Introduction to Federal Tax Rates in 2026

When it comes to tax planning and understanding your financial obligations, federal tax rates play a crucial role. For individuals and businesses alike, knowing the ins and outs of these rates can help make better decisions throughout the year. Whether you’re preparing for your annual filing or planning long-term financial strategies, understanding how federal tax rates work can save you money and prevent surprises at tax time.

In this blog post, we’ll break down federal tax rates for 2026, explain what’s changed from previous years, and offer insights into how these rates affect your financial situation. We’ll also cover some tax-saving strategies that align with the current federal tax rates, helping you make the most of your tax planning.

What Are Federal Tax Rates?

Federal tax rates refer to the rates at which income is taxed by the federal government. The U.S. operates on a progressive tax system, meaning that as your income increases, so does the rate at which your income is taxed. The IRS publishes federal tax rates each year, which are typically categorized into tax brackets.

For 2026, federal tax rates are structured into several tax brackets. These rates determine how much of your income is taxed at each level. The rates increase as your income grows, but tax brackets also account for deductions and credits that can lower your overall tax burden.

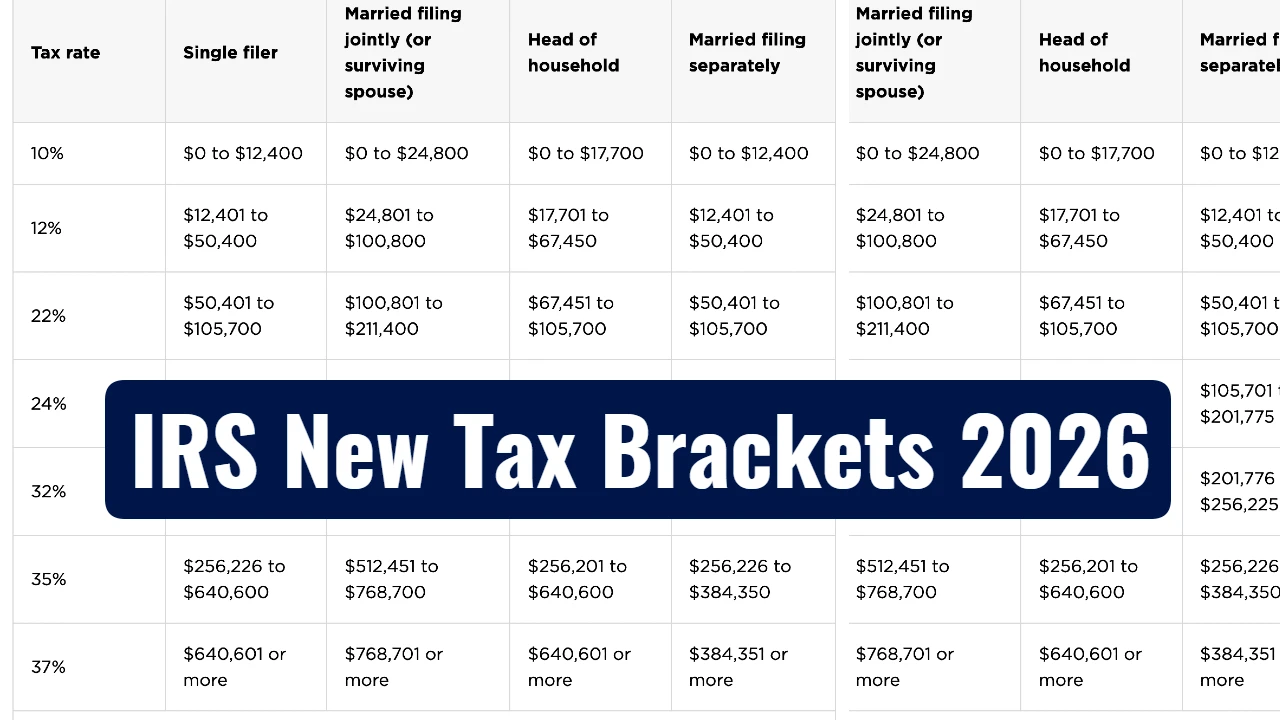

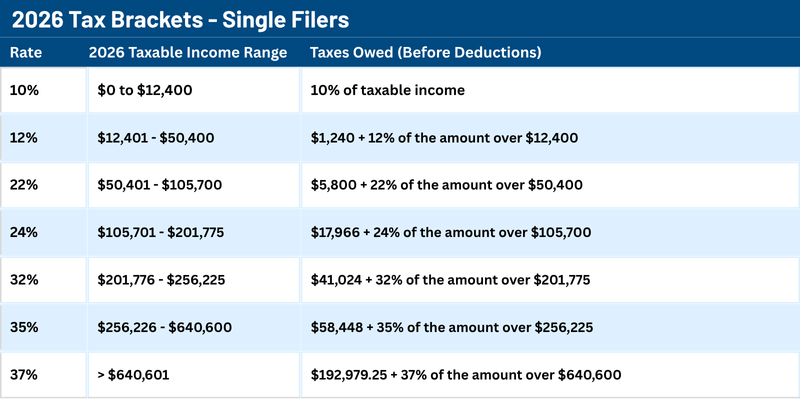

The Federal Tax Brackets for 2026

The federal tax rates for 2026 are designed to impact taxpayers differently based on their income. The IRS has updated the tax brackets for 2026, and it’s important to know where you fall in order to estimate your tax liability. The current brackets for individuals are as follows:

-

10% on income up to $11,000 for single filers ($22,000 for married couples filing jointly)

-

12% on income from $11,001 to $44,725 ($22,001 to $89,450 for married couples)

-

22% on income from $44,726 to $95,375 ($89,451 to $190,750 for married couples)

-

24% on income from $95,376 to $182,100 ($190,751 to $364,200 for married couples)

-

32% on income from $182,101 to $231,250 ($364,201 to $462,500 for married couples)

-

35% on income from $231,251 to $578,100 ($462,501 to $693,750 for married couples)

-

37% on income over $578,100 ($693,750 for married couples)

The above tax brackets reflect the progressive nature of the federal tax rates, where higher income earners pay a larger percentage of their income in taxes.

How Do Federal Tax Rates Impact Your Income?

Understanding how federal tax rates impact your income can help you estimate your tax bill and make adjustments to your withholding if needed. For example, if you’re in a higher tax bracket, a larger portion of your income will be taxed at the higher rates. However, it’s important to note that federal tax rates are applied incrementally to your income within each bracket. This means that even if you earn enough to fall into a higher tax bracket, not all of your income is taxed at that higher rate.

For example, if you are a single filer with a taxable income of $100,000 in 2026, your income will be taxed as follows:

-

The first $11,000 will be taxed at 10%.

-

The next $33,725 (from $11,001 to $44,725) will be taxed at 12%.

-

The next $50,650 (from $44,726 to $95,375) will be taxed at 22%.

-

The remaining $4,625 (from $95,376 to $100,000) will be taxed at 24%.

As you can see, even though your income is in the 24% tax bracket, only a portion of it is taxed at that rate. This progressive system ensures that the higher federal tax rates apply only to income within a particular bracket.

The Importance of Deductions and Credits in Reducing Taxable Income

While the federal tax rates provide a framework for determining how much of your income will be taxed, deductions and credits are key factors in reducing your taxable income. Deductions, such as the standard deduction or itemized deductions, can lower the amount of your income that is subject to federal tax rates. Similarly, tax credits directly reduce the amount of tax you owe, which can have a significant impact on your final tax bill.

For example, the standard deduction for 2026 is:

-

$13,850 for single filers

-

$27,700 for married couples filing jointly

By taking advantage of deductions like these, you can reduce your taxable income, which may lower the overall amount of tax you owe.

What Has Changed in Federal Tax Rates for 2026?

One of the most important updates to federal tax rates in 2026 is the adjustment for inflation. The IRS typically increases the tax brackets each year to account for inflation, ensuring that taxpayers are not pushed into higher tax brackets due to rising costs of living.

This year, taxpayers will see slight increases in the income thresholds for each bracket, meaning that more income will fall into lower tax brackets, potentially reducing tax liability for some individuals. Additionally, there have been some changes to tax credits, such as the Child Tax Credit and the Earned Income Tax Credit, which could further reduce your tax burden.

Strategies to Minimize the Impact of Federal Tax Rates

While the federal tax rates are inevitable, there are strategies you can implement to minimize their impact on your finances. Some of the most effective strategies include:

-

Maximize Your Deductions: Take advantage of tax deductions, whether it’s through the standard deduction or itemizing your deductions, to lower your taxable income.

-

Contribute to Retirement Accounts: Contributing to retirement accounts like a 401(k) or IRA can reduce your taxable income and provide tax-deferred growth on your investments.

-

Utilize Tax Credits: Tax credits directly reduce your tax liability, so make sure you take advantage of any available credits, such as the Child Tax Credit, the American Opportunity Credit, or the Lifetime Learning Credit.

By planning ahead and utilizing these strategies, you can reduce the impact of federal tax rates on your finances.

How Federal Tax Rates Affect Small Businesses

For small business owners, understanding federal tax rates is crucial for managing both personal and business finances. Businesses are subject to their own set of federal tax rates, which can differ depending on the type of business entity (e.g., sole proprietorship, LLC, S-corp). It’s important to be aware of these rates to avoid any surprises when filing taxes for your business.

Small business owners may also be eligible for deductions and credits that are not available to individuals, such as the Qualified Business Income (QBI) deduction, which allows you to deduct up to 20% of your business income. Staying informed about these opportunities can help you save on taxes and increase profitability.

Conclusion

Navigating federal tax rates can be challenging, but staying informed about how these rates impact your income is essential for smart financial planning. With the 2026 tax brackets in place, there are many opportunities to reduce your taxable income through deductions, credits, and retirement contributions.

At Syed Professional Services, we are here to help you navigate the complexities of the federal tax rates and other tax-related matters. Whether you’re filing as an individual or running a small business, our team can help you optimize your tax strategies and minimize your tax burden. Contact us today to learn more about how we can assist with your tax planning and filings for 2026 and beyond.