Introduction to Tax Transcripts

When dealing with taxes, it is crucial to understand the various forms and documents that the IRS uses. One such document that plays a key role in your tax journey is the tax transcript. If you’ve ever needed to provide proof of your income, past tax filings, or any other tax-related information, you’ve likely encountered the need for a tax transcript.

This blog post will break down what a tax transcript is, why it’s important, how to obtain one, and how you can use it to your advantage. Whether you’re an individual taxpayer, a business owner, or even someone working through immigration processes, understanding the tax transcript can help ensure you’re always prepared for financial tasks.

What is a Tax Transcript?

A tax transcript is a summary of your tax return information as filed with the IRS. The IRS provides several different types of transcripts that include key details from your past tax filings, including income, tax paid, adjustments, and more. It’s a convenient way to retrieve your tax information without needing to dig through multiple forms and documents.

For example, if you need to apply for a mortgage or a student loan, a lender may request a tax transcript as part of their verification process. Similarly, if you’re applying for immigration or government benefits, tax transcripts may be required to verify your income or tax filing history.

Types of Tax Transcripts

There are several types of tax transcripts that the IRS offers, and each one serves a different purpose. Understanding the various types can help you choose the one you need when requested.

1. Tax Return Transcript

A tax return transcript is a summary of your tax return, including most of the line items from the original return. It doesn’t reflect any changes made after your original filing, such as amendments or corrections. It is the most commonly requested type of tax transcript and is often needed when applying for loans or mortgages.

2. Tax Account Transcript

A tax account transcript includes details on your account activity with the IRS, such as any adjustments, payments, and the balance you owe. This transcript is helpful if you need to see changes made to your tax return after filing or if you’re dealing with tax issues like audits.

3. Record of Account Transcript

A record of account transcript combines both the tax return transcript and tax account transcript, providing a complete picture of your tax history.

4. Wage and Income Transcript

A wage and income transcript shows your income sources as reported by third parties, including W-2s, 1099s, and other income documents. This is essential if you need detailed information on your earnings for a specific year.

5. Verification of Non-filing Letter

If you didn’t file taxes for a particular year, the IRS can provide a verification of non-filing letter that verifies you did not submit a return for that year. This is often required for students applying for financial aid or for individuals who did not file taxes but need to provide proof of non-filing.

Why is a Tax Transcript Important?

A tax transcript serves a variety of important functions and is essential in many personal, business, and legal situations. Here are just a few reasons why your tax transcript matters:

-

Proof of Income: If you are applying for a loan, mortgage, or government benefits, your tax transcript can serve as proof of your income. Lenders and financial institutions often use the tax transcript to verify that the income you report on loan applications matches what is reported to the IRS.

-

Immigration Applications: If you are going through an immigration process, tax-transcripts are often required as part of the documentation to prove your financial stability or to verify your past tax filings.

-

Tax Issues: If there is any issue with your tax filings, such as an audit or discrepancies between your filed return and the IRS’s records, your tax-transcript can help clarify the situation.

-

Tax Filing Verification: In the event of an audit or dispute with the IRS, your tax-transcript can serve as a verification of your filed return, supporting your claim with official documentation.

How to Obtain Your Tax Transcript

Obtaining a tax transcript is easier than you might think. The IRS offers several ways to request and retrieve your transcripts:

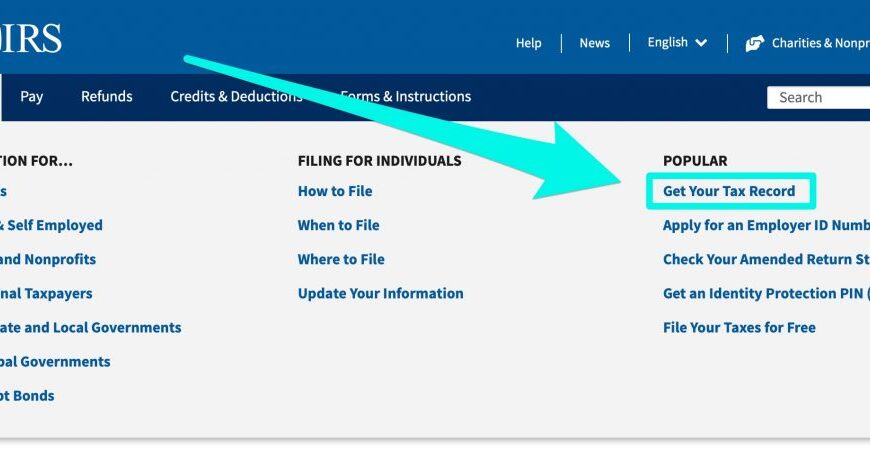

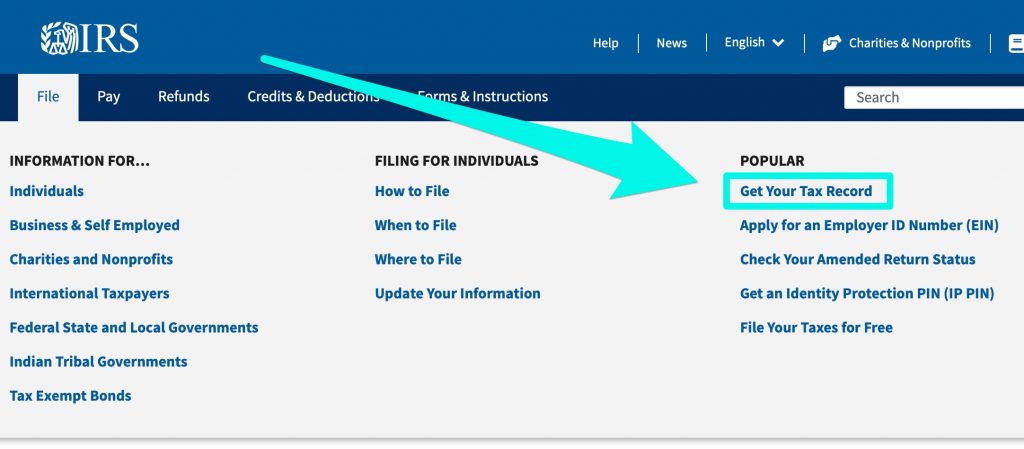

1. Online Request

The quickest way to get a tax transcript is through the IRS’s online tool, “Get Transcript.” This service allows you to download or have your tax-transcript mailed directly to you. To access this, you’ll need to verify your identity using personal information, including your Social Security Number (SSN) and tax filing information.

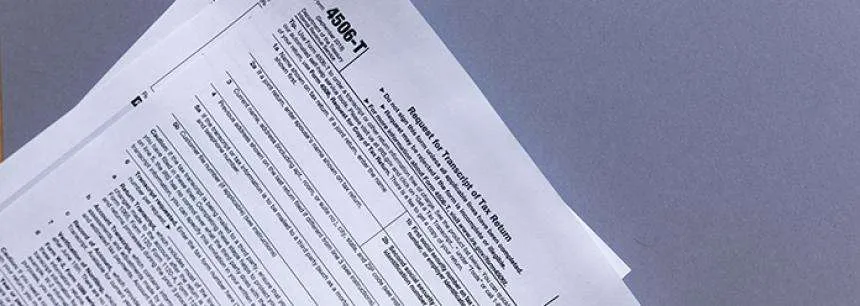

2. Request by Mail

If you prefer to request a tax transcript by mail, you can do so by completing the IRS Form 4506-T, “Request for Transcript of Tax Return.” This form allows you to specify the type of transcript you need and the year for which you need it. Once submitted, the IRS will mail you your tax-transcript.

3. Request by Phone

You can also call the IRS at 1-800-908-9946 to request your tax-transcript. The request will be sent to the address on file with the IRS, and you should receive it within 5 to 10 business days.

How to Use a Tax Transcript

Once you have your tax transcript, it’s important to understand how to use it effectively. Whether you’re submitting it for a loan application, an immigration process, or verifying your tax filings, here’s how to make the most of your tax-transcript:

1. Submitting to Lenders

When you are applying for a loan or mortgage, lenders often request a tax-transcript to verify your income. This document helps ensure that you are financially responsible and capable of repaying the loan. Be sure to provide the correct year’s transcript when submitting it to lenders to avoid delays.

2. Filing for Immigration or Government Benefits

Immigration processes often require proof of income or tax filings, and a tax-transcript can help meet these requirements. Be sure to check with the relevant immigration office or government agency to ensure you submit the right type of transcript.

3. Resolving Tax Issues

If you are dealing with tax issues, such as an audit, your tax-transcript will be a critical document in resolving discrepancies or disputes with the IRS. By reviewing your tax-transcript, you can identify any errors or misreporting and work with the IRS to make corrections.

Common Issues with Tax Transcripts

Though tax transcripts are a valuable tool, there are some common issues that individuals face when using or obtaining them. Some of the most frequent problems include:

-

Incorrect Information: Sometimes, the information on your tax-transcript may be incorrect or outdated. This can happen if the IRS has not updated your account details or if there are discrepancies between what you reported and what the IRS has on file. In these cases, you may need to file an amended return or work directly with the IRS to resolve the issue.

-

Delay in Processing: Although the IRS strives to process transcript requests quickly, there can sometimes be delays, especially during busy tax seasons or if the IRS is experiencing high volumes of requests.

-

Requesting the Wrong Type of Transcript: With multiple types of tax-transcripts available, it’s essential to request the correct one. Ensure you understand what information you need before submitting your request.

Conclusion

Understanding your tax transcript is crucial for staying on top of your financial and tax obligations. Whether you’re applying for a loan, working through an immigration process, or simply need to verify your tax filings, knowing how to obtain and use your tax-transcript can save you time and effort.

At Syed Professional Services, we specialize in helping individuals and businesses navigate the complexities of tax filings, immigration processes, and other financial matters. If you need assistance with obtaining or understanding your tax-transcript, don’t hesitate to reach out. Our team of experts is here to provide you with the guidance and support you need to ensure a smooth and stress-free experience.