Essential Tax Tips: Save Big and Maximize Your Refunds with These Simple Strategies

Essential Tax Tips: How to Save Big on Your Taxes Tax season can be a stressful time for many individuals and businesses. From deciphering complex

Essential Tax Tips: How to Save Big on Your Taxes Tax season can be a stressful time for many individuals and businesses. From deciphering complex

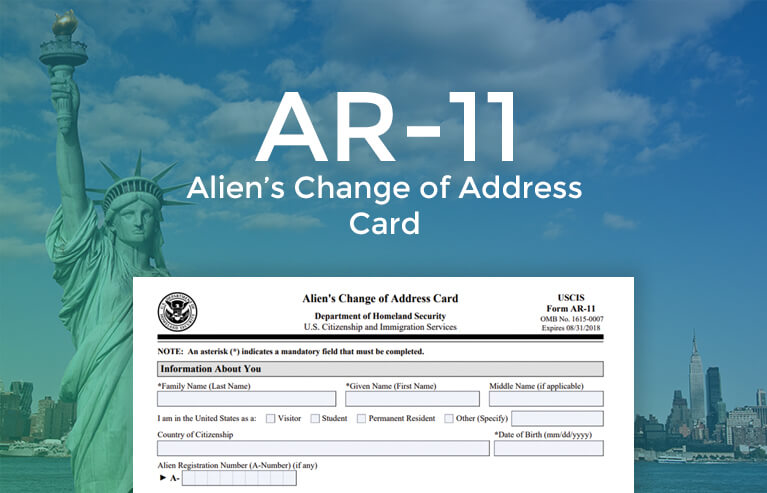

What Is AR11 and Why It Matters for Immigrants The AR11 form, officially known as the Alien’s Change of Address Card, is a required notification

Introduction: The L-1B visa is a valuable tool for companies looking to bring specialized workers into the United States. This temporary visa allows international businesses

Introduction Navigating the world of USCIS forms can be overwhelming, confusing, and even stressful for many immigrants and visa applicants. Whether you are applying for

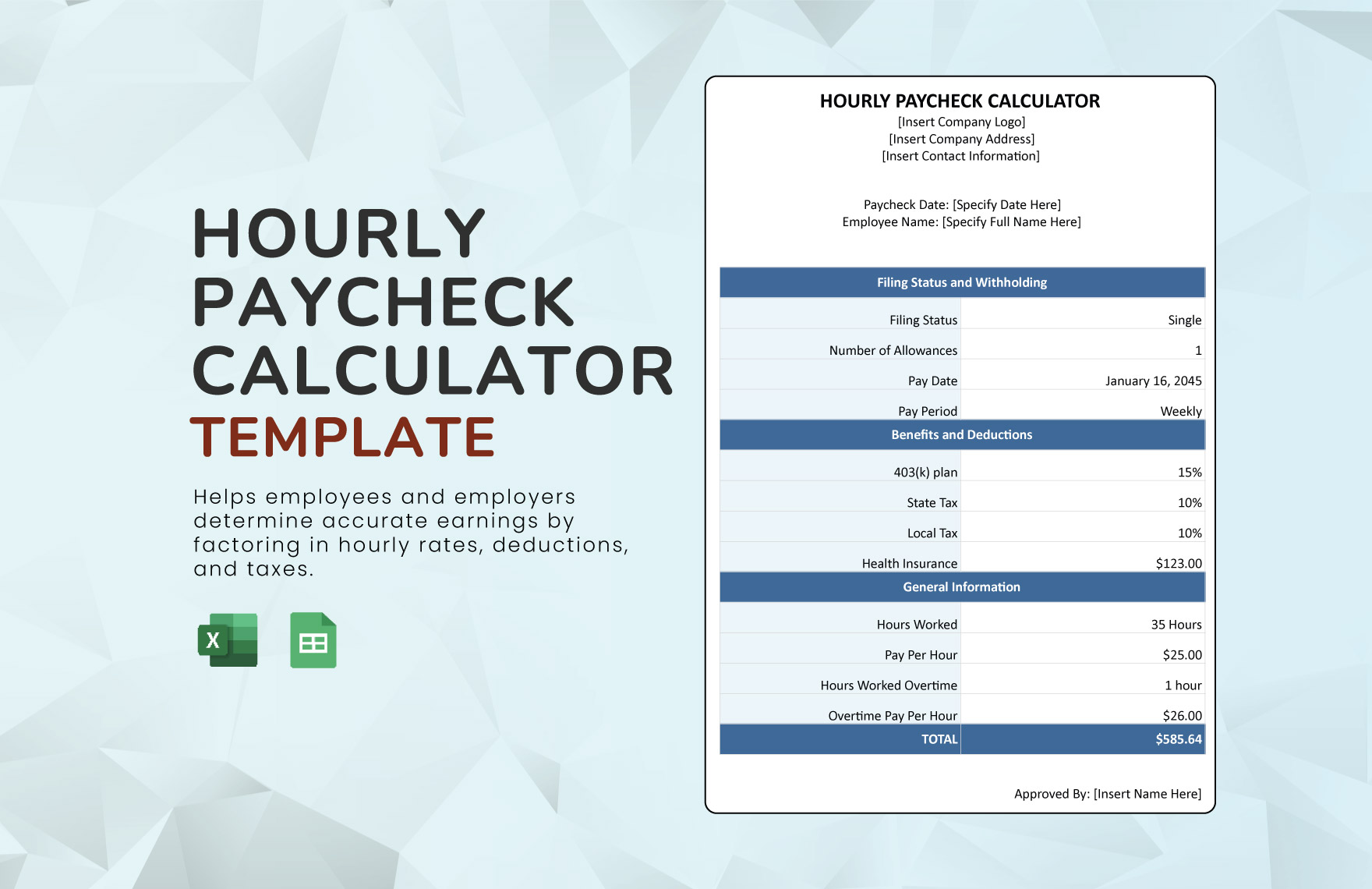

Paycheck Calculator A paycheck calculator is one of the most powerful financial tools available to employees, employers, and self-employed professionals today. Whether you’re managing payroll,

cuenta uscis: If you searched for cuenta uscis, you’re likely trying to understand how to create, access, or properly manage your USCIS online account. Whether

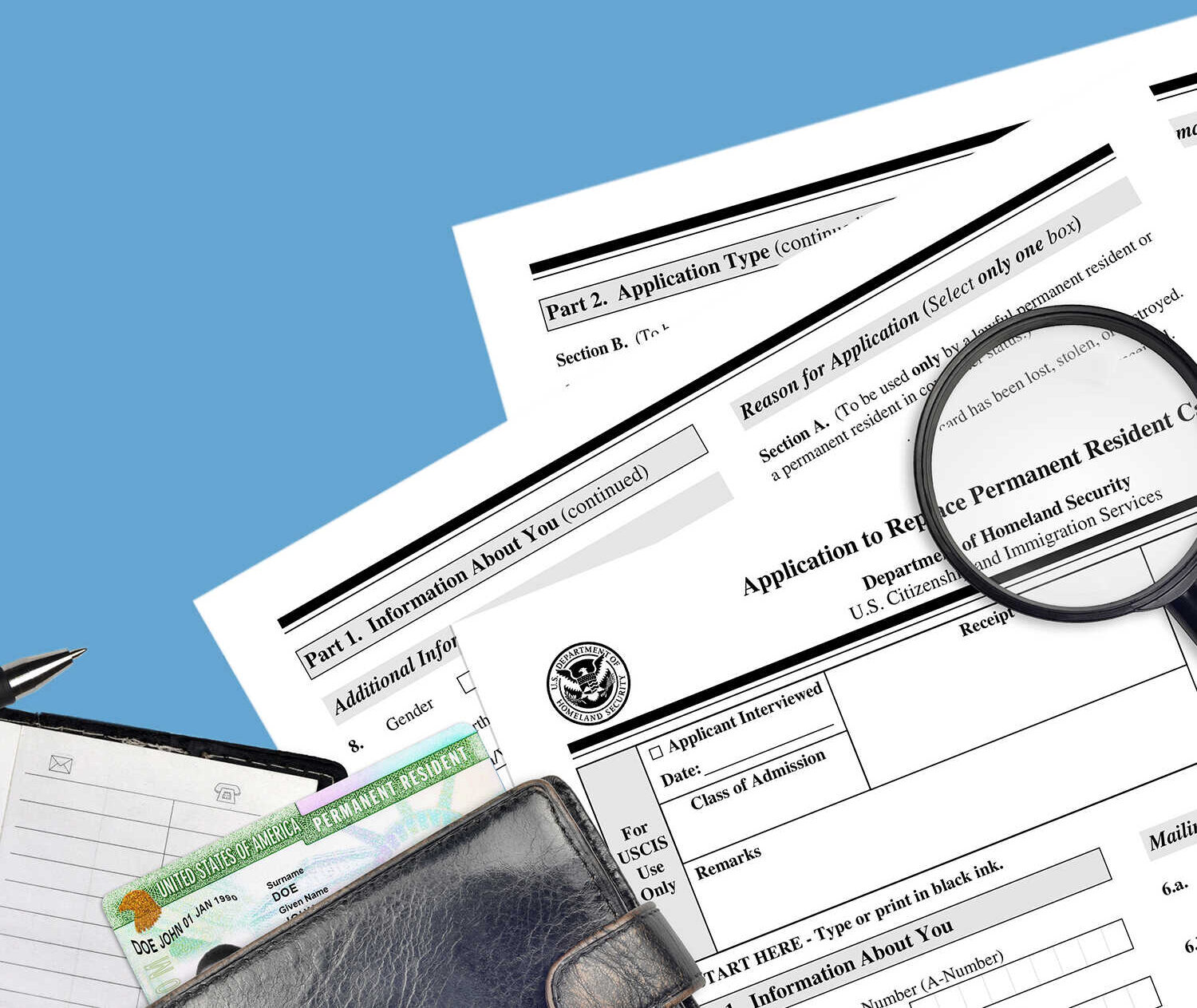

9 Critical & Powerful Facts About i 90 form That Could Save or Ruin Your Green Card If you are a lawful permanent resident in

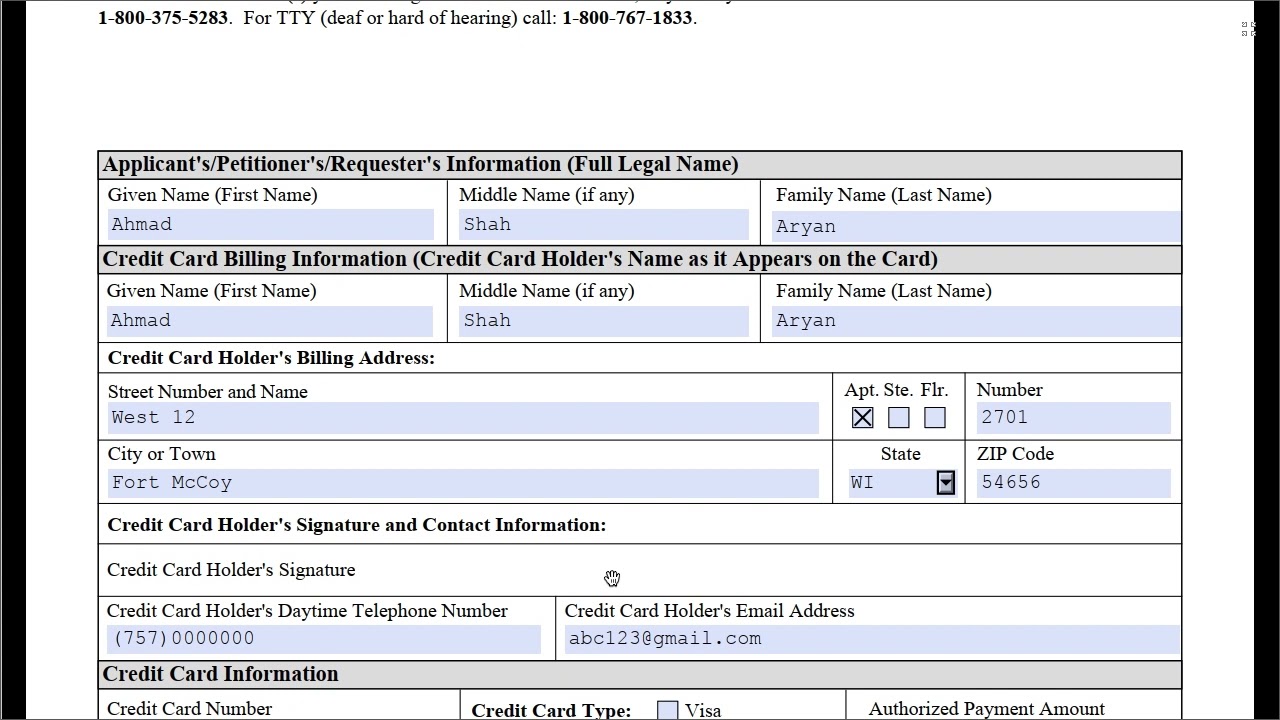

Introduction Navigating the world of immigration and taxation can be overwhelming, especially when dealing with various forms and documentation that are required for processing. Among

How to Navigate ID.me IRS for IRS Verification: A Step-by-Step Guide When it comes to verifying your identity for IRS purposes, ID.me has become a

Maximizing Your Tax Refund: Tips, Common Mistakes, and What You Should Know Tax season can be stressful, but it can also present an opportunity for

Introduction: Navigating the intricacies of U.S. immigration laws can be a daunting task, especially when it comes to understanding how visa availability impacts your journey.

Everything You Need to Know About the I-821 Form: When it comes to U.S. immigration, there are various forms and procedures that applicants need to