Introduction

Starting or expanding a business in the United States comes with many responsibilities, and one of the most important is obtaining an Employer Identification Number (EIN). At the center of this process is the SS4 form. While it may look simple, mistakes on the SS4 form can delay your EIN, cause IRS correspondence, or even disrupt your business operations.

At Syed Professional Services, we regularly assist clients—business owners, startups, and immigrants—with EIN applications using the SS4 form. Many clients come to us after experiencing unnecessary delays or rejections due to avoidable errors.

This comprehensive guide explains everything you need to know about the SS4 form, how to fill it out correctly, who must use it, and how to avoid costly IRS mistakes.

SS4 Form: What It Is and Why It Matters

The SS4 form is an official IRS document titled Application for Employer Identification Number. It is used to request an EIN, which functions like a Social Security number for a business entity.

The IRS uses the SS4 form to identify businesses for:

-

Tax filing and reporting

-

Hiring employees

-

Opening business bank accounts

-

Applying for licenses and permits

Without a properly completed SS4 form, a business cannot legally operate in many situations. Even single-member LLCs and sole proprietors often require an EIN depending on their activities.

Because the EIN becomes a permanent identifier, accuracy on the SS4 form is critical from the start.

Who Needs to File the SS4 Form?

Many people believe only large corporations need the SS4 form, but that’s far from true. You must file an SS4 form if you are:

-

Starting a new business

-

Forming an LLC or corporation

-

Hiring employees

-

Opening a business bank account

-

Establishing a trust or estate

-

A non-U.S. resident starting a U.S. business

Immigrants and foreign nationals frequently require the SS4 form to obtain an EIN even without a Social Security number. This is a common area where professional guidance makes a significant difference.

How to Fill Out the SS4 Form Correctly

Completing the SS4 form requires attention to detail. A single incorrect entry can result in processing delays or IRS notices.

Legal Name and Trade Name

The name entered on the SS4 form must exactly match the legal formation documents. Any mismatch between state records and the SS4 form can trigger rejection.

Responsible Party Information

The IRS requires the name and Taxpayer Identification Number of the responsible party. This section of the SS4 form is especially important for LLCs and corporations.

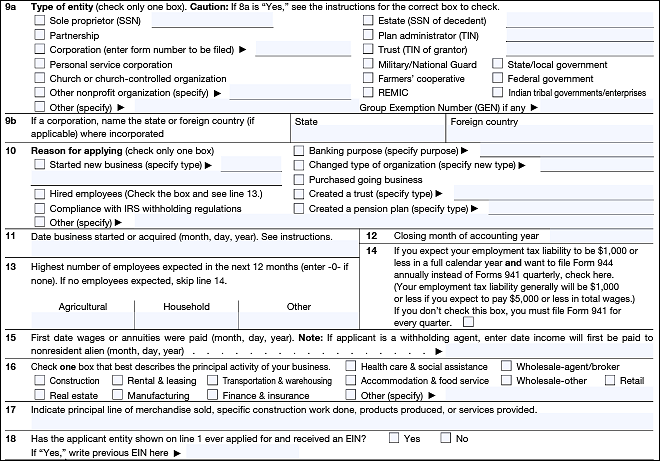

Entity Type Selection

Selecting the wrong entity type on the SS4-form is one of the most common mistakes. The IRS treats LLCs, partnerships, and corporations very differently for tax purposes.

Reason for Applying

You must clearly indicate why you’re filing the SS4-form, such as:

-

Started a new business

-

Hired employees

-

Banking purposes

An unclear or incorrect reason can delay EIN issuance.

Common SS4 Form Mistakes That Cause Delays

Despite being only a few pages long, the SS4-form is frequently completed incorrectly. Some of the most costly mistakes include:

-

Using a personal address instead of a business address

-

Entering the wrong start date

-

Selecting the incorrect tax classification

-

Providing inconsistent responsible party details

-

Filing multiple SS4-forms unnecessarily

These errors often result in IRS letters requesting clarification or additional documentation.

At Syed Professional Services, we review every SS4-form carefully to ensure compliance and accuracy before submission.

SS4 Form for Immigrants and Non-Residents

One of the most misunderstood aspects of the SS4-form involves non-U.S. residents. Many foreign nationals assume they cannot obtain an EIN without an SSN, which is incorrect.

The IRS allows non-residents to file an SS4-form by:

-

Writing “Foreign” where an SSN is requested

-

Applying by mail or fax instead of online

This process must be handled carefully, as errors on the SS4-form for non-residents often result in longer processing times.

Syed Professional Services specializes in EIN applications for immigrants, international entrepreneurs, and foreign-owned U.S. businesses.

How Long Does It Take to Process an SS4 Form?

Processing time depends on how the SS4-form is submitted:

| Submission Method | Processing Time |

|---|---|

| Online | Same day |

| Fax | 4–7 business days |

| 4–6 weeks |

Non-resident applicants filing the SS4-form usually must use fax or mail, making accuracy even more important.

SS4 Form vs Online EIN Application

While many applicants can apply online, the SS4-form remains essential in situations such as:

-

No Social Security Number

-

Foreign ownership

-

Trusts and estates

-

Special entity structures

Even when applying online, the IRS uses the same data fields as the SS4-form, making it the foundation of the EIN process.

Do You Need Professional Help With the SS4-Form?

Although the SS4-form appears straightforward, the consequences of mistakes can be significant. Professional assistance ensures:

-

Correct entity classification

-

Accurate responsible party designation

-

Compliance with IRS and immigration-related tax rules

At Syed Professional Services, we provide end-to-end support for EIN applications, business formation, and tax compliance.

Frequently Asked Questions About the SS4-Form

Is the SS4 form mandatory to get an EIN?

Yes. Whether submitted online or manually, the SS4-form is the basis for every EIN issued.

Can I submit the SS4-form myself?

Yes, but errors can delay processing. Many clients choose professional help to avoid mistakes.

Does the SS4-form expire?

No. Once approved, the EIN issued through the SS4-form is permanent.

Can I update information after submitting the SS4 form?

Yes, but changes require notifying the IRS separately.

Is there a fee to file the SS4 form?

No. The IRS does not charge a fee to process the SS4-form.

Can immigrants without SSNs file an SS4-form?

Yes. This is a common and legal use of the SS4-form.

Conclusion

The SS4-form is more than just an application—it’s the foundation of your business’s tax identity. Mistakes can lead to delays, compliance issues, and unnecessary stress. When completed correctly, the SS4-form allows your business to operate smoothly, hire employees, open bank accounts, and meet IRS requirements.

At Syed Professional Services, we combine tax expertise, business knowledge, and immigration awareness to ensure your SS4-form is completed accurately and efficiently.

🌐 Visit www.syedpro.com today to schedule a consultation and let our professionals handle your EIN and tax compliance the right way.