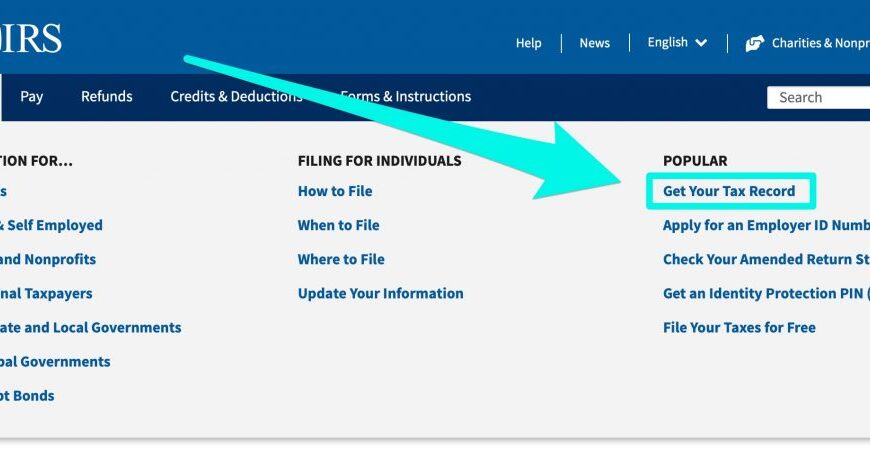

Everything You Need to Know About Tax Transcripts: A Comprehensive Guide

Introduction to Tax Transcripts When dealing with taxes, it is crucial to understand the various forms and documents that the IRS uses. One such document that plays a key role in your tax journey is the tax transcript. If you’ve ever needed to provide proof of your income, past tax filings, or any other tax-related […]