Introduction

When it comes to estate planning, asset protection, and long-term financial security, one of the most powerful roles a person can take on is becoming the grantor of trust. But with great power comes serious responsibility. Whether you’re setting up a revocable living trust, an irrevocable trust, or a more complex estate plan, being the grantor of trust means more than just funding the trust — it means managing legal, tax, and fiduciary obligations that can affect your family for generations.

At Syed Professional Services, we specialize in helping individuals and families understand what it really means to be a grantor of trust — from choosing trustees and beneficiaries to navigating IRS reporting rules and asset transfers.

This in-depth guide reveals 7 powerful responsibilities every grantor of trust must understand to avoid costly mistakes, ensure smooth administration, and preserve wealth. If you’re considering becoming or naming a grantor of trust, keep reading — this is your blueprint for success.

Understanding the Role of a Grantor of Trust

Let’s start with the basics. The grantor of trust is the person who creates and funds the trust. You decide:

-

What assets go into the trust

-

Who will manage those assets (the trustee)

-

Who will benefit from them (the beneficiaries)

-

When and how the assets will be distributed

The grantor can be an individual or couple, depending on the estate plan. In revocable trusts, the grantor often retains control over the assets during their lifetime. In irrevocable trusts, the grantor gives up ownership rights — for tax and asset protection benefits.

No matter the structure, the grantor of trust holds the pen that writes the rules. That’s why your choices today could impact your family’s financial health decades down the road.

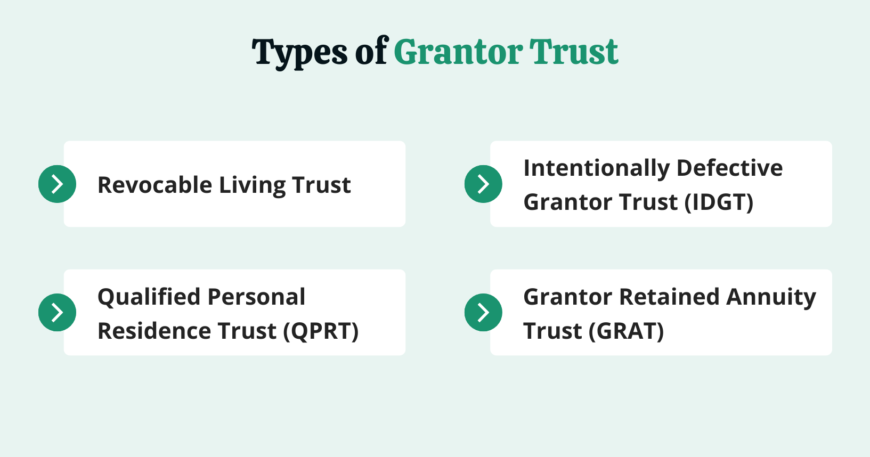

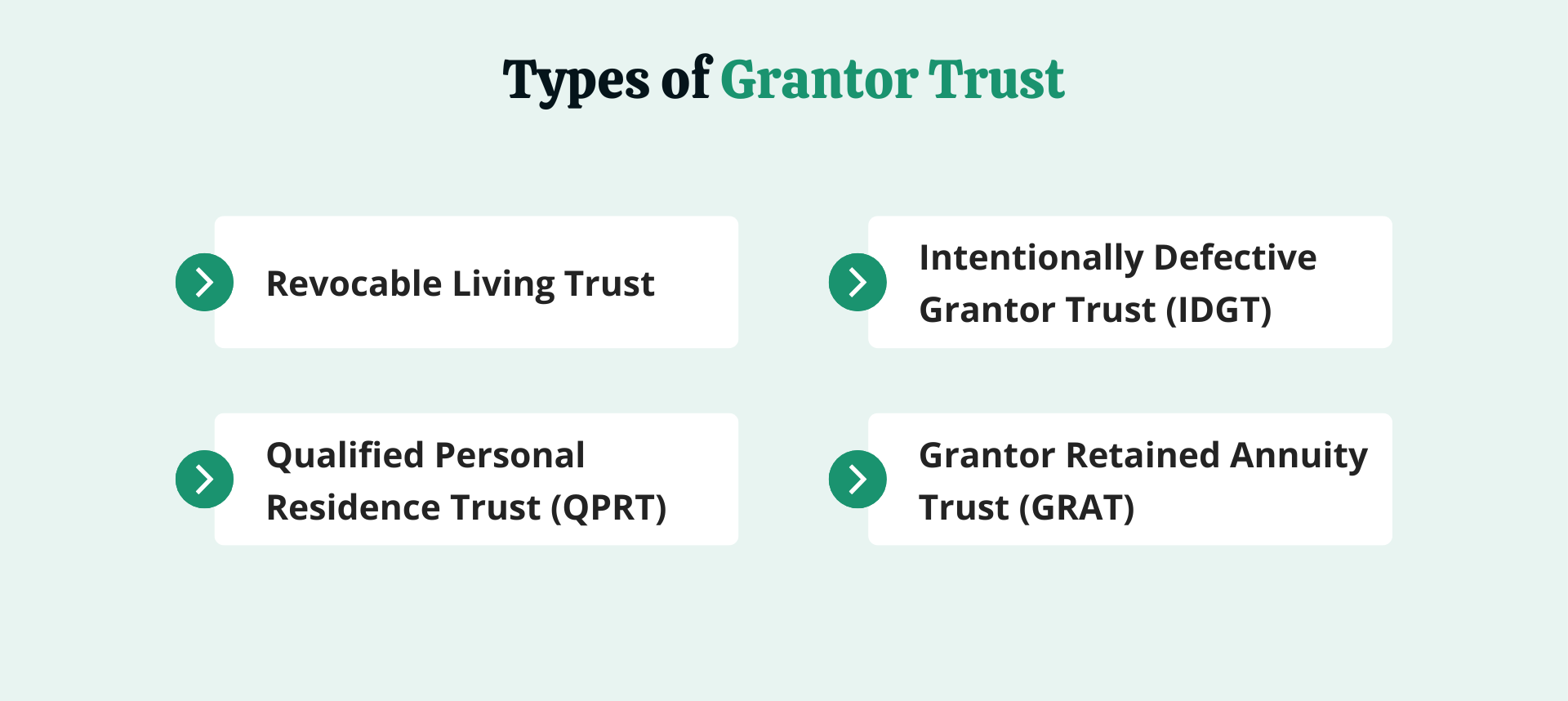

Responsibility #1: Choosing the Right Type of Trust

One of the first and most important duties of a grantor of trust is selecting the appropriate type of trust. Your goals, assets, and tax profile determine whether you should use:

-

Revocable Living Trust – offers flexibility and probate avoidance

-

Irrevocable Trust – used for asset protection and tax planning

-

Testamentary Trust – created by a will, effective after death

-

Grantor Retained Annuity Trust (GRAT) – ideal for estate tax savings

Choosing the wrong trust type can lead to legal complications, tax liabilities, and unintended consequences for your heirs. At Syed Professional Services, we analyze your unique situation to match you with the right structure — empowering you as a grantor of trust to achieve your goals.

Responsibility #2: Funding the Trust Properly

Creating a trust is only step one — the real magic happens when you fund it correctly. That means formally transferring ownership of assets like:

-

Bank accounts

-

Real estate

-

Investment portfolios

-

Life insurance policies

-

Business interests

If you forget to transfer assets or title them properly, the trust is essentially useless. The grantor of trust must work closely with legal and tax advisors to ensure everything is moved into the trust’s name, documented accurately, and legally compliant.

Unfunded trusts are a leading cause of probate and estate disputes. Our experts at Syed Professional Services guide clients through every asset transfer to ensure your trust is fully functional from day one.

Responsibility #3: Understanding Grantor Trust Taxation Rules

As the grantor of trust, you may still be responsible for the income tax on the trust’s earnings — especially if you set up a grantor trust under IRS rules.

Here’s how it works:

-

In grantor trusts, the grantor is still treated as the owner for tax purposes

-

Income from trust assets is reported on the grantor’s personal tax return

-

You may receive a grantor trust letter instead of a separate 1099

This has pros and cons. On the one hand, you maintain control and simplify tax reporting. On the other hand, you could be hit with unexpected tax bills if the trust earns substantial income.

That’s why it’s critical for the grantor of trust to understand how their structure affects Form 1040, Schedule E, and other IRS forms. Let Syed Professional Services help you avoid surprises with proactive tax planning.

Responsibility #4: Selecting a Trustworthy Trustee

The trustee is the person or institution you appoint to manage the trust’s assets according to your instructions. In some cases, especially revocable trusts, the grantor of trust serves as the initial trustee. But you still need to name successor trustees who will take over in case of death or incapacity.

Qualities to look for in a trustee include:

-

Financial literacy

-

Impartiality

-

Honesty

-

Willingness to serve

A bad trustee can mismanage assets, cause family disputes, or even break the law. As the grantor of trust, it’s your duty to appoint someone you trust — and to review that choice every few years.

Our team can advise you on whether to choose a family member, professional trustee, or corporate fiduciary — and help draft clear instructions that leave no room for confusion.

Responsibility #5: Defining Clear Distribution Terms

Ambiguous or poorly written trust terms can tear families apart. The grantor of trust must define who gets what, when, and how. Questions to answer:

-

Will distributions be based on age, need, or milestones (like college graduation)?

-

Should funds be withheld if a beneficiary is in debt or struggling with addiction?

-

How will discretionary income be handled?

The clearer you are, the fewer conflicts arise later. As the grantor of trust, you set the tone — not just financially, but emotionally.

At Syed Professional Services, we’ve helped clients craft ironclad distribution clauses that reflect their values and reduce risk.

Responsibility #6: Reviewing and Updating the Trust

Life changes — and so should your trust. As the grantor of the trust, you need to review your trust documents regularly, especially after events like:

-

Birth of children or grandchildren

-

Divorce or remarriage

-

Death of a trustee or beneficiary

-

Major asset purchases or sales

-

Tax law changes

Failing to update your trust could leave out new family members or include outdated instructions. You might also miss opportunities to reduce estate taxes or avoid future legal challenges.

We recommend an annual review with a tax and estate professional — and we offer that service as part of our client care at Syed Professional Services.

Responsibility #7: Communicating with Beneficiaries

Many grantors of trust fail to communicate their plans with loved ones — and it often leads to confusion, resentment, and even litigation. While it’s not always comfortable, it’s wise to let beneficiaries know:

-

That a trust exists

-

Who the trustee is

-

What the general terms are

-

How they can expect distributions

You don’t have to disclose exact amounts, but clarity today can prevent conflict tomorrow.

At Syed Professional Services, we help clients facilitate sensitive family conversations and prepare written memos to accompany their trusts.

FAQs About the Grantor of Trust

Who can be the grantor of trust?

Anyone legally competent can be a grantor — individuals, couples, or even business entities, depending on the trust type.

Can the grantor of trust also be the trustee?

Yes, in revocable trusts, the grantor often serves as the initial trustee. In irrevocable trusts, it’s usually a third party.

What’s the difference between grantor and trustee?

The grantor creates and funds the trust. The trustee manages its assets according to the grantor’s instructions.

Is the grantor of trust responsible for taxes?

Yes, especially in grantor trusts. The income is often reported on the grantor’s personal tax return.

Can the grantor of trust change the trust?

Yes, if it’s a revocable trust. Irrevocable trusts generally cannot be changed unless very specific conditions are met.

What happens when the grantor of trust dies?

In most cases, the trust becomes irrevocable, and successor trustees take over to manage and distribute assets.

Conclusion

Being the grantor of trust is a powerful position — but it’s not just about setting up a document and forgetting it. You’re creating a financial legacy that affects generations. The choices you make today will determine whether your family is protected, your wishes are respected, and your assets are preserved.

At Syed Professional Services, we understand the legal, tax, and personal dimensions of trust planning. Whether you’re starting fresh or revisiting an existing trust, we’re here to guide you with clarity, professionalism, and care.

Visit www.syedpro.com today to schedule a consultation. Let’s make your legacy count — the smart, secure way.