employers in some states, may be required to use it. The system provides an added layer of confidence that the information provided on the I9 form is accurate and that the employee is legally authorized to work in the country.

Digital I9 Forms: A Future Trend

The shift towards digital and online processes has significantly impacted the way businesses handle employment documentation. With the advent of electronic I-9 forms, businesses can reduce paperwork, improve data accuracy, and speed up the onboarding process. Here’s why you should consider using a digital I-9 form:

Easy Access and Storage

Storing I9 forms electronically is becoming more common. Digital storage allows employers to keep records in a secure, easily accessible system. Cloud-based systems can also assist with ensuring the document is compliant with legal retention requirements.

Streamlined Verification Process

Using an online I9 form reduces the chance of errors during data entry. Many platforms also integrate with E-Verify, automating the verification process and ensuring that everything is processed smoothly.

Improved Compliance

When done electronically, employers can take advantage of automated reminders and tools that guide them through the process of filling out the form correctly, reducing the likelihood of errors or omissions.

Common Challenges Employers Face with the I9 Form

Even with all the available resources, employers may still face challenges when completing and managing the I-9 form. Here are some of the most common hurdles:

Document Fraud

Some employees may attempt to present fraudulent documents, which can be difficult to detect without proper knowledge and training. Employers must be vigilant and use the guidelines on the I9 form to verify the authenticity of documents.

New Employee Orientation and I9 Training

Employers must ensure that their HR teams are properly trained to handle the I9 form and document verification. In addition to compliance, HR professionals must be well-versed in how to spot expired documents and ensure that they are correctly recorded.

Remote Work Considerations

In today’s work environment, remote hiring has become more common. For remote employees, employers must find a way to verify documents while maintaining compliance. Some businesses opt for video conferencing or third-party notaries to ensure that the process is conducted securely and correctly.

The Consequences of Not Completing the I9 Form Properly

Failing to complete the I9 form properly can have serious consequences for employers. Here are some potential outcomes of non-compliance:

- Fines and Penalties: Employers who fail to complete or retain I9 forms correctly can face significant fines. The fines can range from hundreds to thousands of dollars per violation, depending on the severity of the error.

- Legal Troubles: In cases of widespread violations, employers may face lawsuits or investigations. This could lead to further legal ramifications that could hurt the reputation of the company and its ability to operate.

- Loss of Government Contracts: Employers who fail to comply with immigration laws may find themselves disqualified from securing certain government contracts, which can significantly impact business opportunities.

Best Practices for I-9 Form Compliance

To ensure smooth operations and avoid potential penalties, employers should implement best practices when handling the I9 form. Here are some strategies for maintaining compliance:

Implement an I-9 Compliance Checklist

An I9 compliance checklist is a valuable tool for employers to follow when completing I9 forms. This checklist can ensure that no steps are overlooked during the process, from collecting documents to storing completed forms.

Conduct Periodic Audits

Regular audits of I-9 forms in the company’s records help identify any missing or incorrect forms. Periodic reviews are also beneficial in ensuring that documentation is still valid and that the company remains compliant with any legal changes regarding the I9 form.

Provide Employee Training

Training employees on the importance of the I-9 form and the necessary documentation can help prevent delays and errors. Training programs should cover what is required for the form and how to handle document verification.

Stay Updated on I9 Form Changes

Stay informed about updates or changes to the I9 form. In 2025, there will be several new features and changes in how the form is processed, and it is important that employers stay current to avoid falling out of compliance.

Conclusion

The I9 form is a critical document for ensuring that employers follow U.S. immigration laws and maintain a legally compliant workforce. By understanding the steps involved in filling out the form, the documents required, and the updates in 2025, both employers and employees can ensure that the process runs smoothly. Whether you’re an employer handling multiple hires or an employee navigating the process for the first time, having a clear understanding of the form will help you avoid mistakes and maintain compliance.

With digital tools becoming more prevalent, ensuring your processes are up-to-date will save time, reduce the chances of error, and provide added security for all involved. Remember, a small mistake on the I9 form can lead to significant consequences, but with proper knowledge and diligent attention, you can keep your business compliant and running smoothly.

Why Do I Always Choose Syed Professional Services?

Syed Professional Services stands out because it provides expert-level assistance tailored to individuals and businesses in need of high-quality services. Whether it’s assisting with complex forms, legal documentation, tax services, business solutions, or other professional needs, Syed Professional Services offers a reliable, knowledgeable team with a strong track record of success. Their commitment to accuracy, compliance, and customer satisfaction is unparalleled, making them a top choice for anyone looking to ensure their processes are seamless and legally sound.

Some reasons why Syed Professional Services stands out include:

- Expert Knowledge: They have a wealth of expertise across various fields, especially in areas like compliance, employment forms (such as the I9), tax filing, and business consulting.

- Attention to Detail: They provide personalized services to ensure every requirement is met precisely, minimizing the chances of errors and penalties.

- Reliability and Trust: When you work with Syed Professional Services, you can rest assured that your needs will be met with professionalism and integrity.

What Can Syed Professional Services Do for You?

Syed Professional Services is equipped to assist with a wide range of needs, including:

Employment Compliance Assistance:

I-9 Form Management: They can help you understand, fill out, and maintain I-9 forms to ensure compliance with U.S. immigration and employment laws.

Employee Verification: Syed Professional Services can guide businesses through the process of verifying employee eligibility to work in the U.S. and ensure that all documentation is in order.

1) Tax Services:

Tax Preparation: Offering assistance with individual and business tax filings to ensure compliance with local, state, and federal tax laws.

Tax Consultation: Providing expert advice on tax planning, deductions, and strategies to reduce liabilities.

2) Business Consulting:

Legal and Business Documentation: From contracts to legal filings, they help businesses navigate paperwork, ensuring all legal requirements are met.

Start-Up Services: Syed Professional Services can help new businesses set up the proper foundations, including registering with the government, understanding tax obligations, and structuring the business effectively.

3) Immigration and Work Authorization Services:

Visa and Work Permit Assistance: For foreign nationals, Syed Professional Services can assist with documentation for visa applications, work permits, and other immigration processes.

Compliance and Reporting: Keeping you up-to-date with the latest requirements for compliance in terms of employment eligibility and employee documentation.

4) Customized Solutions for Specific Needs:

Tailored Support: Whether you’re an individual or a corporation, Syed Professional Services can provide solutions customized to your unique situation, whether it’s related to employment law, business growth, or document management.

5) Professional Consulting for Individuals and Organizations:

Advisory Services: If you need professional advice on any business decision, tax-related questions, or immigration concerns, they can provide personalized consultations to ensure the best course of action is taken.

In essence, Syed Professional Services acts as a one-stop shop for individuals and businesses needing professional help with documentation, compliance, consulting, and legal matters. Their expertise and attention to detail help clients avoid complications and ensure long-term success.

If you’re looking for guidance on I-9 forms, taxes, business solutions, or any other professional service, Syed Professional Services is the partner you can trust to get it right!