Introduction

When you’re starting a business or making important structural changes, understanding IRS Form 2553 is critical. This form is used to elect S corporation status for your company, which can provide various tax benefits. Whether you’re a new business owner or need help navigating the paperwork, IRS Form 2553 is something you’ll need to understand thoroughly. In this guide, we’ll explain everything about IRS Form 2553, from how to file it to common mistakes to avoid.

What is IRS Form 2553?

IRS Form 2553 is an official form used by businesses to elect S corporation status under the Internal Revenue Code. It allows a corporation or LLC to be taxed as an S corporation, which can help avoid double taxation (once at the corporate level and again at the shareholder level). By filing IRS Form 2553, a business can potentially reduce its overall tax burden.

An S corporation (S corp) is a special tax designation granted by the IRS that enables businesses to pass their income, deductions, and credits directly to their shareholders. This means that profits and losses pass through to individual tax returns, avoiding the “double taxation” that corporations typically face.

Why Should You File IRS Form 2553?

If you’re considering electing S corporation status, understanding the benefits of IRS Form 2553 is essential. Here are some reasons why filing this form might be the right choice for your business:

-

Avoid Double Taxation: As mentioned earlier, one of the key benefits of an S corporation is avoiding double taxation. Traditional corporations (C corporations) face taxation at the corporate level, and shareholders are taxed again on any dividends they receive. S corporations eliminate this problem by allowing the business income to pass directly to the shareholders.

-

Potential Tax Savings: S corporations can save their shareholders money on self-employment taxes. Unlike a sole proprietorship or partnership, S corporation shareholders who work for the business only pay self-employment taxes on their salary, not on the business’s profits.

-

More Flexible Ownership: S corporations can have up to 100 shareholders, providing more flexibility in ownership. They can also issue stock, making it easier to raise capital.

-

Limited Liability Protection: Like other corporations and LLCs, S corporations offer limited liability protection. This means that shareholders are typically not personally responsible for the debts of the business.

Who Should File IRS Form 2553?

Not all businesses are eligible to file IRS Form 2553. There are specific requirements to qualify for S corporation status, including the following:

-

Domestic Corporation or LLC: Only U.S.-based businesses can file for S corporation status. Foreign businesses must meet additional requirements to qualify.

-

Number of Shareholders: S corporations are limited to 100 shareholders. These shareholders must be individuals, estates, or certain trusts; corporations and partnerships cannot be shareholders.

-

Type of Stock: S corporations can only have one class of stock. This means that all shareholders must have equal voting rights and share equally in profits and losses.

-

Eligible Shareholders: S corporation shareholders must be U.S. citizens or resident aliens. Non-resident aliens cannot be shareholders.

If your business meets these criteria, filing IRS Form 2553 may be an excellent way to minimize taxes and protect your personal assets.

When Should You File IRS Form 2553?

The timing of your IRS Form 2553 filing is critical. You must file the form within a specific time window for it to be valid. Here are the key deadlines:

-

Within Two Months and 15 Days of Starting Your Business: If you are a new business, you must file Form 2553 within two months and 15 days after your business’s start date. This means if your business begins in January, you must file Form 2553 by March 15 of that year.

-

By March 15 for Existing Businesses: If your business is already operating and you want to switch to S corporation status, you must file Form 2553 by March 15 of the year you wish to begin S corporation taxation. This is a critical deadline to avoid losing the tax benefits for that year.

-

Late Election: If you miss the deadline for filing IRS Form 2553, you may still be able to file a late election. In this case, you must provide an explanation to the IRS, and they will review whether they’ll accept your late filing.

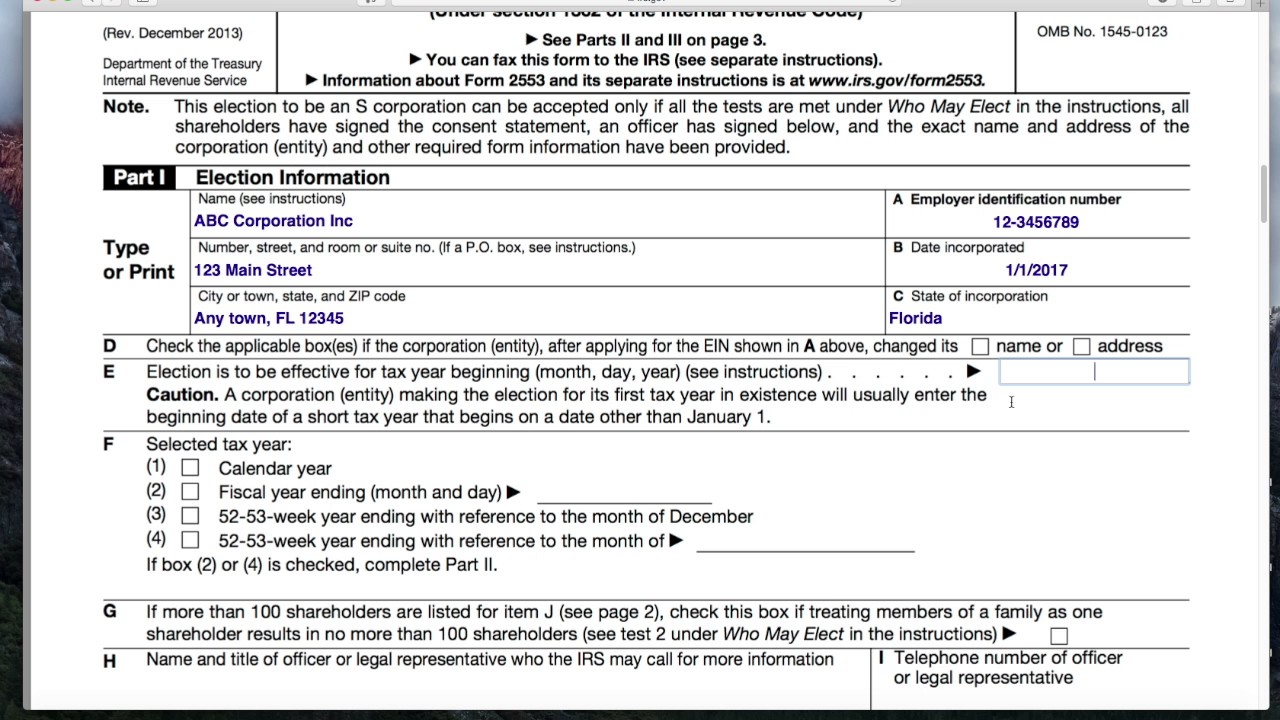

How to Complete IRS Form 2553

Completing IRS Form 2553 is relatively straightforward, but you must provide specific information about your business. Here’s what you need to do:

-

Enter Your Business Information: Provide your business name, employer identification number (EIN), and the date your business started.

-

Select Your S Corporation Election Year: Indicate the tax year for which you are requesting S corporation status. This can be the current year or a future year if you qualify for a late election.

-

List Shareholders: Include the names, addresses, and taxpayer identification numbers (TINs) of all shareholders. Make sure to indicate that they meet the eligibility requirements to be S corporation shareholders.

-

Sign and Date the Form: The business owner or officer must sign and date the form to verify its accuracy.

-

Submit the Form to the IRS: Once completed, submit IRS Form 2553 to the IRS by mail or electronically if you’re eligible.

Common Mistakes to Avoid When Filing IRS Form 2553

Filing IRS Form 2553 may seem straightforward, but there are several common mistakes that business owners should be aware of:

-

Missing the Deadline: As discussed earlier, missing the filing deadline can result in your election being rejected. Make sure to file the form on time.

-

Incorrect Shareholder Information: Ensure that you list all shareholders correctly and that they meet the eligibility criteria. Incorrect or incomplete information can lead to delays or rejection.

-

Not Understanding the One Class of Stock Requirement: S corporations can only have one class of stock. If your business has multiple classes of stock, you cannot elect S corporation status until you resolve this issue.

-

Failure to File State Forms: In some states, you must file additional paperwork to establish S corporation status. Make sure to check your state’s requirements and file any necessary documents.

What Happens After You File IRS Form 2553?

After you submit IRS Form 2553, the IRS will process your request and send a confirmation notice to your business. This notice will officially grant you S corporation status for the tax year you requested. Keep this notice for your records, as it serves as proof of your election.

Once your business is designated as an S corporation, you’ll need to file your taxes accordingly. This means reporting the business’s income, deductions, and credits on your personal tax return (Form 1040) rather than a corporate tax return (Form 1120).

Conclusion

IRS Form 2553 is an important document for any business looking to elect S corporation status. By understanding the requirements, deadlines, and common mistakes, you can ensure that your business benefits from the tax advantages of an S corporation. If you’re uncertain about the process, it’s always a good idea to consult with a tax professional or accountant who can guide you through the filing process. At Syed Professional Services, we are here to help with all your tax, accounting, and immigration needs.

If you need assistance with IRS Form 2553 or have any questions about S corporations, don’t hesitate to reach out to us. Our team of professionals can help you make the right decisions for your business and ensure that you’re fully compliant with IRS regulations.