Introduction

If you run a business, work as an independent contractor, or deal with payments in the U.S., the W-9 form is not optional—it’s essential. Yet, despite its importance, this simple IRS document is one of the most misunderstood and frequently mishandled tax forms. A small mistake on a W-9 form can trigger backup withholding, delayed payments, IRS notices, or even penalties that could have been avoided.

At Syed Professional Services, we regularly help clients correct errors related to the W-9 form, resolve IRS issues, and stay compliant with U.S. tax laws. This in-depth guide breaks down everything you need to know—from what the W-9 form is to how to complete it correctly and avoid common traps.

Whether you’re a freelancer, business owner, landlord, or immigrant taxpayer, understanding the W-9 form will protect your income and your peace of mind.

W-9 Form Explained: What It Is and Why It Matters

The W-9 form, officially titled Request for Taxpayer Identification Number and Certification, is an IRS form used to collect accurate taxpayer information. Unlike many IRS forms, the W-9 form is not submitted directly to the IRS. Instead, it is provided to the person or business that is paying you.

The primary purpose of the W-9 form is to ensure the payer has:

-

Your correct legal name

-

Your federal tax classification

-

Your Taxpayer Identification Number (TIN), such as an SSN or EIN

This information is later used to prepare tax documents like Form 1099-NEC or Form 1099-MISC.

If a W-9 form is missing or incorrect, the IRS may require backup withholding, where 24% of your payments are withheld automatically. That’s why accuracy is critical.

At Syed Professional Services, we emphasize that the W-9 form is not just paperwork—it’s your first line of defense against tax problems.

Who Must Complete a W-9 Form?

Many people mistakenly believe the W-9 form applies only to freelancers. In reality, it applies to a wide range of individuals and entities.

You are required to complete a W-9 form if you are:

-

An independent contractor or consultant

-

A freelancer or gig worker

-

A landlord receiving rental income

-

A business receiving payments over $600

-

A U.S. citizen or resident alien

-

An LLC, partnership, or corporation receiving reportable income

Even immigrants with U.S. tax residency often need to submit a W-9 form rather than a W-8, depending on their status.

Failing to provide a W-9 form when requested can delay payments and raise red flags with the IRS.

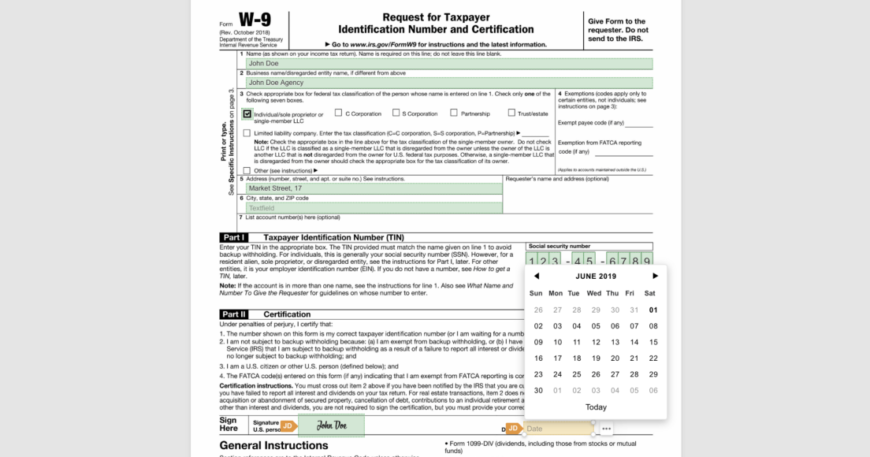

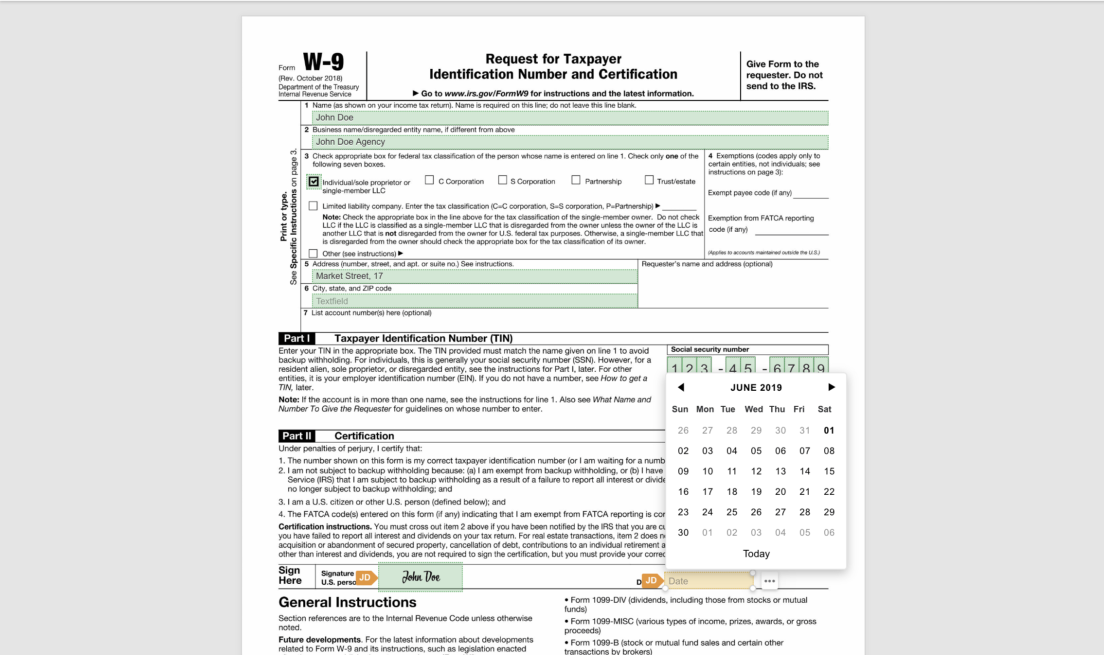

How to Fill Out a W-9 Form Correctly

Completing a W-9 form may look simple, but small errors can have serious consequences. Let’s walk through each key section.

Name and Business Information

Enter your legal name exactly as it appears on your tax return. If you operate under a business name or DBA, list that on the second line. Mismatched names are one of the most common W-9 form mistakes.

Federal Tax Classification

Check the correct box:

-

Individual / Sole Proprietor

-

LLC (and specify tax status)

-

Partnership

-

C Corporation or S Corporation

Incorrect classification on a W-9 form often leads to IRS mismatch notices.

Taxpayer Identification Number (TIN)

-

Use your SSN if you’re an individual

-

Use your EIN if you operate a business

Accuracy here is critical. A wrong TIN on a W-9 form can trigger backup withholding.

Certification and Signature

By signing the W-9 form, you certify that:

-

Your TIN is correct

-

You are not subject to backup withholding (unless notified)

-

You are a U.S. person

Signing falsely can result in penalties.

Common W-9 Form Mistakes That Cost Money

Despite its simplicity, the W-9 form causes countless tax problems every year. Some of the most costly mistakes include:

-

Using a nickname instead of a legal name

-

Providing the wrong EIN or SSN

-

Selecting the wrong tax classification

-

Submitting an outdated W-9-form

-

Forgetting to sign the form

Each of these errors can result in IRS notices, delayed income, or withheld payments.

At Syed Professional Services, we routinely correct W-9-form errors before they become expensive IRS issues.

W-9 Form vs 1099: Understanding the Connection

The W-9-form and 1099 forms work together. The W-9-form provides the information needed to create a 1099.

Here’s how it works:

-

You submit a W-9 form to the payer

-

The payer uses it to issue Form 1099-NEC or 1099-MISC

-

The IRS matches the 1099 to your tax return

If the information on the W-9-form doesn’t match IRS records, problems arise.

This is why accurate completion of the W-9-form is essential for clean tax reporting.

W-9 Form Rules for Immigrants and Non-Citizens

Immigration status often complicates tax compliance. Many non-citizens are unsure whether to submit a W-9-form or a W-8 form.

You should use a W-9-form if you are:

-

A U.S. resident for tax purposes

-

A green card holder

-

A resident alien under the substantial presence test

Submitting the wrong form can result in incorrect tax withholding and compliance issues.

Syed Professional Services specializes in helping immigrant clients correctly determine whether a W-9-form is appropriate for their situation.

Is the W-9-Form Sent to the IRS?

No. This is one of the biggest misconceptions.

The W-9-form is kept by the payer, not filed with the IRS. However, the information on it is later reported to the IRS through 1099 forms.

That means the IRS will see the data, even though they never receive the W-9-form directly.

How Long Should You Keep a W-9-Form?

Businesses should retain W-9-forms for at least four years after the last payment is made. This helps protect against audits, disputes, and IRS inquiries.

Secure storage is crucial since a W-9-form contains sensitive personal data.

Frequently Asked Questions About the W-9-Form

What happens if I refuse to submit a W-9 form?

Your payments may be delayed or subject to 24% backup withholding.

Can I email a W-9-form?

Yes, but it should be encrypted or sent securely to protect your data.

Does a W-9-form mean I owe taxes?

No. The W-9-form only provides information—it does not calculate or collect taxes.

Can I update a W-9-form?

Yes. You should submit a new W-9-form whenever your name, TIN, or tax status changes.

Is the W-9-form only for businesses?

No. Individuals receiving reportable income must also complete a W-9-form.

Do foreign nationals ever use a W-9-form?

Yes, if they qualify as U.S. residents for tax purposes.

Conclusion

The W-9-form may seem like a small administrative task, but its impact on your financial and tax life is significant. Errors can lead to withheld income, IRS notices, and unnecessary stress. When completed correctly, the W-9-form ensures smooth payments, accurate tax reporting, and peace of mind.

At Syed Professional Services, we bring expertise, accuracy, and trust to every tax document we handle. Whether you need help completing a W-9-form, resolving IRS issues, or managing your business taxes, our professionals are here to help.

📍 Visit www.syedpro.com to schedule a consultation and ensure your tax compliance is handled the right way—every time.