Introduction to PTIN Renewal: A Must for Every Tax Professional

As a tax professional, ensuring that your Preparer Tax Identification Number (PTIN) is renewed each year is not only a legal requirement but also a crucial part of maintaining your credibility and ability to serve clients effectively. At Syed Professional Services, we understand the importance of staying on top of the latest regulations and deadlines regarding PTIN renewal. This guide will help you navigate the PTIN renewal process in 2025, ensuring that you remain compliant and avoid unnecessary delays or penalties.

But what exactly is a PTIN, and why is it necessary to renew it annually? Let’s dive into the details and explore why PTIN renewal is something you can’t afford to overlook.

What Is PTIN?

A PTIN, or Preparer Tax Identification Number, is an identification number issued by the Internal Revenue Service (IRS) to tax preparers. This number is used by the IRS to track tax preparers who prepare or assist in preparing federal tax returns. All paid tax preparers, whether you’re working as an individual or through a firm, are required to obtain and renew their PTIN annually.

The PTIN is an essential tool that enables the IRS to properly monitor tax preparation professionals and their activities. Without a valid PTIN, you are not legally allowed to prepare tax returns for clients.

Why Is PTIN Renewal Important?

The importance of PTIN renewal cannot be overstated. If you fail to renew your PTIN annually, you won’t be able to legally prepare or file tax returns for clients. This could lead to a suspension of your tax preparation services and potential penalties.

In addition, maintaining an up-to-date PTIN allows tax professionals to avoid the hassle of backlogs and avoidable complications during tax season. Your PTIN is also used to validate your eligibility for specific credentials, such as becoming an enrolled agent or participating in certain tax programs. Renewing it on time ensures that you continue to meet the standards required by the IRS for tax professionals.

Steps to Renew Your PTIN: A Simple Guide

Renewing your PTIN may seem like a tedious process, but with the right steps, it can be straightforward and stress-free. Here’s a step-by-step guide to help you through the PTIN renewal process for 2025:

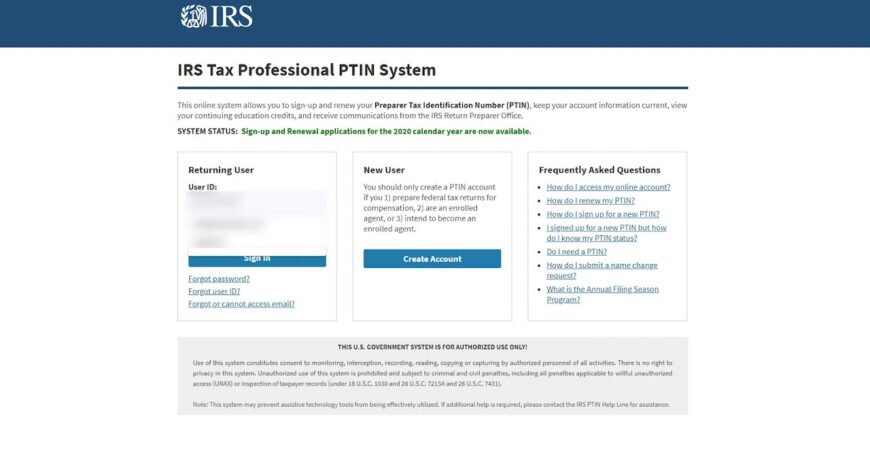

Step 1: Visit the IRS PTIN System Website

To begin your PTIN renewal, visit the official IRS PTIN system website (https://www.irs.gov/tax-professionals/ptin-application). This is the official platform where all PTIN renewals are processed. Be cautious about any third-party services that may attempt to charge fees for renewing your PTIN.

Step 2: Sign In to Your Account

If you already have an existing PTIN, you will need to log in to your account using your current credentials. If you don’t have an account, you will need to create one. The IRS system requires you to provide your personal information and your previous PTIN if applicable.

Step 3: Complete the PTIN Renewal Application

Once logged in, you will be directed to the PTIN renewal application. The application will ask you to verify your personal and business information. Ensure that all details are accurate and up to date. If there have been any changes in your address or business practices, be sure to update them on the renewal form.

Step 4: Pay the PTIN Renewal Fee

As of 2025, the fee for PTIN renewal is $35.95. This fee is payable online via credit card or other available payment methods. Make sure to keep a record of your payment confirmation for your reference.

Step 5: Submit Your Renewal Application

After completing the application and paying the fee, review all the information before submitting the renewal. The IRS typically processes PTIN renewals within 4-6 weeks. You will receive a confirmation once your PTIN is successfully renewed, and you will be able to print your updated PTIN card.

Common Issues with PTIN Renewal

While renewing your PTIN is generally straightforward, some tax professionals encounter issues that delay or complicate the process. Below are some common issues and how to resolve them:

Missing or Incorrect Information

If the information you entered on your PTIN renewal application is incorrect or incomplete, your application may be rejected. Make sure to double-check your personal and business information before submitting.

Fee Payment Problems

Sometimes, issues with payment can cause delays in the renewal process. If your payment does not go through, the IRS system will notify you. You can resolve this by contacting the IRS support team or trying a different payment method.

Delays in Processing

While PTIN renewals are typically processed within 4-6 weeks, there can be delays during peak periods, such as during tax season. If your renewal hasn’t been processed after several weeks, it’s a good idea to contact the IRS PTIN hotline to inquire about the status of your application.

PTIN Renewal Deadlines: Don’t Miss the Date!

It’s crucial to renew your PTIN before the deadline. The IRS sets annual deadlines for PTIN renewals, and missing this deadline could impact your ability to work as a tax preparer.

For 2025, the PTIN renewal deadline is December 31, 2025. You should aim to complete your renewal at least a few weeks before the deadline to avoid last-minute complications. The IRS usually starts accepting renewals on October 1st, giving you ample time to process your application.

What Happens If You Miss the PTIN Renewal Deadline?

Failing to renew your PTIN on time can result in significant consequences. If you miss the deadline, you risk losing your ability to prepare tax returns for clients, which can be especially problematic during tax season. Furthermore, you may have to pay late fees, and the renewal process might take longer than usual due to the influx of applications. In some cases, you may need to reapply for a PTIN, which can be a lengthy and costly process.

PTIN Renewal for New Tax Preparers

If you’re new to the tax preparation field and are applying for a PTIN for the first time, the process is similar to the renewal process. However, you will need to fill out a full application instead of just renewing your existing PTIN.

New tax preparers must complete an IRS background check, which includes questions about any prior criminal convictions or issues with tax compliance. This is a step that seasoned professionals are already familiar with, but first-time applicants should be prepared for a more detailed process.

Maintaining a Valid PTIN Throughout the Year

Renewing your PTIN annually is just one part of maintaining your status as a qualified tax preparer. Here are a few tips for ensuring your PTIN remains valid throughout the year:

-

Stay Updated on IRS Requirements: The IRS often updates its regulations and requirements for tax preparers. Make sure you’re aware of any changes that could impact your PTIN status.

-

Follow Continuing Education Guidelines: Many tax preparers are required to complete continuing education (CE) credits to remain compliant. Check the IRS guidelines to see if you need to complete any courses before renewing your PTIN.

-

Keep Your Information Updated: Notify the IRS of any changes to your personal or business information, such as address changes or employment changes.

Why Choose Syed Professional Services for Your Tax Needs?

At Syed Professional Services, we specialize in providing expert tax, accounting, and immigration services to individuals and businesses. Our team of professionals is dedicated to helping you navigate complex regulations, including the PTIN renewal process.

Whether you need assistance with renewing your PTIN or require other services related to tax preparation, we are here to ensure that you stay compliant and efficient. Our comprehensive approach to tax services ensures that you can focus on what matters most—serving your clients.

Conclusion

PTIN renewal is a crucial step for all tax professionals, and staying on top of this process is essential to avoid complications. By following the simple steps outlined above, you can renew your PTIN without hassle and continue your tax preparation work without interruption.

At Syed Professional Services, we are here to help you through the PTIN renewal process and provide guidance on all your tax, accounting, and immigration needs. Don’t wait until the last minute—start your PTIN renewal today!